Choosing to hire a contractor vs. an employee depends on your unique business goals and circumstances.

Engaging contractors is a cost-effective and efficient option for hiring expert talent for short-term projects. However, by hiring employees, organizations build a connected company culture, generating ongoing business contributions that often outweigh the higher associated costs.

This guide lists the primary differences between contractors and employees and explains why employers often choose one option over the other.

Plus, find a cost comparison for each approach and answers to commonly asked questions.

What is an independent contractor?

A domestic or global independent contractor, also often called a contract employee, is a self-employed person or entity that provides goods, labor, or services to another individual or organization as a non-employee.

Independent contractors generally do not receive the same protections and rights as employees under local labor laws and are responsible for paying their income tax, insurance, and other statutory contributions on their own.

What is a full-time employee?

A full-time employee is an individual who works under an employment agreement with an entity—usually for 30 to 40 hours per week—and receives full protection under local labor laws.

Unlike independent contractors, full-time employees receive entitlements related to minimum wage, paid overtime, and paid leave, plus mandatory employer contributions to state insurance funds and pension plans.

The number of hours constituting full-time employment differs between organizations and jurisdictions, but it usually ranges from 30 to 40 hours per week. For example, in the U.S., a full-time employee performs at least 30 hours of service per week or 130 hours per month.

Have you classified your talent correctly? Use our contractor compliance checklist to learn about worker misclassification in global markets and assess the risk it poses to the success of your business:

Contractors vs. employees: Key differences

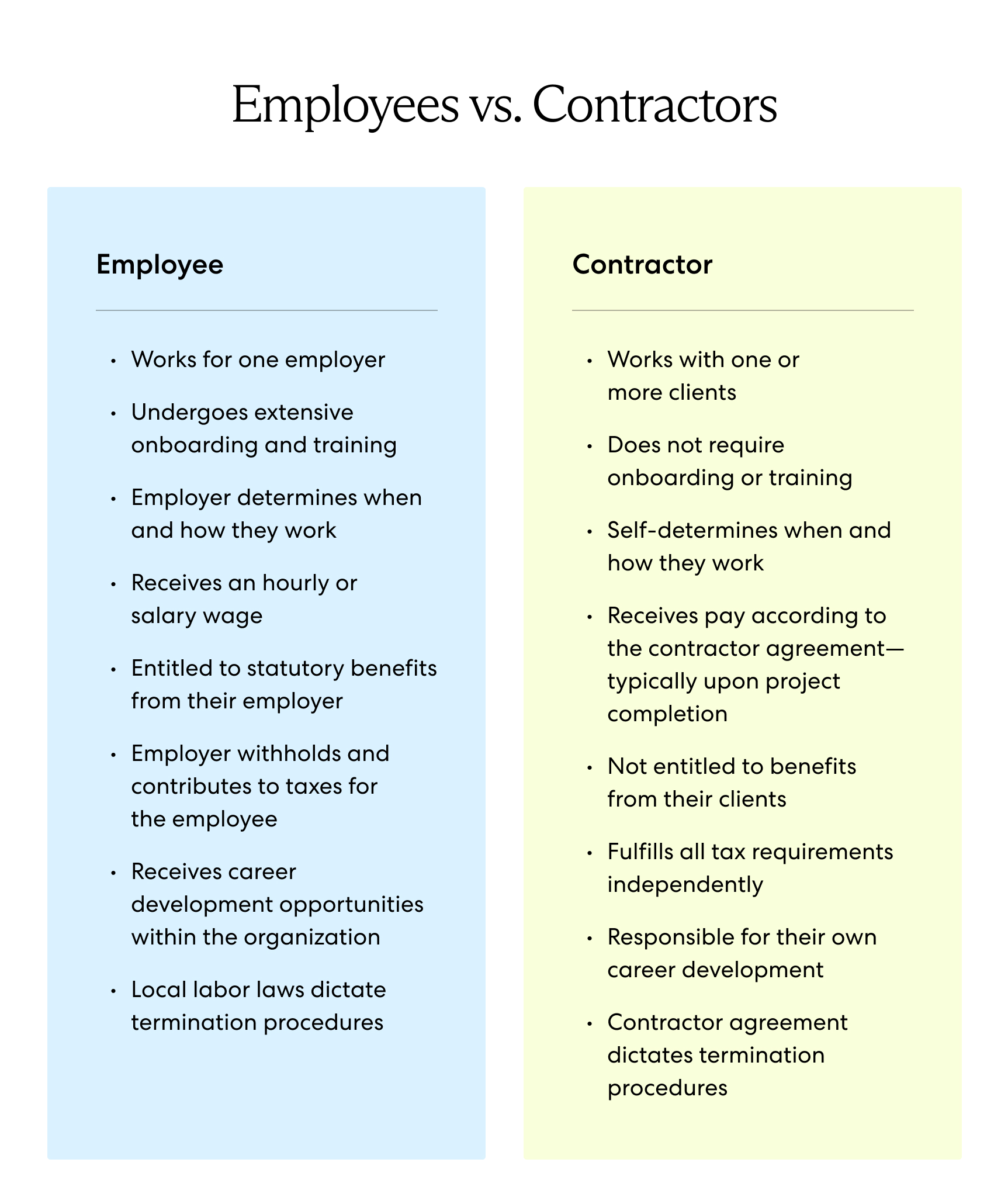

A worker's legal employment status depends on factors related to the financial and behavioral relationships between the employer and the worker.

Plus, the elements associated with hiring employees versus engaging contractors differ in various ways, such as in their onboarding procedures, training, payment schedules, and career development opportunities.

Below we outline these differences in detail.

Onboarding

Onboarding employees requires much more time and resources than onboarding contractors.

After applying for employment with a company, a candidate must pass an initial HR screening before completing several rounds of interviews. Upon receiving a job offer, the employee undergoes several weeks of in-person or virtual onboarding, meeting the team, and learning about job duties.

Conversely, independent contractors often skip the initial HR screening, undergo fewer interview rounds, and usually start working right away—without undergoing onboarding.

Training

When a company hires a new employee, part of the onboarding process involves a lengthy training period.

During this time, a hiring manager teaches the new hire about their team’s workflows, acquaints them with company tools, involves them with job-related skills development, and helps them get familiar with their new responsibilities.

However, because organizations usually hire independent contractors for their expertise on short-term assignments, contractors generally do not require training.

Payment method

Employees are on the company payroll and receive a consistent wage or salary; however, contractors are not on the payroll, and their payment schedule varies from job to job.

Contractors may charge their clients an hourly or per-project rate and usually receive an upfront deposit followed by milestone payments or full payment upon project completion.

Benefits

Employees are entitled to various statutory benefits, such as health insurance, paid leave, and a 13th-month salary, depending on the local labor laws and their employer’s individual policies.

Conversely, contractors are not entitled to most of the same statutory benefits and generally do not receive supplemental benefits from clients. Contractors usually have to purchase any critical or desired additional insurance policies, such as unemployment insurance, on their own.

Taxes

Employers pay income taxes and statutory contributions on their employees’ behalf, such as for social security and health insurance. However, contractors must fulfill all income tax and additional contribution requirements independently.

For example, in the U.S., independent contractors must pay income and self-employment taxes on their own, which covers Medicaid and Social Security.

Work autonomy

Common-law employees must follow a fixed work schedule and abide by employer regulations regarding how and where they conduct their work.

However, contractors enjoy greater work autonomy. They can set their own schedule, decide which tools they use to complete the job, and may even choose their location, depending on the nature of the project. They may also work for several clients at once.

Career development

Employers often make significant investments in ongoing employee career development to reduce employee churn and retain top talent.

This process involves identifying opportunities for upskilling employees and scheduling training sessions focused on skill development throughout the employee’s tenure with the company.

However, because organizations generally hire contractors for their expertise on short-term projects, ongoing career development doesn’t apply.

Termination

In most countries, local labor laws regulate when and how an organization may terminate its employees. These laws generally include a list of circumstances that allow for termination and the required notice periods.

By contrast, terminating an independent contractor is generally much more straightforward as long as the employer and contractor have specified the termination provisions in their work contract.

So, should you hire a contractor or an employee? Let’s look at key reasons why employers choose to hire independent contractors or full-time employees.

Why employers hire independent contractors

A contractor is a popular choice for organizations that need to hire someone to work independently on a short-term assignment with established expertise in the project area.

By engaging independent contractors, employers enjoy many benefits, such as low commitment beyond the contract terms, quick onboarding, and no additional costs, such as payroll tax, statutory contributions, and supplemental benefits.

Additionally, an organization usually doesn’t need a local branch or entity to engage international contractors and can pay these contractors remotely from their home country.

However, many of these advantages often obscure the risks of engaging contractors overseas, such as misclassification, non-compliant payments, and reputational damage.

Why employers hire full-time employees

Despite facing additional costs and administrative procedures, companies that hire full-time employees enjoy numerous benefits that make this route more attractive than engaging independent contractors.

By hiring employees, an organization secures long-term workers and creates continuity in its talent base, facilitating ongoing contributions to its business. By hiring employees, organizations also avoid employee misclassification risks.

However, when hiring employees abroad, companies must undergo many nuanced administrative procedures and face unique risks, such as noncompliance with local labor laws. Organizations must also set up legal entities in the countries where they seek to hire international talent.

When hiring international talent, many companies partner with a third-party expert, such as an employer of record (EOR), to shorten their time-to-market, eliminate the need for foreign entity establishment, and mitigate compliance risks along the way.

Learn more: What Is an Employer of Record (EOR)?

Cost considerations for hiring contractors vs. employees

In addition to the differences between engaging contractors and hiring employees, these two options also involve several differences related to employee cost.

These cost differences include taxes, onboarding, misclassification penalties, and risks associated with reputational damage. Below we outline each of these differences in detail.

Salaries, benefits, and taxes

When hiring employees, businesses face significantly higher upfront costs than when engaging contractors.

With employees, a business must pay regular salaries plus taxes and benefits, such as workers’ compensation, health insurance, and paid leave.

On average, employee benefits cost companies roughly 25% to 40% of an employee’s base salary. An employee who makes US$100,000 a year could cost their company US$25,000 to US$40,000 in benefits.

By retaining available self-employed workers, businesses can eliminate some of these costs.

Onboarding, training, and team building

Another cost associated with hiring employees comes from time spent onboarding, training, and team building.

As we mentioned above, engaging contractors usually doesn’t involve these stages. As a result, employers enjoy significant time savings by engaging contractors.

Misclassification penalties

Hiring contractors comes with costs, too. If a business engages contractors abroad, they must pay special attention to worker classification laws in the jurisdiction in which they hire. Otherwise, they face hefty misclassification penalties.

For example, Italian labor law provides detailed conditions that govern contractor classification. If a foreign employer supervises their Italian contractor’s work or offers fixed monthly payments, local authorities may classify their talent as an employee, subjecting the business to social contribution backpay, fines, and barred business activity.

Reputational damage

By engaging contractors, an organization risks undermining its company ethics and reputation as a reliable service provider.

Hiring contractors with fewer protections than employees may eventually undermine the ethics of a business that values full-time team members and aims to create a connected company culture.

Also, because some contractors may not have the same skills as trained employees, contractors risk diluting the quality of a product or service, which can hurt the company’s reputation.

To mitigate this risk, HR teams must be diligent when vetting contractors to ensure they have a history of providing quality work.

Hiring contractors vs. employees: FAQs

Below you can find answers to several commonly asked questions about engaging contractors versus hiring employees.

What are the pros and cons of engaging contractors?

Organizations receive numerous benefits from engaging contractors, such as low commitments, quick onboarding, cost savings, increased flexibility, and added efficiency.

However, engaging contractors entails significant risks as well, such as misclassification, lack of control over workers, increased liability for on-the-job injuries, and inconsistent worker availability.

Read more: The Pros and Cons of Independent Contractors

Can I convert contractors to employees?

Most companies can transition existing contractors into employment roles within their organization, depending on the nature of the contractor’s role and the employment laws in the country in which the contractor resides.

The process of converting contractors to employees varies between countries and is usually a complicated procedure that requires familiarity with local employment laws. In some cases, you may need to undergo the costly and time-consuming process of entity establishment.

Many businesses partner with a third-party expert, such as an employer of record (EOR), to quickly and compliantly convert contractors worldwide to employees without setting up local entities.

What is a 1099 employee in the U.S.?

A 1099 employee in the U.S. is another term for an independent contractor, self-employed worker, or freelancer.

The term 1099 comes from the form clients must fill out and file with the IRS before the end of the tax year, indicating payments they made to an independent contractor throughout that year.

What’s the difference between a contractor and a part-time employee?

The primary difference between a contractor and a part-time employee is that a part-time employee works for an organization under an employment contract and receives similar labor protections as a full-time employee.

For example, unlike contractors, part-time employees in the U.S. receive minimum wage, overtime, and family and medical leave guarantees. Their employers must also pay income tax and make statutory contributions, such as workers’ compensation and social security, on their behalf.

Compliantly build your dream team with Velocity Global

The best way to build your dream team while maximizing your budget and avoiding worker misclassification risks is to hire full-time talent beyond borders—and partnering with Velocity Global makes it easy.

As an employer of record (EOR), we simplify hiring, paying, and managing employees in more than 185 countries. We handle onboarding, payroll, benefits, and HR support so you stay compliant while avoiding the time and costs of foreign entity setup.

Our team of experts also helps you correctly classify talent and quickly convert contractors to employees while staying on the right side of labor laws.

Contact Velocity Global today to learn how to build a global team with confidence and ease.