Malaysia sits at the heart of the Asia-Pacific Rim and is a member of the nine-nation ASEAN Free Trade Area. Malaysia’s strategic trade location and highly educated workforce make it an attractive option for many businesses eyeing expansion into this region.

However, business expansion into Malaysia requires due diligence. Foreign employers looking to hire employees in Malaysia must familiarize themselves with local legislation to avoid noncompliance penalties such as fines, back pay, and even imprisonment.

This guide summarizes the main points of Malaysian employment law and explains how to compliantly hire employees in Malaysia.

2 ways to hire employees in Malaysia

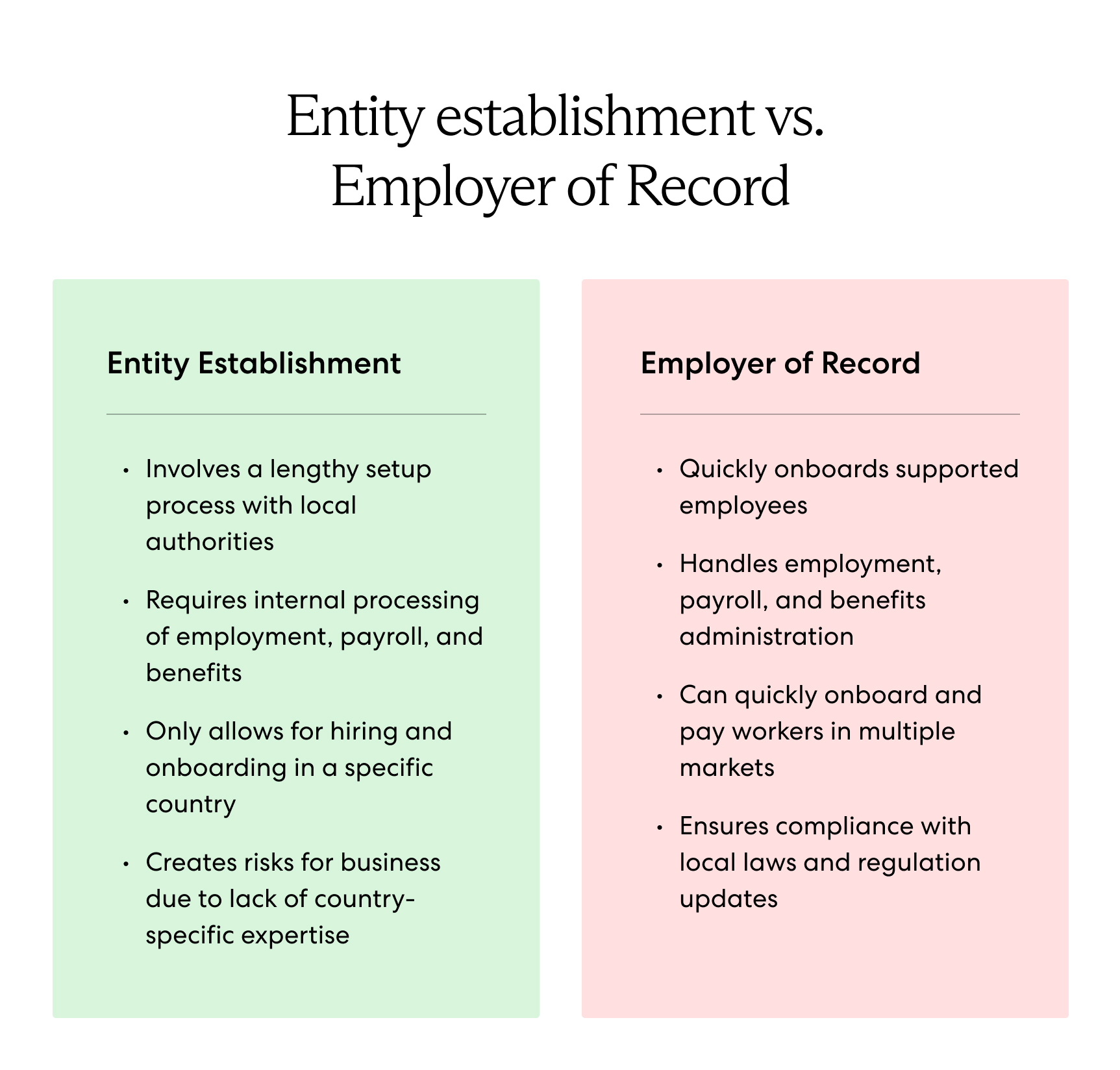

Foreign employers have two options for hiring employees in Malaysia: setting up a legal entity or partnering with an employer of record in Malaysia.

1. Set up a legal entity

Setting up a legal entity in-country makes sense if you are interested in long-term investments in Malaysia. Foreign employers can choose from four incorporated and two unincorporated structures. The best structure for your business depends on your plans and goals.

Establishing a separate legal entity allows you to benefit from some of the tax exemptions available under the free trade agreements with ASEAN countries. The most common entity among foreign investors is the Private Limited Company—a separate legal entity that allows 100% foreign ownership.

To establish a company in Malaysia, you must gather the necessary documents, submit your company name for search and approval, and apply with the Companies Commission of Malaysia (Suruhanjaya Syarikat Malaysia or SSM). This process can take several weeks.

If you’re not ready to make long-term investments in Malaysia, consider partnering with an employer of record (EOR) instead.

2. Use an employer of record in Malaysia

Partnering with an employer of record (EOR) is the most straightforward route to quickly and compliantly hiring employees in Malaysia. By partnering with an EOR, your business can jumpstart operations in Malaysia without waiting weeks or months.

An EOR is a legal entity that handles every aspect of employment in Malaysia, from onboarding and payroll to benefits administration and risk mitigation. An EOR is also well-versed in Malaysian employment law and ensures your business always complies with local legislation.

With this option, you unlock the benefits of global expansion without increasing your workload.

Learn more: What Is an Employer of Record (EOR)?

Alternative to employees: Engage contractors in Malaysia

An alternative to hiring employees in Malaysia is to engage contractors instead. Many foreign employers entertain this option because it offers lower commitment and greater flexibility.

However, setting up compliant work contracts and correctly classifying your talent without professional guidance exposes you to noncompliance risks. For example, if local authorities classify your contractors in Malaysia as employees, you will face hefty misclassification penalties such as back wages, tax arrears, fines, and even imprisonment.

Read more: Should You Hire a Contractor or Employee?

Key considerations when hiring in Malaysia

Before hiring employees in Malaysia, businesses must familiarize themselves with Malaysian employment law, worker classification, payroll standards, and social security tax.

Employment law in Malaysia

Employers must meet the basic provisions of the Employment Act of 1955, such as work agreement terms, statutory leave entitlements, standard working hours, mandatory notice periods, and severance pay.

- Work agreements. Employees must formalize any employment arrangement that lasts longer than one month with a written contract. Contracts must specify key terms, such as work scope, work location, and wages.

- Leave entitlements. Employees are entitled to annual and sick leave depending on their tenure with the company, plus 11 public holidays, 98 days of maternity leave, and seven days of paternity leave.

- Working hours. A standard workweek is 45 hours. Standard workdays and worknights are eight hours.

- Termination. Employers and employees must provide termination notices. The minimum notice period depends on the employee’s tenure:

- Less than two years: four weeks' notice

- Two to five years: six weeks' notice

- Five years or more: eight weeks' notice

- Severance. Except in cases of gross misconduct, employees are entitled to severance pay. The amount depends on the employee’s tenure:

- Less than two years: 10 days’ wage for each completed year

- Two to five years: 15 days’ wage for each completed year

- Five years or more: 20 days’ wage for each completed year

Work contracts that do not include the basic provisions are invalid and can lead to time-consuming litigation and back pay.

Misclassification: Employees vs. contractors

Malaysian employment law does not provide a fixed formula or test for determining a worker’s correct classification. Instead, the Industrial Court hears each dispute individually, considering all of the relevant facts and circumstances, such as:

- The nature of work

- The employer’s degree of control over the worker

- The period of work

- Contractual terms, if any

- How the company treated the worker relative to other employees

This ambiguity presents a compliance risk for employers. Misclassification penalties include 24 months’ back wages, fines, and even jail time. Many prudent employers entering the Malaysian market rely on an EOR to guarantee compliance.

Read our complete guide to employee and contractor misclassification.

Payroll in Malaysia

Businesses should consider several key points about payroll in Malaysia:

- Tax dates. The tax year is the calendar year. Individuals without business income must file tax returns by April 30, and individuals with business income must file returns by June 30.

- Payroll cycle. The payroll cycle in Malaysia is monthly. Employers make payments for the previous wage period by the seventh day of the next month.

- Average hours. Standard working hours cannot exceed eight hours per workday and 48 hours per workweek.

- Overtime. Malaysian law defines any hours beyond the standard working hours as overtime. Employers cannot require employees to work more than 12 hours per day, including overtime, and the minimum overtime pay is 150% of the regular wage.

Many foreign employers rely on a payroll outsourcing company in Malaysia to simplify payroll and ensure compliance.

Social security tax and employees provident fund

Employers and employees in Malaysia must make monthly earnings-based contributions to three social security funds: the Social Security Organization (SOCSO), Employees Provident Fund (EPF), and Employee Insurance Scheme (EIS).

Social Security Organization (SOCSO)

The SOCSO administers the Employment Injury Scheme and Invalidity Scheme:

- Employment Injury Scheme. This fund protects employees from workplace accidents.

- Invalidity Scheme. This fund insures employees under 60 against chronic illnesses that prevent them from working.

Employers’ and employees’ monthly contributions range from 0.5% to 1.75%, and noncompliance penalties include fines of up to RM10,000 and two years of imprisonment. Both funds cover Malaysian citizens and permanent residents only.

Employees Provident Fund (EPF)

The EPF is Malaysia’s public pension fund. Employer and employee contribution rates vary depending on the employee’s age, resident status, and income level. Rates range from 4% to 13% for employers and 0% to 11% for employees.

Non-Malaysian citizens and non-permanent residents may choose to contribute to the EPF, but it’s not required.

Employee Insurance Scheme (EIS)

The EIS supports people who have lost employment under circumstances that were out of their control or when they had no choice but to quit. It also provides job placement assistance. Employer and employee monthly contributions are 0.2% each, totaling 0.4%.

Find out more about employment, payroll, and taxes in Malaysia here.

Hire in Malaysia with a trusted partner

Expanding into Malaysia opens up many opportunities for global companies looking to do business in the Asia-Pacific Rim. However, navigating Malaysia’s complex labor laws can expose you to various noncompliance penalties. By partnering with a local expert, you can eliminate these risks.

Velocity Global’s Employer of Record (EOR) solution removes the burden of navigating Malaysian employment law and expedites hiring employees in Malaysia. Our EOR solution handles onboarding, payroll, benefits administration, compliance, and ongoing support for your distributed workforce so you can hire internationally without increasing your workload.

Get in touch with Velocity Global today to learn how to compliantly hire employees in Malaysia.