The logistics of expanding a U.S. business into a new country are complex—including adhering to local laws and navigating a new culture. Learning how to pay international employees is yet another learning curve.

This guide outlines ways for paying international employees while maintaining compliance with local employment and payroll laws.

How does a U.S. company pay foreign employees?

Once a company decides to expand overseas, the next step is to determine how to legally hire international employees, as well as how to compliantly pay international employees.

There are two primary ways to legally pay foreign employees overseas. First, a company can set up and incorporate a legal entity. Second, a company can use a global employer of record (EOR). Both options allow companies to expand their workforce, but the former requires far more commitment and risk.

Set up a legal entity in the foreign country

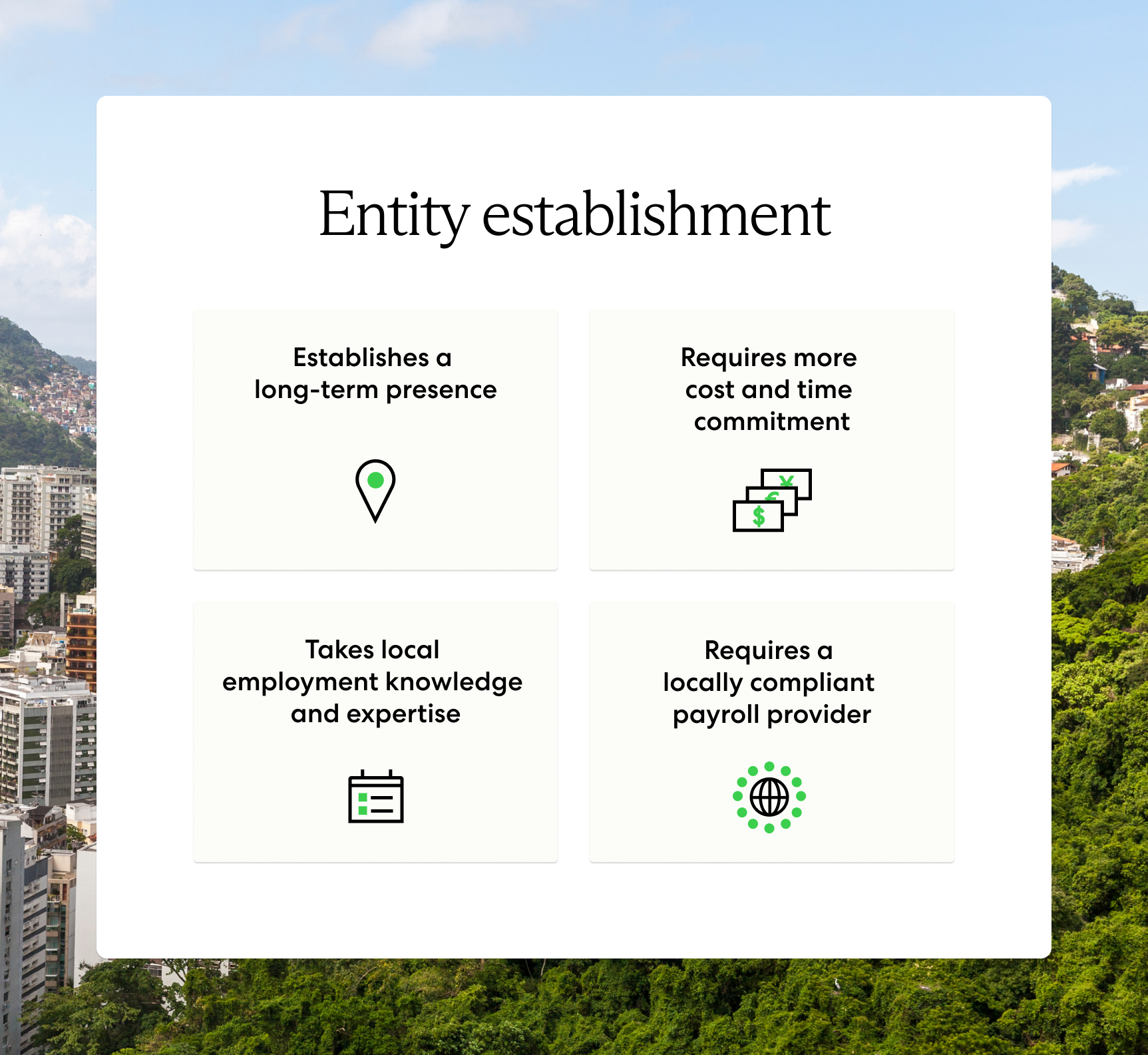

Setting up a legal entity is a natural choice for companies that want to permanently establish themselves in a new country.

For example, if a U.S. manufacturing company expands into India to open a new plant, it would likely create a legal entity in India. While entity establishment is costly and a time-consuming process, it may be a worthwhile investment for companies that see long-term or permanent operations.

U.S. companies that create legal entities in other countries still face the challenge of payroll for international employees. If a company has legal entities in more than one country, payroll becomes even more complicated.

A multi-country payroll solution makes it easy for U.S. companies to pay international employees across multiple countries and mitigates the need to manage multiple payroll providers. Standard multi-country payroll offers country-compliant payroll processes, reduces payroll reruns, automates payroll for multiple countries, and integrates with other payroll tasks such as time and attendance management.

Partner with an EOR

Not all companies have to set up a legal entity to do business in another country. Rather than going through the expensive, time-consuming process of establishing an entity, many companies opt to partner with a global EOR instead.

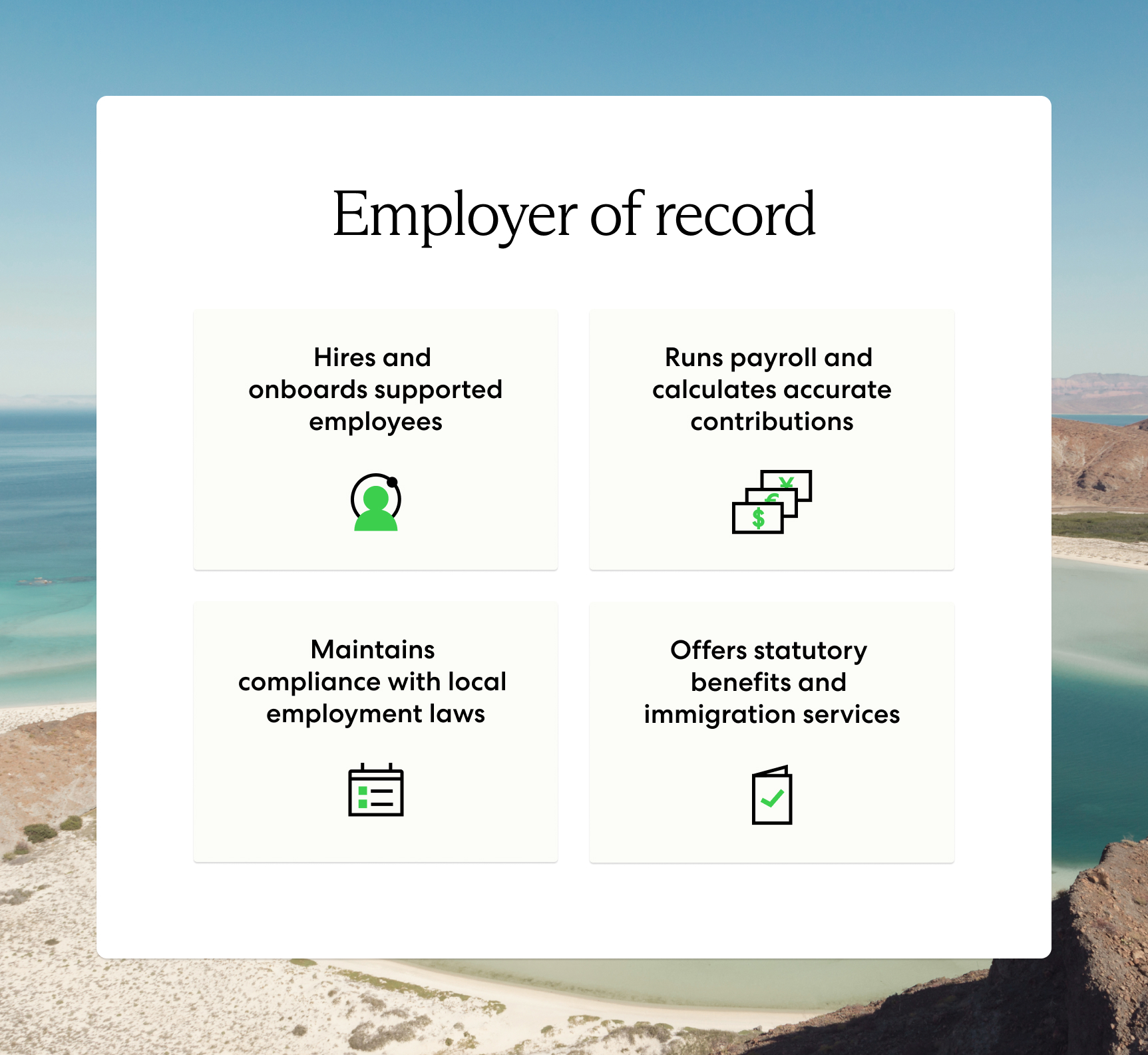

An EOR streamlines global expansion and hiring for companies by simplifying processes such as onboarding, payroll, and benefits. The EOR becomes the legal employer of a company’s supported employees and ensures hiring and payroll compliance with local labor laws in each country.

For example, if a U.S. software company wanted to hire a team of workers in France to develop a new product, it would benefit from partnering with an EOR. EORs have the expertise on how to pay international employees, navigate complex labor laws, and ensure employees get paid on time.

Global payroll, an integrated feature of a standard EOR solution, takes care of paying international employees in multiple countries. If that same U.S. software company also has a team in the U.K., the EOR would manage paying employees in both France and the U.K. through one platform.

What is the total cost of employment for international employees?

The total cost of employment for international employees varies depending on factors like location, job role, and payroll contribution requirements. Payroll contributions vary drastically at both regional and national levels around the world, so employers must know how to accurately calculate these contributions if they want to maintain compliance when hiring and paying international employees.

Do you want to calculate how much it costs to hire an international employee? Use our employee cost calculator below to get reliable insights into employee costs and payroll contributions around the globe:

Alternatives to paying international employees

Hiring international employees isn’t the only option if your company plans to expand. Some companies may choose to hire contractors if they have temporary needs that require international expertise.

For example, if a U.S. marketing agency needs an Italian subject matter expert to create content for a new client, they may choose to engage and pay an international contractor. The company can access the talent it needs without onboarding an employee and making major changes to its workforce.

Hire and pay overseas contractors

Once you’ve found the international contractor you intend to work with, the next step is onboarding and paying them. This isn’t as easy as just sending a PayPal payment: Hiring contractors requires U.S. companies to understand local labor laws to ensure they aren’t misclassifying their talent.

Misclassification refers to the illegal practice of classifying employees as contractors. Employees and contractors are classified differently by law as it relates to factors such as their financial relationship with the company and the degree of control over their work.

Companies may misclassify employees as contractors in an attempt to avoid paying taxes, or they may misclassify their talent unintentionally. Either way, should local authorities classify your contractors as employees, you may face fines, legal fees, employee back pay, business interruptions, and reputational damage.

Paying international contractors comes with its own set of challenges. Some difficulties include needing a secure platform, fast payments, and abiding by international payment regulations.

To avoid the inevitable risks and costs that come with hiring and paying contractors, many companies choose to partner with an EOR to quickly and compliantly hire and pay full-time employees or convert their existing contractors into employees.

Challenges and risks with global payroll

Paying international employees presents a number of challenges and risks, which is why it’s important to partner with a trusted EOR.

Below are some global payroll challenges and risks when paying international employees:

- Misclassifying workers

- Dealing with complex labor laws

- Navigating payroll contributions and taxes

- Risking permanent establishment commitments

- Adhering to immigration requirements

As you can see, many of these risks revolve around compliance with local laws and employee protections. An EOR takes most of the guesswork out of the process of hiring and paying international employees so companies can focus on business operations.

Streamline your payroll for international employees

U.S. companies that expand internationally should hit the ground running without worrying about payroll for international employees.

Rather than setting up a legal entity, Velocity Global’s EOR solution streamlines and simplifies onboarding, payroll, benefits, and many other HR tasks for growing U.S. companies. Our integrated global payroll capabilities make paying international employees simple and risk-free across multiple countries.

Contact Velocity Global today to find out how to pay international employees the easy way.