A leading employer of record

We are proud to share that NelsonHall has identified Velocity Global as a three-time leader in its 2023 EOR evaluation, acknowledging our ability to provide immediate customer benefits and meet future needs.

Download the report to discover what sets us apart.

Hire global talent with ease

Build your dream team with our global Employer of Record (EOR) solution. We help you effortlessly hire international employees while complying with local employment laws—so you can grow seamlessly across the globe.

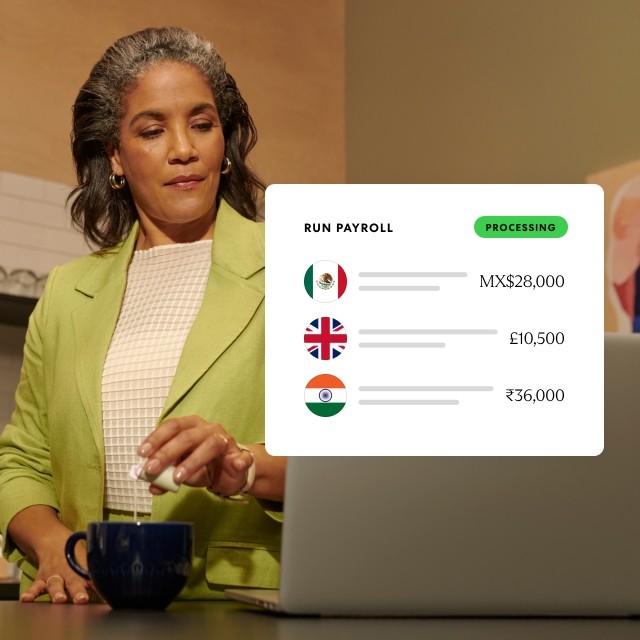

Pay talent on time, every time

Accurately and compliantly pay your global workforce through one centralized solution powered by world-class expertise.

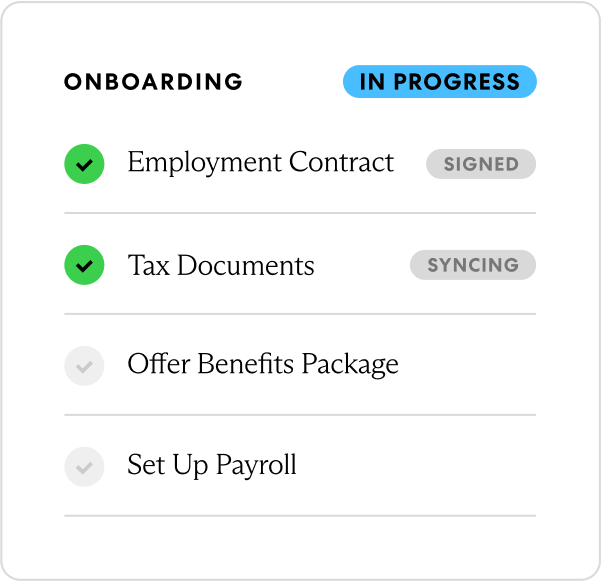

Watch the Global Work Platform demo

See how to onboard talent compliantly and enter new countries quickly with our Global Work Platform™.

Keep your talent—and keep them happy

We equip your business with the competitive perks and rewards that keep talent engaged for the long term.

Global Benefits

Support every member of your team with comprehensive, flexible medical and life coverage.

Global Equity Program

Easily reward talent with a transparent equity program that eliminates compliance risks.

Global Immigration

Make talent relocation or visa approvals simpler for an easy transition of employment.

International Pensions

Empower your talent to invest in their future with flexible retirement savings plans.

Flexible Office Space

Give your global team a home base with Upflex workspaces available in 120+ countries.

We’ve got the world-class expertise and human support to take you anywhere.

Expertise everywhere

Tech for global dream teams

Always there for your people

Transforming how the world works

Businesses go farther with velocity

Get a global perspective with our resources

Learn more about borderless hiring

Get answers about global hiring, payroll, benefits, international workforce compliance, and pricing.