For employers looking to hire talent, benefits play a significant role in today’s competitive global hiring landscape. The benefits you provide your international teams go a long way and often make the difference between an employee’s choice to work for your company or someone else’s.

In addition to meeting statutory benefit requirements, employers use supplemental benefits as a competitive differentiator. Supplemental benefits vary from country to country, and international employees might have different expectations of a well-rounded benefits package.

Learn about supplemental benefits, examples in different countries, and how they serve as a competitive hiring solution for global employers.

Supplemental benefits meaning

Supplemental benefits are additional benefits an employer provides to enhance the worker’s medical, retirement, and insurance coverage. Supplemental benefits offer a higher coverage level for employees and often extend the coverage to their families.

Examples of supplemental benefits include additional health insurance, such as dental and vision, retirement contributions, and extended leave benefits.

Talent no longer desires a paycheck and the bare minimum benefits. Workers worldwide seek employers who provide indirect compensation that improves their quality of life, allows them to care for their families, and makes them feel valued at work.

Employees worldwide often expect robust supplemental benefits as part of their global compensation package, regardless of the statutory benefits offered.

To meet this demand, employers offer robust benefits packages to make their company more desirable to prospective employees and retain their current workforce.

Read more: How to Create a Global Compensation Strategy

Get our guide to learn how to easily administer compliant, market-tailored benefits packages that go above minimum requirements, no matter your talent's location:

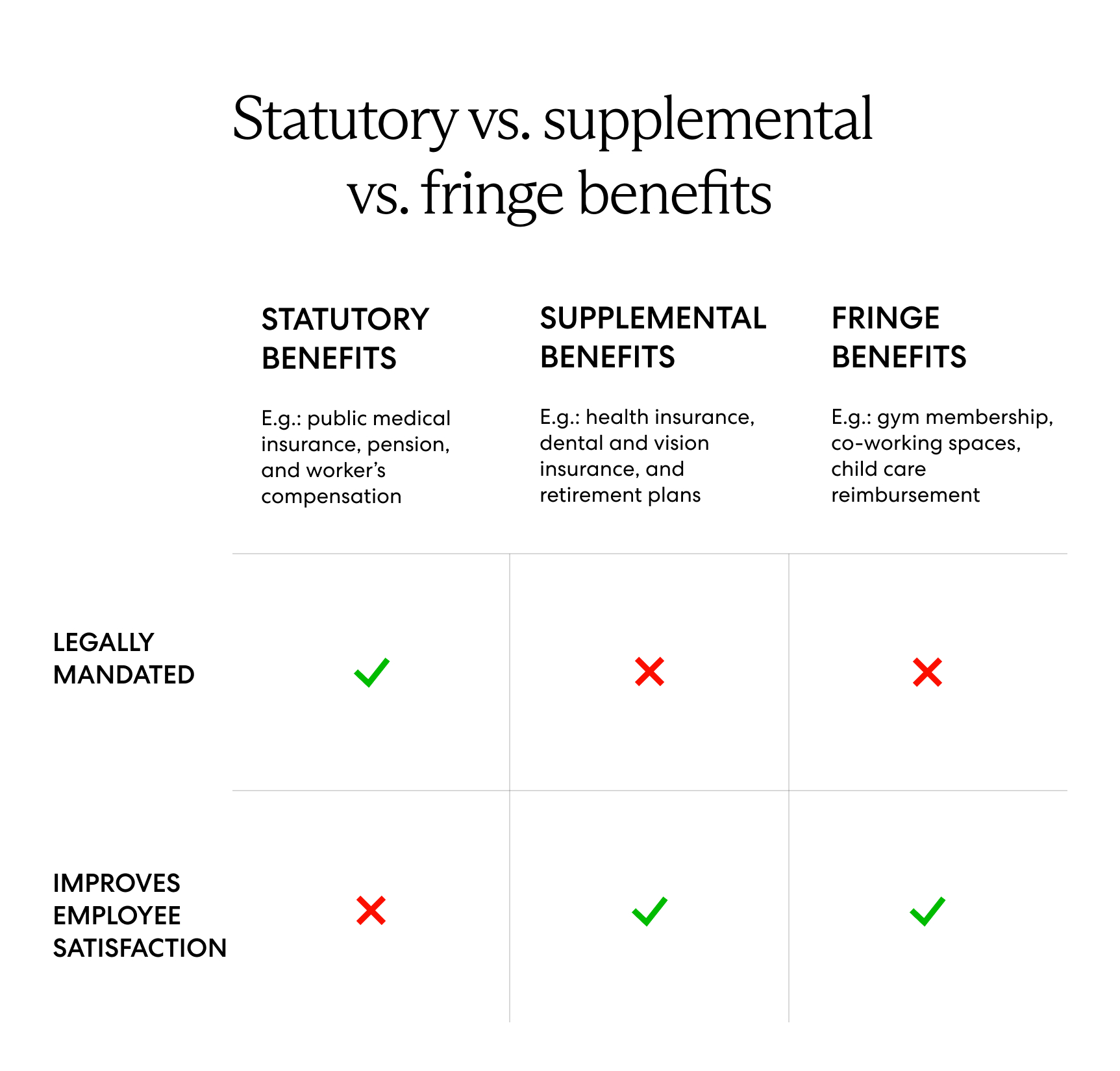

Statutory vs. supplemental vs. fringe benefits

Statutory benefits are mandatory benefits an employer must provide their employees. Statutory benefits vary depending on each country’s specific laws, but they often include publicly managed medical insurance, pension, and time off.

Unlike statutory benefits, supplemental benefits are not required by law. However, they go beyond the mandatory benefits that keep you compliant with local labor laws and offer more comprehensive coverage for employees and their families.

Another type of benefit employers often provide is fringe benefits. Fringe benefits are perks that help supplement an employee’s salary for costs related to their work, health, and wellness.

Examples of fringe benefits include gym membership, a remote office stipend, or a co-working space allowance. As with supplemental benefits, legal authorities do not require employers to offer fringe benefits.

Employers often use supplemental benefits and fringe benefits as tools to create a well-rounded and competitive compensation policy that increases employee attraction, retention, and satisfaction.

Read more about fringe benefits here.

Supplemental benefit examples

Here are some examples of supplemental benefits that not only support and complement statutory benefits but also offer an attractive and competitive draw for today’s workforce.

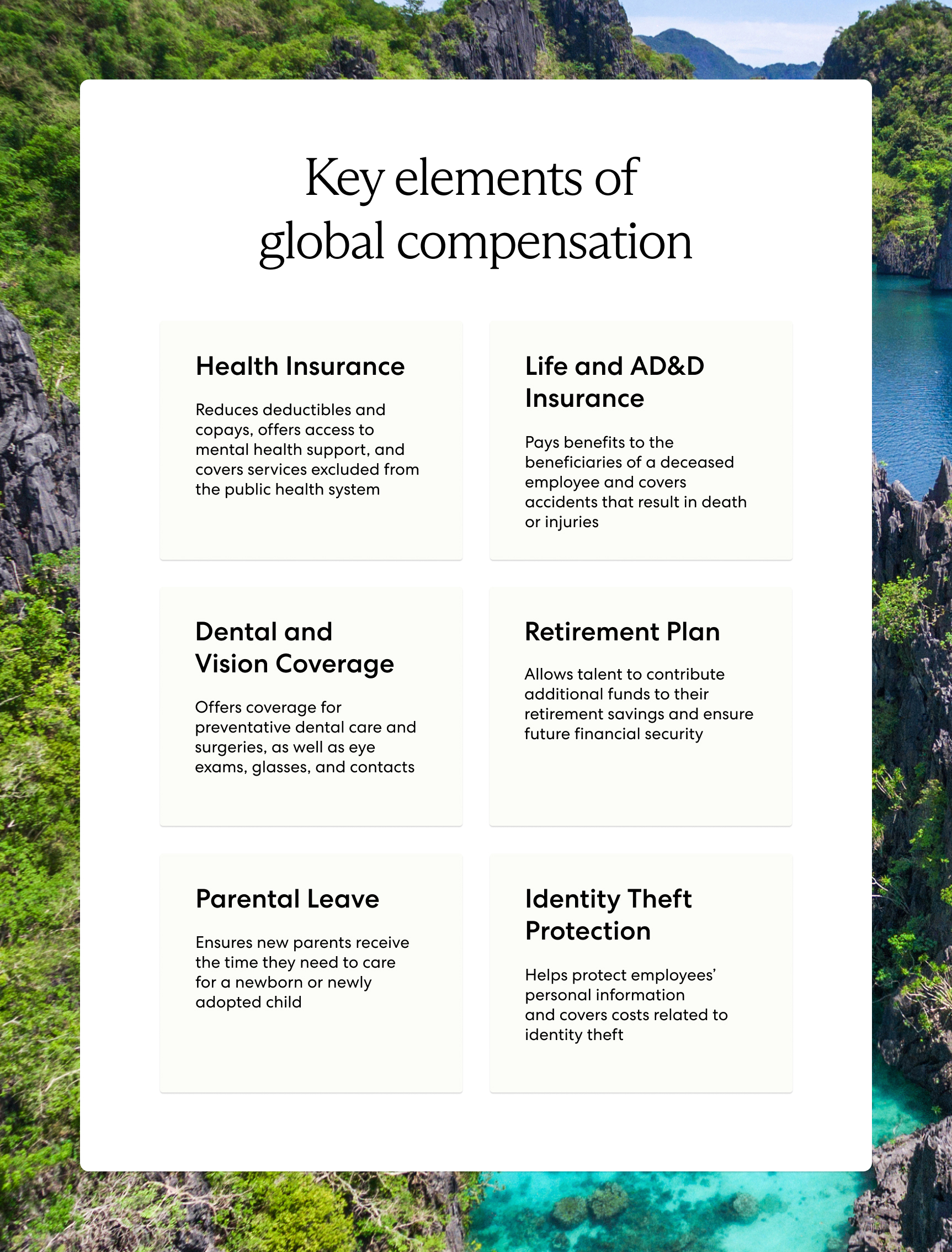

Supplemental health insurance

Health insurance is one of the most common benefits employers offer, and it plays a major role in employee satisfaction. In a Transamerica Center for Health Studies survey, nearly 55% of respondents pointed to healthcare as the top factor for their level of contentment with their employment.

Health coverage is a statutory benefit in many countries. Public health insurance typically covers routine doctor’s appointments, hospital visits, and prescription drug costs. However, health insurance coverage varies across countries and regions.

To maintain equity across a company’s global workforce and ensure competitive coverage for their team, employers offer supplemental health insurance plans. These include lower deductibles and copays, elective surgeries, and better access to mental health care and telehealth services.

Learn more: The Differences Between Public vs. Private Healthcare

Example: Employee benefits in India

Employee State Insurance (ESI) is the statutory medical insurance in India. However, ESI is limited in coverage scope. In India, employers typically offer additional medical coverage for maternity care, cancer treatments, and fertility treatments that extend to dependents and partners.

Find more information about statutory and supplemental benefits in India here.

Life and AD&D insurance

In the case of unforeseen events, life and accidental death and dismemberment (AD&D) plans are valuable supplemental benefits and offer protection for employees and their families.

Supplemental life insurance pays benefits to the beneficiaries of a deceased employee to help cover various expenses, such as funeral services, mortgage payments, income replacement, and loans. AD&D insurance includes coverage for accidents that result in death or injuries, such as dismemberment or loss of eyesight or hearing.

Dental and vision coverage

Employers often provide individual dental plans as a supplemental benefit because dental care is not typically included in general health insurance packages.

Through dental insurance, an employee and their dependents receive coverage for annual dental appointments and cleanings. Beneficiaries also gain access to lower-cost dental care, such as orthodontics and dental surgeries.

Employers offer vision plans as an additional standalone benefit due to the lack of vision coverage in general medical plans. Vision care benefits provide affordable coverage for eye exams, medical eye care, eyeglasses, contact lenses, and vision correction surgery.

Retirement benefits

In many countries, pension plans are part of statutory benefits. However, there are limitations on the benefits and annual contribution amounts, so employers often choose to provide additional retirement benefits. Common retirement benefits include pension plans that provide retirement income or employer contributions to country-specific retirement programs.

According to a Benefits Survey Report by People Keep, 87% of employees surveyed value retirement benefits. Retirement plans enable employees and employers to contribute to retirement savings and secure long-term financial security. Additionally, retirement programs and contribution-matching policies impact employee satisfaction and increase long-term retention.

Example: Employee benefits in Canada

Canada and Quebec both require statutory employee pension plans, the Canadian Pension Plan (CPP) for employees outside of Quebec, and the Quebec Pension Plan (QPP) for employees in Quebec.

While employers are required to provide these benefits, there are limitations to annual contribution amounts. Employers often offer Group Registered Retirement Savings (GRRS) to allow for additional contributions to ensure sufficient funds when the employee retires.

Read more about statutory and supplemental benefits in Canada.

Parental leave

Parental leave is a benefit that provides guaranteed time off for employees to navigate pregnancy and care for a newborn or newly adopted child. Parental leave is separate from paid time-off statutory benefits and is often referred to as maternity leave, paternity leave, and adoption leave.

Read our complete guide covering paid maternity leave by country.

Identity theft protection

Identity theft protection is a benefit that protects employees as well as employers. Identity theft protection monitors credit activity and reports, the internet, and social media. It also detects possible fraud alerts and assists with identity restoration.

In today’s ever-changing technology climate, the risk of cyber crimes and data breaches has significantly increased. In fact, identity theft and fraud reports rose 45% in 2020 and Allstate alone serves one-third of Fortune 500 companies for identity and privacy protection. More employers are offering identity theft protection as part of a competitive employee benefits package.

Benefits and challenges of offering supplemental benefits to a global team

Benefits

According to a 2022 MetLife study, 66% of employees say comprehensive benefits are a must-have. Employees who are satisfied with their benefits packages are also two times more likely to be satisfied with their jobs. Additional benefits to offering supplemental benefits include:

- Attracting and retaining top talent. The MetLife study also revealed that when employees’ holistic health and well-being needs are met, 74% are more likely to be satisfied with their current job and 51% more likely to stay at their current organization.

- Showing employees their needs are prioritized by tailoring benefits to their unique locations.

- Peace of mind that you support your global team with thorough coverage.

- Ensuring equity of care and benefits across an international team.

Challenges

While there are many positives to offering extra benefits, doing so also requires additional time, expertise, and costs that HR teams don’t have. In fact, 42% of HR teams report struggling under the weight of too many responsibilities.

Other challenges that come with offering supplemental benefits to a global workforce include:

- Complying with foreign benefits laws, managing various benefits costs, and keeping up with changing regulations.

- Finding a reputable partner in a foreign country. Vetting vendors and comparing prices can be a time-consuming, overwhelming process.

- Juggling multiple partners if your workforce is located in various countries.

- Ensuring fair benefits to employees in different countries.

- Triggering permanent establishment. A business is at risk for permanent establishment if it has an employer of record (EOR) but offers employee benefits through an external provider other than their EOR.

- Securing competitive and cost-effective plans for a small number of international employees.

Offer supplemental benefits in over 185 countries

Going far beyond statutory benefits is critical in attracting and retaining a highly skilled global workforce. Supplemental benefits are one solution to supporting your employees. And while there are challenges with providing supplemental benefits to a global team, a knowledgeable and experienced global partner can help ensure you meet your employees’ needs.

As your EOR partner, Velocity Global streamlines the employee benefits process to help you attract and retain top talent worldwide. Our Global Benefits solution offers comprehensive and cost-effective benefits coverage in more than 185 countries. With plans tailored to local markets, our team of experts ensures you have compliant benefits that meet the highest coverage standards for your distributed workforce.

Contact Velocity Global today to learn how to boost your global employee benefits.