Employer of Record líder do setor

Temos orgulho de compartilhar que a NelsonHall nomeou a Velocity Global como líder pela terceira vez em seu relatório de avaliação de EORs de 2023, reconhecendo nossa habilidade de oferecer benefícios imediatos a nossos clientes e atender às suas necessidades futuras.

Contrate talentos globais com facilidade

Crie seu dream team com nossa solução de Employer of Record (EOR) global. Ajudamos você a contratar talentos internacionais com facilidade e em conformidade com a legislação trabalhista local, para sua empresa ganhar o mundo.

Pague suas equipes pontualmente, sempre

Conte com uma solução centralizada, criada por especialistas de renome mundial, para pagar suas equipes globais com precisão e conformidade.

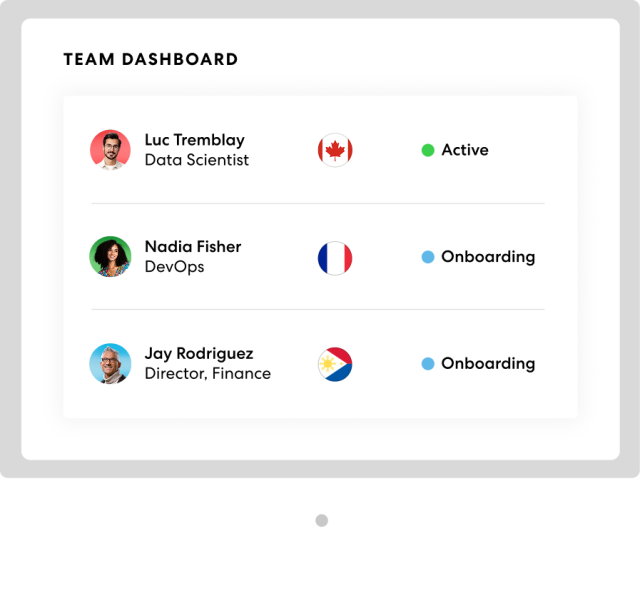

Demonstração da Global Work Platform

Veja como garantir a conformidade no onboarding de talentos em outros países e entrar rapidamente em novos mercados com nossa Global Work Platform™.

Retenha e garanta a satisfação de seus talentos

Equipamos sua empresa com vantagens e recompensas competitivas que mantêm a motivação dos seus talentos a longo prazo.

Benefícios globais

Apoie todas as pessoas da sua equipe com planos de saúde e seguros de vida abrangentes e flexíveis.

Plano global de participação acionária

Recompense facilmente suas equipes com um programa de participação acionária que elimina riscos de conformidade.

Imigração global

Simplifique a transferência de talentos ou a aprovação de vistos, para facilitar as transições de seus colaboradores.

Planos de previdência internacionais

Capacite seus talentos a investir no futuro com planos de previdência flexíveis.

Temos a expertise mundial e o atendimento humano que você precisa para chegar onde quiser.

Especialistas locais

Tecnologia para dream teams globais

Esteja sempre ao lado de suas equipes

Transformando o mundo do trabalho

As empresas vão mais longe com a Velocity Global

Ganhe uma perspectiva global com nossos recursos

Saiba mais sobre contratações sem fronteiras

Tire suas dúvidas sobre contratação global, folha de pagamentos, benefícios, regularização de colaboradores internacionais e preços.