Employer of Record der Extraklasse

Wir freuen uns, dass Velocity Global in 2023 gleich dreifach von NelsonHall ausgezeichnet wurde. Mit unserem umfassenden Angebot bieten wir unseren Kund*innen nachhaltigen Mehrwert und konnten uns so gegen andere EOR durchsetzen.

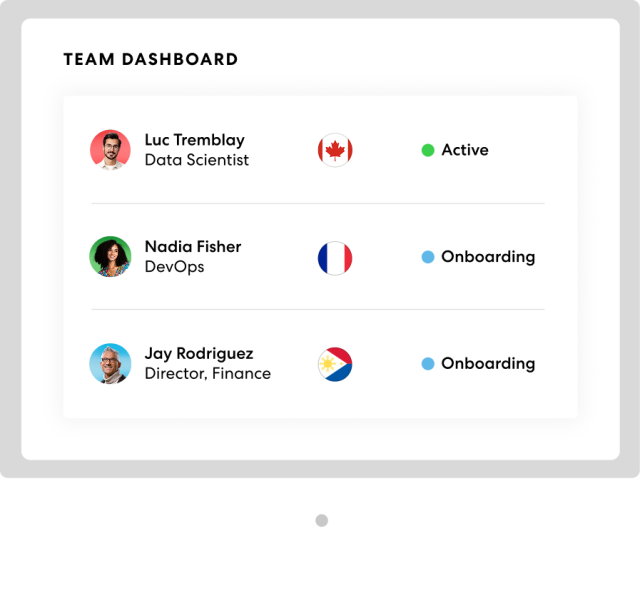

Top-Talente weltweit einstellen

Mit Velocity Global als Employer of Record (EOR) steht Ihrem Dream-Team nichts mehr im Weg. Mit uns als Partner können Sie die besten Leute weltweit einstellen, müssen sich um Compliance keine Sorgen machen – und können ungebremst weiter wachsen.

Verlässliche Vergütung

Vertrauen Sie auf eine erprobte, zentralisierte Lösung, um Ihre Teammitglieder auf der ganzen Welt korrekt und rechtskonform zu bezahlen.

Demo der Global Work Platform ansehen

Erfahren Sie, wie Sie mit der Global Work Platform™ Talente schnell und compliance-gerecht einstellen und neue Märkte erschließen können.

Glückliche Mitarbeitende sind loyale Mitarbeitende

Mit unserer Hilfe können Sie Top-Talenten überzeugende Zusatzleistungen und Boni bieten und sie ans Unternehmen binden.

Weltweite Benefits

Bieten Sie Ihrem Team umfangreiche und flexible Kranken- und Lebensversicherungen.

Weltweites Equity-Programm

Mit unserem Equity-Programm können Sie Ihr Team weltweit compliance-gerecht belohnen.

Internationale Relocation

Unterstützen Sie Ihre Mitarbeitenden bei der Relocation und der Beantragung von Visa.

Internationale Altersvorsorge

Unterstützen Sie Ihre Mitarbeitenden mit flexiblen Vorsorgelösungen dabei, ihre Zukunft abzusichern.

Mit unserer Expertise und Unterstützung kommen Sie international weiter.

Weltweites Know-how

Tools für globale Teams

Unterstützung für Ihr Team

Die Zukunft der Arbeit mitgestalten

Weiterkommen mit Velocity Global

Blick über den Horizont – Unsere Ressourcen

Mehr über grenzübergreifendes Recruiting

Erfahren Sie alles über internationale Payroll, Benefits und Compliance sowie über unsere Preise.