Un employer of record líder

Nos alegra comunicar que NelsonHall ha nombrado a Velocity Global líder, por tercera vez, de la evaluación EOR de 2023. Este reconocimiento se debe a nuestra capacidad de brindar ventajas inmediatas al cliente y de satisfacer las necesidades del futuro.

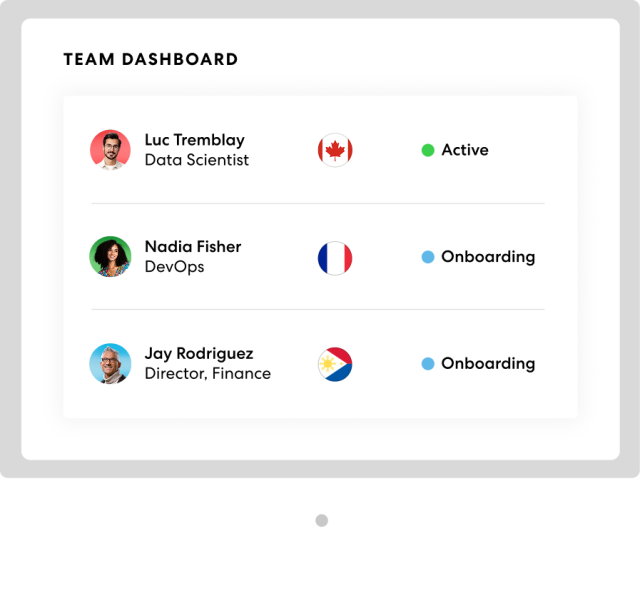

Contrata talento global sin problemas

Forma el equipo ideal con nuestra solución de employer of record (EOR) global. Te ayudamos a contratar fácilmente a empleados internacionales según la legislación laboral local para que tu empresa crezca por todo el mundo.

Paga a tu talento siempre a tiempo

Ponemos a tu servicio una solución centralizada y nuestra dilatada experiencia para que pagues a tu plantilla global sin inconvenientes, vivan donde vivan.

Ver la demostración de Global Work Platform

Descubre cómo incorporar talento según la normativa y accede a otros países rápidamente con Global Work Platform™.

Atrae al mejor talento y no lo dejes escapar

Ofrecemos a tu negocio incentivos y beneficios que logran motivar a tu equipo a largo plazo.

Beneficios globales

Protege a los miembros de tu plantilla con seguros médicos y de vida que se adaptan a sus necesidades.

Capital accionario

Recompensa a tus trabajadores con un plan de participación en el capital que cumple con la legislación.

Movilidad laboral

Facilita a tu equipo la aprobación de visas y la gestión de los traslados para que se muevan libremente.

Pensiones globales

Anima a tu plantilla a invertir en su futuro con planes de ahorro flexibles para la jubilación.

Contamos con la experiencia y los conocimientos necesarios para llevar tu negocio tan lejos como quieras.

Presencia local

Tecnología global

Apoyo constante

El futuro del trabajo

Negocios que crecen a toda velocidad

Adopta una perspectiva global con nuestros recursos

Obtén más información sobre la contratación global

Respondemos tus preguntas sobre contratación, nóminas, beneficios, cumplimiento normativo y costos.