Contractors offer several advantages for companies and are a valuable resource for global teams. Engaging contractors allows companies to target talent with specialized skills and quickly expand into new international markets.

Understanding how to compensate contractors compliantly is crucial for managing a distributed workforce, but contractor tax form requirements can be complex and unfamiliar compared to employee tax filing.

So, where do you begin when filing compensation for contractors who aren’t permanent employees? Do you pick Form 1099-NEC or Form 1099-MISC?

The following guide discusses the difference between forms 1099-NEC and 1099-MISC and how to file each to ensure compliance when engaging contractors.

What is Form 1099-NEC?

Form 1099-NEC (non-employee compensation) is a tax form that U.S. businesses use to report payments of more than $600 to U.S. contractors, consultants, freelancers, and other self-employed people who perform services for the company but aren’t permanent employees.

Read more: Pros and Cons of Hiring Independent Contractors

Who should file Form 1099-NEC?

Businesses must report and file any compensation exceeding $600 annually for anyone who is not an employee. Companies use Form 1099-NEC to report this information to the Internal Revenue Service (IRS).

What should be reported on Form 1099-NEC?

A business reporting non-employee compensation on Form 1099-NEC must include the following information:

- Business’s name, address, phone number, and Federal Employer Identification Number (FEIN)

- Nonemployee's name, address, and Tax Identification Number (TIN) as reported on their Form W-9

- State identification number

- Non-employee compensation exceeding $600 paid during the previous year

What is Form 1099-MISC?

Form 1099-MISC is a tax form that reports miscellaneous income over $600, not part of compensation. Before 2020, Form 1099-MISC reported contractor or sole proprietor income, but now it’s only used to report miscellaneous payments.

According to the IRS, businesses or individuals must report payments for the following:

- Rent payments

- Royalties

- Prizes and awards

- Attorney payments

- Medical and health care payments

- Crop insurance proceeds

- Any fishing boat proceeds

- Cash payments from fishing

- Payments of $10 or more in broker payments or royalties in placement of dividends or tax-exempt interest

- Earnings through the direct sale of consumer products intended for resale surpassing $5,000

Who should file Form 1099-MISC?

A business must file Form 1099-MISC if they paid over $600 to an individual or entity for miscellaneous expenses such as rent, prizes, awards, or attorney payments.

What should be reported on Form 1099-MISC?

Businesses must report the following information on the Form-MISC:

- Business’s name, address, phone number, and FEI

- Recipient's name, address, and TIN as reported from their Form W-9

- State identification number

- Applicable boxes for specific types of income reported, such as rent, royalties, or prizes and awards

- Withholding boxes for federal or state income tax

- Any foreign assets subject to withholding under the Foreign Account Tax Compliance Act

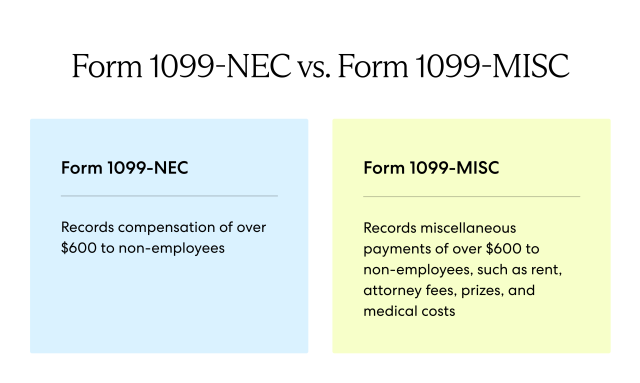

Form 1099-NEC vs. Form 1099-MISC

Businesses use both tax forms 1099-NEC and 1099-MISC to report payments of more than $600 to non-employees. The differences include what those payments are for and the employment relationship.

Before 2020, companies reported all non-employee compensation in box seven on Form 1099-MISC. Due to confusion regarding dual-filing deadlines on Form 1099-MISC, the IRS introduced Form 1099-NEC for reporting non-employee compensation.

Currently, the two forms are for reporting payments:

How to file Form 1099-NEC

Here’s what you need to know to complete and file Form 1099-NEC.

1. Gather the appropriate information

To fill out Form 1099-NEC, you need your recipient’s W-9. Their W-9 form gives you the information you need to complete the 1099. It includes the following details about the recipient:

- Name

- Business entity or relationship (freelancer, proprietor, contractor, business, etc.)

- Address

- Taxpayer Identification Number (SSN, EIN, etc.)

2. Fill out Form 1099-NEC

To fill out Form 1099-NEC, input your business and recipient’s information. Also, include how much you paid the non-employee and how much tax (if any) you withheld.

The information you fill out on Form 1099-NEC includes:

- Payer name or business

- Payer’s tax information

- Recipient’s name or business name

- Recipient’s address

- Account number (if applicable)

- Non-employee compensation

- State withholdings (if applicable)

- Federal withholdings (if applicable)

Ensure all information is accurate and complete before sending Form 1099-NEC.

3. Send Form 1099-NEC

You can send Form 1099-NEC physically with a scannable template from the IRS or electronically through software or services compatible with the IRS’s Filing Information Returns Electronically (FIRE) system. You must submit two copies of Form 1099-NEC, which include:

- Copy A. This copy goes to the IRS.

- Copy B. This copy is for the contractor or freelancer.

Keep a copy for your records, and file on time to avoid penalties.

Depending on where you live, you may also need to file Form 1099-NEC with the state. You are not obligated to submit filings to the state in the following states:

- Alaska

- Florida

- Illinois

- Nevada

- New Hampshire

- New York

- South Dakota

- Tennessee

- Texas

- Washington

- Wyoming

If you live in any U.S. state not listed above, you must file Form 1099-NEC to your state. If you file electronically, the IRS may sometimes file with the state for you. A tax compliance partner can help you navigate exactly where and when to file.

Deadline for filing 1099-NEC

You must send all copies of Form 1099-NEC by January 31 each year for non-employee payments made the prior year.

1099-NEC penalties

Missing the 1099-MISC filing deadline could result in IRS penalties ranging from $50 to $270 per form, depending on how late you submit them.

If you need more time, request a filing extension by submitting paper Form 8809 (Application for Extension of Time To File Information Returns) by January 31 to the IRS. You must mail Form 8809 and can't file it online.

How to file Form 1099-MISC

Filing Form 1099-MISC is a similar process to filing the 1099-NEC, but there are additional sections to complete.

1. Gather the appropriate information

Similar to Form 1099-NEC, start by gathering your recipient’s and payment information. Obtain a completed Form W-9 from the recipient receiving income. The W-9 verifies the recipient’s identity and collects their TIN.

Also, keep track of your miscellaneous payment information.

2. Fill out Form 1099-MISC

To fill out Form 1099-MISC, you must input your information, your recipient’s information, and any relevant payment information, including:

- Payer’s name and address

- Payer’s tax information

- Recipient’s name and address

- Recipient’s tax information

From there, you’ll see boxes broken down by payment type correlating to the miscellaneous payments to report on Form 1099-MISC. Input your payment information as needed down the line.

These boxes include:

- Rents

- Royalties

- Federal income tax withheld

- Fishing boat proceeds

- Medical and health care payments

- Direct sales totaling $5,000 or more of consumer products to recipient for resale

- Substitute payments in placement of dividends or interest

- Crop insurance proceeds

- Gross proceeds paid to an attorney

- Fish purchased for resale

- Excess golden parachute payments

- Nonqualified deferred compensation

- State tax withheld

3. Send Form 1099-MISC

As with Form 1099-NEC, send two copies of Form 1099-MISC electronically or physically:

- Copy A. This copy goes to the IRS.

- Copy B. This copy goes to the recipient

Keep a copy for your records, and send Form 1099-MISC on time to avoid penalties.

Deadline for filing 1099-MISC

You must file Form 1099-MISC with the IRS by February 28 if filing by mail and March 31 if filing electronically.

1099-MISC penalties

You must file Form 1099-MISC accurately and on time to avoid IRS penalties. The penalty for late or incorrect filing varies based on the delay.

To request additional time, you must mail paper Form 8809 (Application for Extension of Time To File Information Returns) to the IRS by January 31.

Should I fill out Form 1099-NEC or 1099-MISC for international contractors?

Neither. When hiring and paying international contractors, U.S. companies should use Form W-8BEN. This tax form classifies a foreign worker’s status as a non-U.S. citizen and determines proper tax reporting and withholdings for the entity providing them income.

If you hire or engage international talent, request a W-8BEN before putting them on payroll or providing compensation. An employee or contractor typically needs to fill out a W-8BEN Form if they apply to the following criteria:

- They are not a U.S. citizen

- They are not a U.S. resident

- They do not have a Green Card

- They performed the work outside of the U.S.

- They are the beneficial owner of the income provided

Compliantly pay talent in 185+ countries

Understanding tax forms and accurately paying contractors is challenging—especially when engaging international contractors.

If hiring contractors is part of your short-term business plan to quickly scale or enter new markets, take time to understand the tax and pay requirements of your talent’s local jurisdictions—or find the right partner to help you simplify contractor payments and compliance.

When converting your contingent workforce to full-time employees to follow international compliance regulations and mitigate classification risk, rely on Velocity Global.

Our market-leading EOR solution leverages local expertise across 185+ countries to seamlessly convert contractors to full-time employees on your behalf so you can grow with confidence while staying on the right side of labor laws.

Our global employment solutions and robust partner network provide the support you need to effortlessly engage and pay contractors in the short term—then ultimately build and support a permanent workforce around the globe with speed and compliance. Contact us to learn more.

Disclaimer: This information does not, and is not intended to, constitute legal or tax advice and is for general informational purposes only. You should contact your attorney or tax advisor to obtain legal and/or tax advice with respect to your particular situation. Only your individual attorney or tax advisor can provide assurances that this information—and your interpretation of it—is applicable or appropriate to your specific situation. All liability with respect to actions taken or not taken based on this information is hereby expressly disclaimed. All content is provided "as is," and Velocity Global makes no representations or warranties concerning this information.

Topic:

Contractors