Mexico’s growing economy, highly skilled workforce, and numerous free trade agreements make it a viable target market for global companies looking to diversify their workforce and expand globally.

Still, to hire employees in Mexico from abroad, foreign employers must first establish a legal entity in the country, undergo lengthy permit processes, clarify their tax liabilities, and navigate complex labor laws, such as payroll tax regulations and employee classification.

Fortunately, hiring employees in Mexico doesn’t have to be risky or overwhelming. This guide outlines everything you need to know about hiring talent in Mexico, from calculating employee cost to mitigating risk. Plus, find out how to hire employees in Mexico without establishing a legal entity.

Can I hire an employee in Mexico?

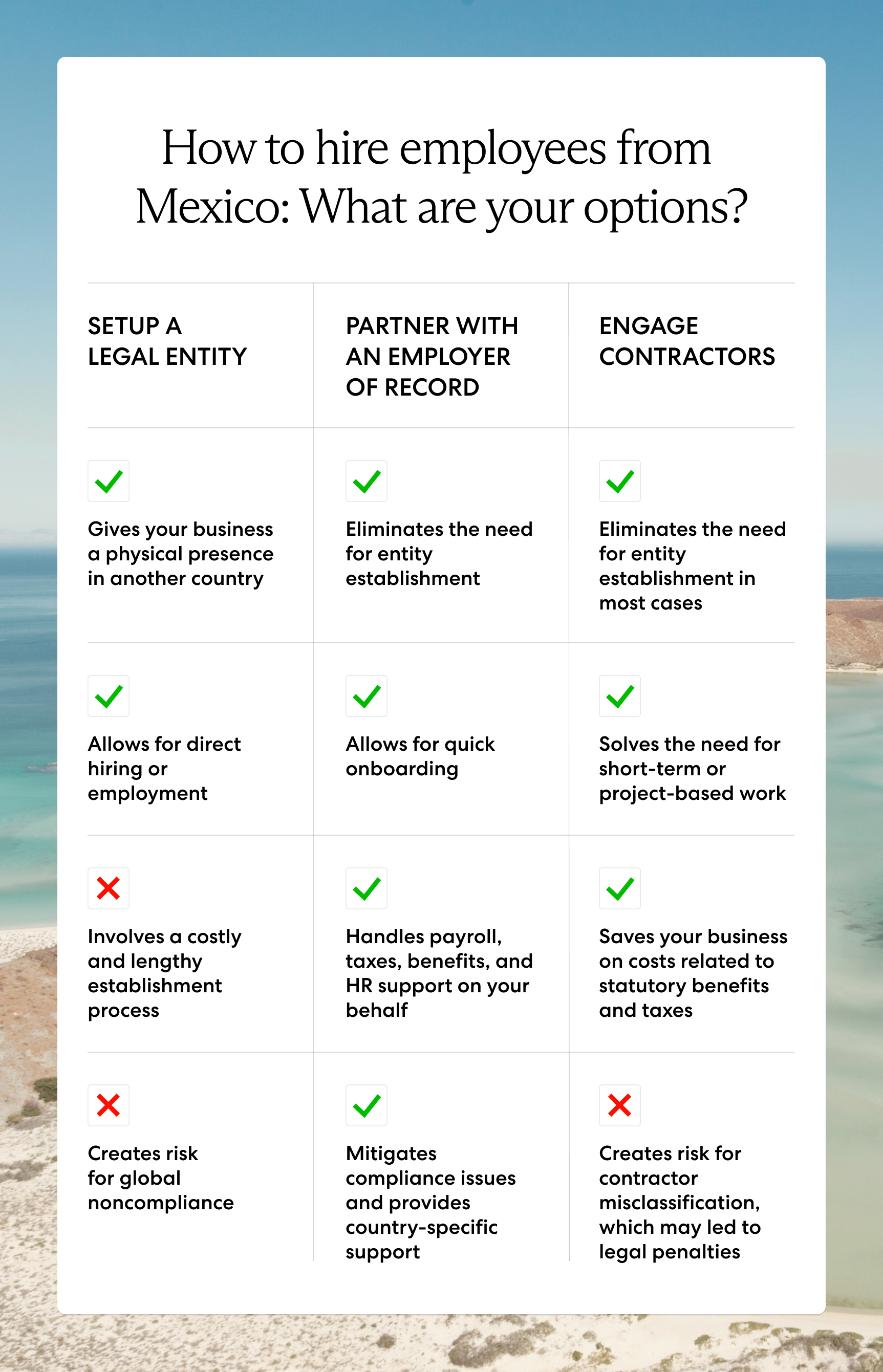

Yes, you can hire employees in Mexico from another country. By establishing a Mexican entity, partnering with an employer of record (EOR), or hiring local contractors, global companies can hire Mexican talent from abroad and enjoy the many growth opportunities this market has to offer.

How do I employ someone from Mexico? 3 options

Global companies have three options for hiring employees in Mexico: setting up a legal entity, partnering with an employer of record, or engaging international contractors.

We discuss each approach in detail below.

Set up a foreign entity in Mexico

Any global company that wants to directly hire employees in Mexico must establish a legal Mexican entity.

When setting up a local entity in Mexico, foreign companies can choose from various company structures, the most common being the Sociedad de Responsabilidad Limitada (S. De R.L.) and the Sociedad Anónima (S.A.). The S. De R.L. caters to small- and medium-sized businesses, while the S.A. offers more potential for long-term growth.

Regardless of which route you choose, registering an entity in Mexico is costly and can take up to 20 weeks. It involves defining company bylaws, formalizing incorporation documents, and filing with the Registry of Foreign Investment, among other lengthy procedures.

Entity establishment makes sense if you plan to hire a large Mexican team and envision long-term growth in the country. However, if you’re not ready to make long-term investments in the Mexican market, consider partnering with an employer of record (EOR) instead.

Partner with an employer of record (EOR)

The simplest way to hire employees in Mexico is to partner with an EOR.

An EOR is a third-party entity that serves as the legal employer of your global workforce. With global infrastructure and international legal expertise, an EOR allows global companies to engage talent worldwide without having to set up entities or worry about violating local employment regulations.

Think of an EOR in Mexico as your international HR team—they provide support at every step as you build a Mexican workforce, from hiring and onboarding to running compliant global payroll and crafting competitive local benefits. With this approach, global companies can quickly and compliantly engage talent in Mexico without the added burden.

Partnering with an EOR offers a lean and flexible approach to hiring employees in Mexico without requiring long-term commitments. It’s also an ideal option for companies interested in engaging local talent while undergoing the lengthy incorporation process.

Read more: What Is an Employer of Record (EOR)?

Hire and pay contractors in Mexico

Some global companies choose to engage contractors in Mexico instead of hiring full-time employees.

This approach comes with several advantages, including flexibility and cost savings. Engaging Mexican contractors allows global companies to target Mexican talent with specialized skills for short-term projects while forgoing the costs associated with onboarding and running payroll for full-time employees.

While this may seem like an ideal solution, engaging contractors involves serious risk and limits growth potential. Hiring contractors limits your ability to create the cohesive, committed team of full-time employees you need to support your business as it expands in any direction you take it.

Plus, navigating worker classification regulations in Mexico poses a major compliance risk for foreign employers unfamiliar with the local law. While you may assume your worker classifications are correct, local authorities may disagree and impose hefty misclassification penalties on your business, ranging from back taxes to employee backpay and benefits arrears.

We discuss misclassification in more detail later on in this guide.

How much does it cost to hire an employee in Mexico?

The cost of hiring an employee in Mexico includes, at a minimum, the employee’s total base salary plus mandatory employer contributions to Mexico’s social security scheme, which ranges anywhere from 34% to 50% of the employee’s base salary.

Employers must also pay a state payroll tax, vacation accrual, and provide their employees with a 13th-month payment.

Interested in hiring employees in Mexico? Use our employee cost calculator below to get reliable insights into employee costs and payroll contributions in Mexico:

Employment laws to know before you hire staff in Mexico

The Mexican government prioritizes employee rights. To avoid noncompliance penalties while hiring in Mexico, global employers must familiarize themselves with key aspects of Mexican labor law, such as employment agreements, payroll taxes, leave entitlements, termination regulations, and labor unions.

We discuss each of these in detail below.

Employment agreements in Mexico

Some countries, like the U.S., allow working relationships based on implied contracts, or verbal work agreements.

However, written work agreements are mandatory in Mexico and must include a minimum set of terms, such as:

- Employee identity information (name, age, nationality)

- Description of services

- Employment duration

- Place of work

- Work schedule

- Salary

- Benefits

Mexican regulations deem all employment agreements as indefinite unless the contract specifies otherwise. Foreign employers can establish fixed-term contracts under particular circumstances, such as seasonal work, special projects, and trial and training arrangements.

Payroll in Mexico

Global companies that engage talent in Mexico must also familiarize themselves with the country’s payroll regulations. Due diligence with local payroll helps ensure timely, accurate payments to your Mexican team while avoiding fines and other noncompliance penalties.

Most of Mexico’s statutory payroll taxes and contributions fall under the umbrella of Social Security, including the following:

- Healthcare

- Disability

- Retirement

- Unemployment

- Occupational risk insurance

- Nursery benefits

- Housing fund

Employer contribution rates to Social Security range from 34% to 50% of the employee’s base salary, depending on industry risk categories and employee income brackets, while employee contribution rates are usually around 2.78%.

Employers in Mexico must also provide their employees with a vacation bonus worth 25% of their regular monthly earnings and a 13th-month salary. Employers must also withhold and remit federal income taxes and a state-level payroll tax from employee earnings.

How do you pay employees in Mexico?

To pay employees in Mexico, you must first register your company with the state tax authority and open a local bank account. Next, calculate payroll taxes and contributions as percentages of your employees’ base wages. Then, pay your employees and provide them with payslips detailing their net earnings and statutory withholdings.

Employers in Mexico must pay employee wages in pesos and remit statutory taxes and withholdings from a government-designated in-country bank account. This rule is important to remember as it can cause delays when setting up payroll in Mexico.

Learn more in our complete guide to payroll and taxes in Mexico.

Leave entitlements in Mexico

All qualifying employees in Mexico are entitled to annual paid leave, which includes holiday, sickness, paternity, and maternity leave. We discuss each of these in detail in the following list:

- Annual leave. Employees in Mexico receive 12 days of paid annual leave after completing one year of service for their employer. After that, they receive two additional days per year for four years, and from the sixth year onward, they receive two additional days every five years.

- Sick leave. There is no time limit for paid sick leave in Mexico—sick leave duration depends on a doctor’s order from the Mexican Institute of Social Security (IMSS).

- Maternity leave. Mothers receive six weeks of 100% paid maternity leave before their expected due date and six weeks after the birth.

- Paternity leave. Fathers in Mexico receive five days of 100% paid paternity leave starting on the day of childbirth.

- Adoption leave. In the case of adoption, mothers receive six weeks of paid leave starting from the day they receive the child. Fathers receive five days.

Terminating employees in Mexico

Unless collective bargaining agreements (CBAs) specify otherwise, Mexican federal labor law does not require termination or resignation notices. However, in cases of early dismissal, federal law requires severance payments.

If an employer dismisses an indefinite employee without just cause, the employee is entitled to a severance package consisting of the following amounts:

- 20 days of wages for each year of service

- 90 additional days of wages as an indemnification

- A seniority bonus worth 12 days’ wages for each year of service beyond 15 years, with calculations capped at twice the region’s average daily wage

- Accrued wages and unused benefits, including vacation days, vacation bonus, and 13th-month salary

If an employer dismisses a fixed-term employee without just cause, the employee is entitled to a severance payment consisting of the following:

- For fixed-term contracts of less than a year, employees receive an amount equal to half of their earnings for the services they provided before dismissal

- For fixed-term contracts of more than a year, employees receive six months of wages for the first year of service and 20 days of wages for each following year

- 90 additional days of wages as an indemnification

- A seniority bonus worth 12 days’ wages for each year of service beyond 15 years, with calculations capped at twice the region’s average daily wage

- Accrued wages and unused benefits, such as vacation days, vacation bonus, and 13th-month salary

In cases of just dismissal, Mexican Federal Labour Law entitles employees to their accrued salary and benefits but to no other severance payments.

Labor unions in Mexico

Labor unions are not prevalent across Mexico—only 14% of the Mexican workforce is unionized. While most of the economically active population in Mexico isn’t affiliated with a labor union, unions still have a dominant presence in specific industries, such as the industrial sector.

Depending on the industry in which you do business in Mexico, you may need to navigate labor union and CBA regulations. Clarifying whether or not you are subject to local labor union and CBA regulations is critical for ensuring compliance, as these regulations predetermine many of your work agreement terms and conditions.

It’s worth noting that more than 90% of labor union agreements in Mexico have a reputation for protecting companies rather than workers, keeping wages and benefits low, and restricting workers’ rights.

As a result, many union-affiliated workers in Mexico are fighting to democratize their existing unions and give themselves more control or break free and establish new, independent unions. Keeping abreast of changes in current labor union regulations is critical for ensuring ongoing compliance.

Other employment laws in Mexico to know

Global employers should also be familiar with the following employment regulations:

- Minimum wage. The general minimum wage (salario mínimo) is MX$207.44 per day. In the Free Economic Zone of the Northern Border, the minimum wage is MX$312.41 per day.

- Workweek. A standard workweek is 48 hours for day work and 42 hours for night work, with an eight-hour workday and a seven-hour worknight.

- Overtime. Mexican labor law permits overtime. Employees receive 200% of their regular wage for the first nine hours of overtime per week and 300% for any additional hours.

- Bonuses. Employees are entitled to an annual Christmas bonus (aguinaldo) in mid-December worth 15 days of their salary, though many employers pay four weeks’ worth.

Compliance risks when hiring employees in Mexico

Ensuring compliance with local employment regulations can make or break your success as you enter new markets and build a global workforce.

Whether you go it alone or partner with a third-party entity with local legal expertise, global employers must familiarize themselves with the compliance risks they’ll face when hiring employees in Mexico.

These include misclassification, permanent establishment, intellectual property rights, and immigration requirements. We discuss each of these in detail below and offer tips for mitigating risk.

Misclassification

Misclassification penalties arise when you incorrectly designate a worker as an employee or contractor. Despite having good intentions, it’s relatively easy for foreign employers to misclassify their contractors in Mexico.

In Mexico, many aspects of a working relationship influence whether a worker is an employee or contractor, ranging from control over work attire, business expense reimbursement, and working relationship exclusivity. Local classification regulations leave plenty of room for interpretation, creating a major risk for global companies unfamiliar with the local law.

For instance, if you start exercising control over your Mexican contractors’ work schedule, such as stipulating when they must be online, this may constitute an employee-employer relationship. If local regulators determine your contractors are employees under local regulations, your business will face fines, tighter tax inspections, and limited business opportunities.

Many foreign employers enlist the help of a third-party expert, such as an EOR, to properly classify talent in Mexico and mitigate risk as they build a distributed workforce in the country.

Read more in our complete guide to employee misclassification.

Permanent establishment

By operating with a fixed presence in Mexico, your business can trigger permanent establishment (PE) status and subject itself to a local tax liability in Mexico.

Mexican PE laws are exceptionally strict, with many different work arrangements constituting a fixed place of business. According to the Mexican Income Tax Law, any local entity through which a non-resident conducts business for any period is a PE—this includes agencies, office buildings, and natural resource exploration sites.

Additionally, any local agent that closes contracts in Mexico on behalf of a foreign company or acts outside of the ordinary frame of their activities on behalf of a non-resident business constitutes a PE.

Clarifying your permanent establishment status is critical for avoiding tax arrears, fines, damaged business reputation, and other penalties when hiring in Mexico.

Intellectual property (IP)

Mexico faces widespread commercial-scale IP infringement, resulting in significant losses for local and foreign companies. Global companies operating in Mexico should take it upon themselves to implement their own measures to protect their IP.

Legislative loopholes, a lack of coordination between federal, state, and municipal authorities, and limited budgeting and resources for IP agencies have exacerbated IP violations in Mexico.

The Mexican government has made significant steps toward curtailing infringements, such as establishing legislative reforms under the United States-Mexico-Canada Agreement (USMCA). Still, most companies operating in this market don’t rely on local governing bodies and legislative channels to mitigate risk and prosecute offenses.

Register your rights in Mexico well in advance since most foreign patents and trademarks cannot protect your IP there. Consider working with legal counsel familiar with Mexican IP regulations to help establish sound employment contracts that include non-compete clauses and confidentiality provisions.

Also, seek out any trade associations and organizations within your industry and collaborate with them to help protect IP and stop counterfeiting in your sector.

Immigration requirements

At some point, you may need to hire an employee in Mexico who is not a Mexican resident or citizen. Or, you may have a domestic employee who wants to relocate to Mexico as a part of your global mobility program.

Your HR team must have the skills and experience necessary to navigate Mexican immigration and visa procedures and acquire the needed work permits for your employees.

Having a qualified HR team that can handle immigration is especially important for global companies building international teams—delays in immigration processes can lead to costly workflow setbacks and cause top talent to seek employment elsewhere.

Compliantly hire staff in Mexico with Velocity Global

Sourcing talent from Mexico’s highly skilled workforce is a savvy business move for global companies. Don’t let Mexico’s complex employment laws stand in your way—partner with Velocity Global to simplify your expansion and mitigate risk.

Velocity Global’s EOR solution helps global companies build and scale international teams in over 185 countries, including Mexico, without setting up legal entities or worrying about non-compliance.

Our EOR solution allows you to jumpstart employment in Mexico and engage talent quickly while enjoying support from our global HR team at every step. We handle everything from hiring, onboarding, risk mitigation, and immigration to running compliant global payroll and administering global benefits.

With Velocity Global at your side, you can quickly and compliantly engage top local talent and build your dream team in Mexico without skipping a beat.

Contact us today to get started.

Disclaimer: The intent of this document is solely to provide general and preliminary information for private use. Do not rely on it as an alternative to legal, financial, taxation, or accountancy advice from an appropriately qualified professional. © 2024 Velocity Global, LLC. All rights reserved.