Global compliance is when a business follows the rules and regulations in each country they do business in as well as overarching international labor laws. When going global, many businesses make compliance mistakes, which can lead to legal headaches and workflow disruption.

To keep you compliant, we’ve created a guide to navigating international laws and regulations.

Key takeaways:

- Global compliance means following the rules and regulations of each country you do business in.

- The most common global compliance rules include equal opportunity laws, tax compliance, minimum employee entitlements, and financial reporting requirements.

- Ignoring global compliance requirements can lead to fines or reputation loss.

- Become globally compliant by reviewing international business rules, planning for the future, communicating with those abroad, preparing for changes, and attaining a global compliance partner.

What Is Global Compliance?

Global compliance is the process of a business following all laws, rules, standards, and regulations that apply to them when going global. There are two distinct elements to becoming globally compliant: local compliance and compliance with international rules and regulations.

When businesses practice global mobility and hire or relocate talent overseas, they must remember to remain compliant with the rules of the jurisdiction they expand their business into. This is known as local compliance. Businesses must comply with that area’s rules and regulations regarding topics such as payment and equal employment opportunities.

Some global compliance rules apply across international borders. These are known as international laws, regulations, and standards and include rules about financial payment standards, product standards, and data protection.

Learn how to compliantly enter new markets and hire global talent with our global expansion checklist:

Common Global Compliance Rules

Each country has its own rules when it comes to business, but there are some commonalities across the board.

Here are four common global compliance rules that are required and crucial in countries across the world.

Equal Opportunity Laws

Many countries have laws preventing discrimination when staffing. These laws are known as equal opportunity laws. Grounds of discrimination vary by country but often include gender, sexual orientation, age, ethnicity, and disability.

Global Tax Compliance

Global tax compliance is the obligation for a business to pay taxes in the countries they do business in. Tax rates may vary, but taxes apply to any business that has a permanent establishment in a country.

How these taxes are paid also varies, but it is important for a business to be aware that they owe taxes in each country they do business in.

Financial Reporting Requirements

Each country has a required way of how the financial statements of a company should be prepared. Thankfully, many countries have now adopted a universal set of rules and principles for the preparation of financial documents.

Be certain to research the financial reporting requirements of the country you are doing business in abroad. When financial statements, such as taxes, are not correctly prepared for reporting purposes, it can cause fines and penalties against the business.

Many businesses hire an international accountant for this reason to ensure tax and payroll compliance.

Minimum Employee Entitlements

Many countries have a set of minimum employee entitlements that are required by law. These are basic statutory employee benefits such as minimum wage, breaks, PTO, and sick leave.

Some countries have less-common international entitlements, such as paid parental leave and insurance.

Anti-Money Laundering Regulations

Most countries now have anti-money laundering and counter-terrorism laws for businesses making a permanent establishment in their territory. Some of these regulations include a program for monitoring large transactions, reporting to regulators, and training employees to protect against money laundering.

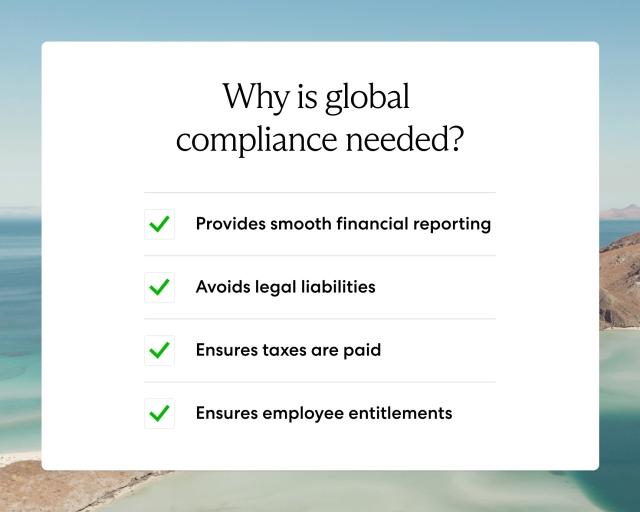

Why Is Global Compliance Needed?

Compliance is needed by businesses to reduce fines and prevent their business from collapsing under the pressures of liability. When businesses follow global rules and regulations when expanding internationally, it will help their business run smoothly.

What Happens If I Am Not Compliant?

When businesses fail to comply with global regulations, they risk the ethics of their company, as well as their business’s ability to continue its international expansion.

Here are a few common consequences businesses face when they are not compliant.

Fines and Penalties

Businesses that fail to comply with a country’s business laws often receive devastating fines and penalties. Typically, this stops businesses from further international expansion or can even shut down a business altogether.

Ruined Reputation

Not complying with international rules and regulations can ruin a business’s reputation. This will cause crucial barriers in finding future business prospects, such as investors or even countries. Countries do not want a business in their territory that is known for not being compliant.

Contracts Breached

Many B2B contracts require businesses to be compliant. When businesses are not compliant with laws and regulations, they are breaching their contracts. A breach of contract could lead to termination of the contract, court hearings, and fees later on.

Loss of Licenses

Failure to comply can lead to the loss of licenses that must be approved by regulators, such as financial services licenses. Since it is often governments that give out these licenses, they can easily be revoked when you do not comply with their laws.

How To Become Globally Compliant

While there is no one-size-fits-all method to becoming globally compliant, there are some steps you can take to help your business avoid crucial compliance mistakes. Here are a few steps to follow when going global to ensure your business is globally compliant.

Review Current Business Practices

Reviewing the big picture is the best place to start when going global. Review what rules your company already has in place and the rules of the country you are setting up a permanent establishment in. This will ensure that your business is compliant with all rules and regulations that must be followed when expanding.

Plan to Ensure Compliance

Plan for how your business will handle all of the rules and regulations associated with new market entry and international staffing. Delegating duties to specific employees and creating a calendar of when tasks must be completed will help to ensure compliance.

Communicate New Practices

As with any business, communication is key. Implementation of new practices and plans should be communicated to employees in these new facilities abroad. Many businesses will even implement global compliance training for employees.

Manage Global Compliance

Global compliance management revolves around preparing for changes in the rules and regulations of the country you have a permanent establishment in. The rules and regulations for global businesses are always changing. Being constantly aware of trends in the market and having a plan for new rules can help you manage global compliance.

Use a Global Compliance Partner

Perhaps one of the best ways to make sure you stay globally compliant is to use your resources, including a global compliance partner. For example, an employer of record (EOR) is specifically trained on all things international business and can provide legal counsel and expertise to help you stay on top of international compliance once you open a business location abroad.

Learn more: What Is an Employer of Record (EOR)?

Work With a Global Compliance Partner

Each country has its own specific regulations and requirements—for example, England enforces a maximum of 48 working hours per week, while the Netherlands enforces a maximum of 60.

With so many different rules to follow, it can be hard to achieve and maintain global compliance on your own, which is why it's important to hire a compliance partner like an EOR when going global.

An EOR partner keeps track of the ever-changing rules and regulations abroad and helps you with other aspects of becoming a global business, such as hiring and paying international talent.

Contact Velocity Global today to take your first step toward complaint global expansion.

This blog was originally posted on December 13, 2021.

Topic:

Compliance