Global companies that expand to Canada benefit from taking on contractors, but not without some challenges. This guide explains how to pay contractors in Canada while remaining compliant with local labor laws.

How to Pay a Contractor in Canada: 4 Methods

There are four common ways that global companies pay contractors in Canada: Using an international wire transfer, an online money transfer provider, an international money order, or a contractor payment platform.

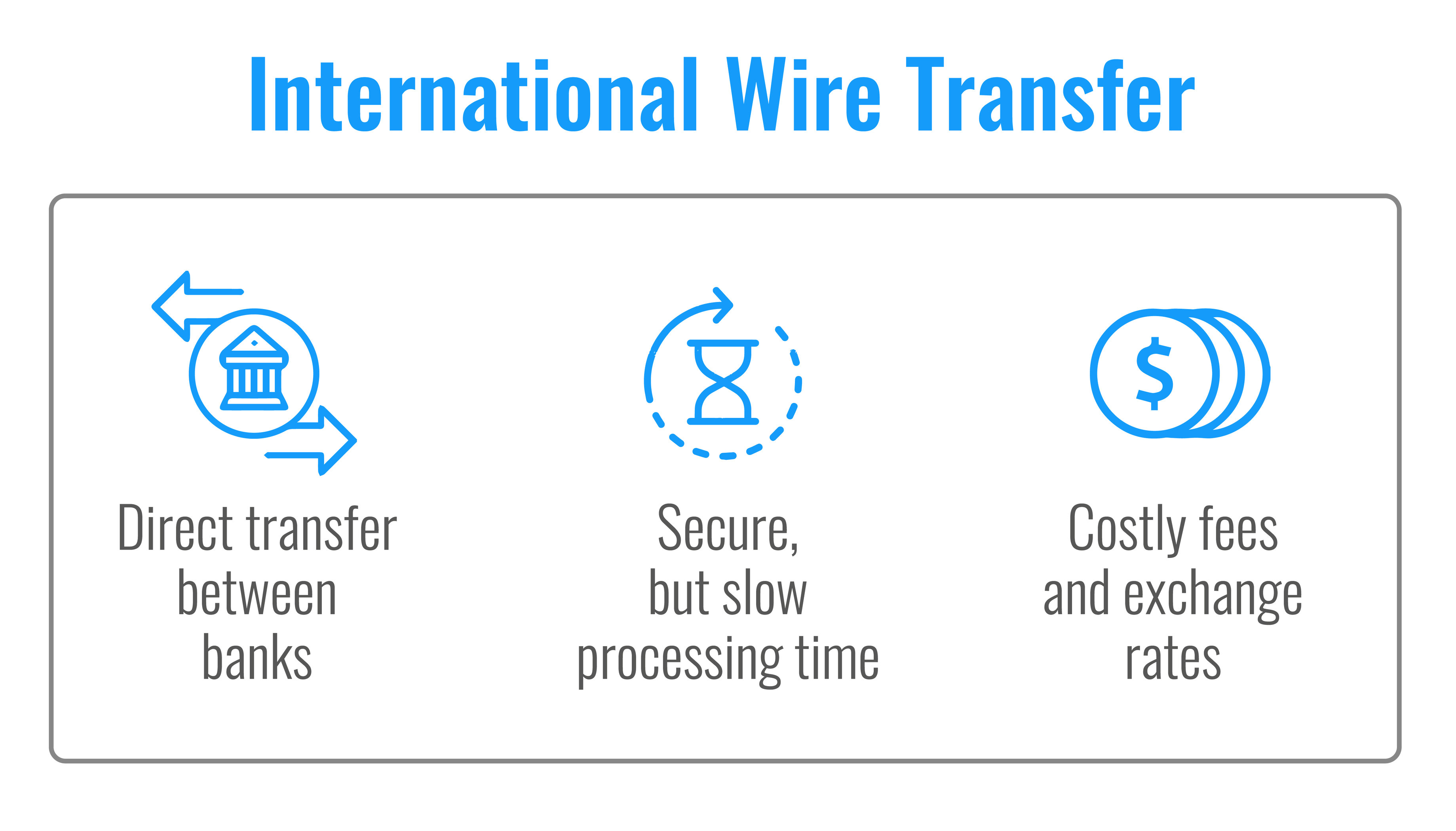

International Wire Transfer

Many global companies opt for an international wire transfer payment to pay contractors. International wire transfers, also known as Society for Worldwide Interbank Financial Telecommunication (SWIFT) payments, are direct transfers between banks.

Wire transfers are secure, but they aren’t fast. Contractors in Canada may have to wait up to five days to receive a transfer. Plus, fees and exchange rates add costs to the wire transfer process.

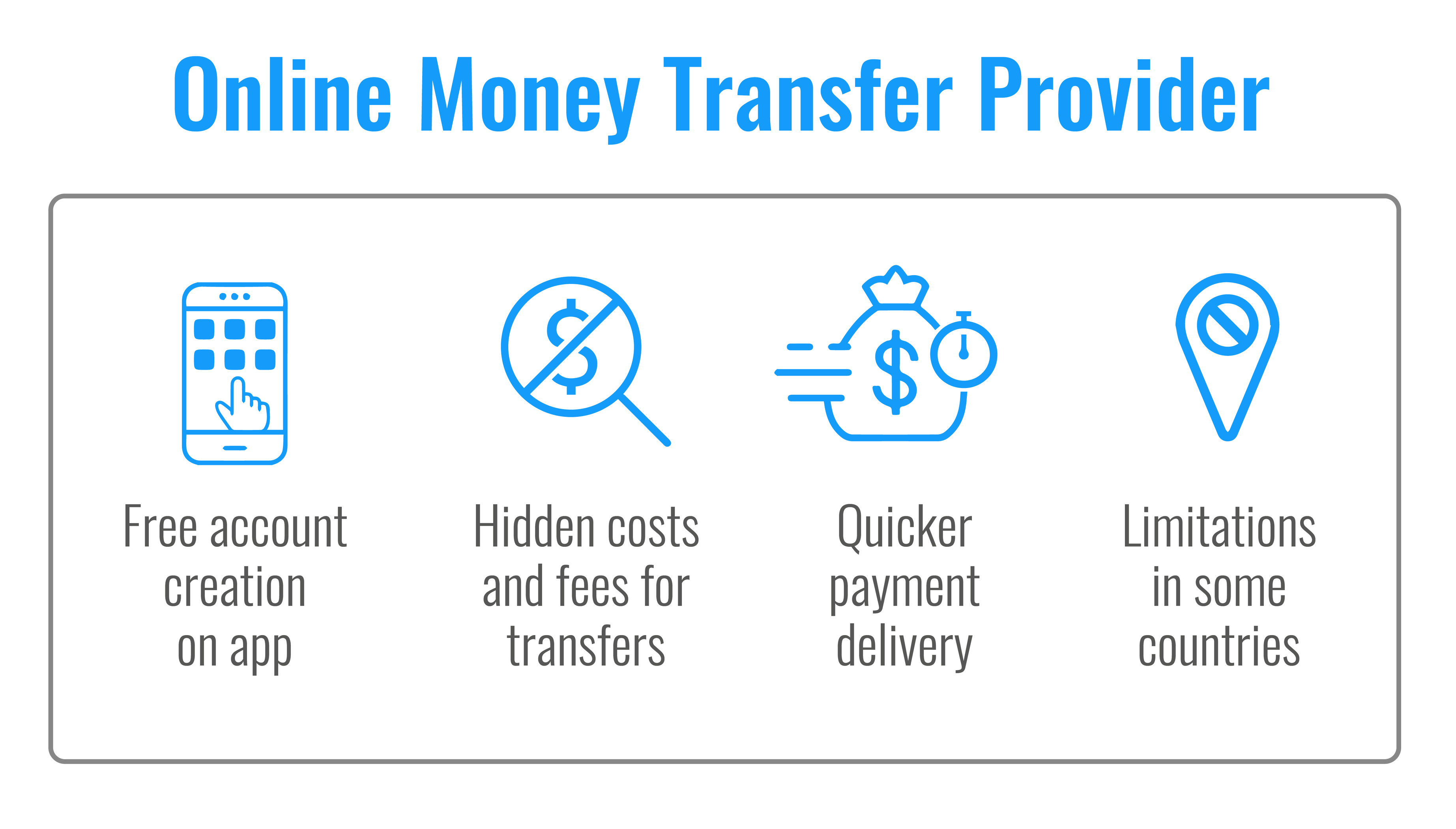

Online Money Transfer Provider

There are plenty of money transfer providers to choose from including Paypal, Melio, or Xoom. All money transfer providers require users first to create an account. Starting an account is typically free, but there are often hidden costs, including transfer and exchange rate fees.

Keep in mind that money transfer providers vary from country to country, and won’t necessarily protect your business from contractor compliance violations in Canada.

International Money Order

International money orders are another method to pay overseas contractors. It’s not a fast option, but it is fairly straightforward. International money orders are pre-paid checks available from various locations such as grocery stores or the post office that can be cashed anywhere in the world.

Purchasers pay for the checks upfront and then mail them to their payee in Canada. There are fees for purchasing and cashing a money order, which can cause issues for both the company and the Canadian contractor.

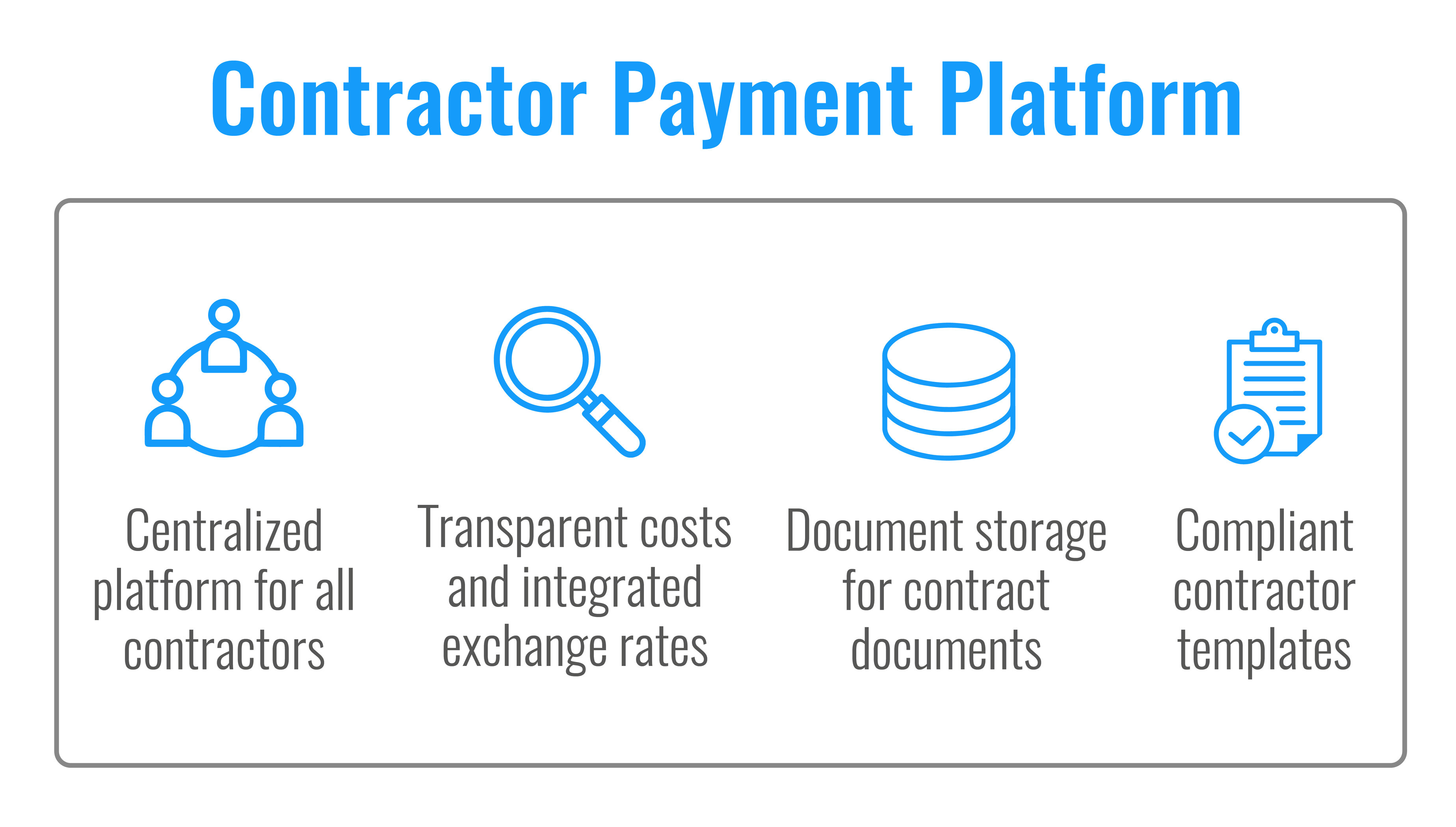

Contractor Payment Platform

Global companies use contractor payment platforms to pay contractors across international markets. Contractor payment platforms are secure and straightforward. Some platforms automatically pass on foreign exchange fees into the contractor’s compensation. Other platforms provide a separate line item as a part of monthly invoicing, making it easy for companies to pay contractors in Canada.

For example, a U.K.-based company looking to hire three sales representatives in Canada can easily onboard their contractors and pay them using a contractor payment platform. The platform allows non-Canadian employers to pay their contractors in Canada quickly, cost-efficiently, and securely.

Employees vs Contractors in Canada: Know the Difference

Global companies that want to hire in Canada need to understand the difference between employees vs. contractors to avoid fines and reputational damage.

Canadian employment law requires companies to distinguish between employees and contractors because it directly affects a person’s entitlement to employment insurance (EI) benefits under the Canadian Employment Insurance Act.

If a worker is deemed an employee, the employer must deduct Canada Pension Plan (CPP) contributions, the EI premium, and income tax from payments. In contrast, a contractor must establish a business (if they earn over $30,000 per year) and pay their own taxes and premiums.

How to Classify Canadian Contractors vs Employees

There are two steps that Canadian employment lawyers use to determine if a person is an employee or a contractor:

- Determine contract of service vs. contract for service. The former would be considered an employee, while the latter would be a contractor. These terms must be clear from the start and working conditions must match the intent.

- Questions to verify intent. Employment lawyers who investigate the contractor-employer working relationship pose a series of questions to identify the level of autonomy the contractor has over their work and time. Answers must reflect the “contract for service” intent or the worker may be deemed an employee under Canadian labor law.

For example, say a U.S. company hired a Canadian contractor but then engaged in activity that signified an employer-employee relationship, such as taking control over the contractor’s daily activities. Canadian labor officials may argue that the contractor is actually an employee and the company may risk fines or legal consequences for misclassifying.

There are nuances when determining if a new hire is an employee or a contractor from a Canadian labor official’s perspective. It’s vital that companies classify their contractors correctly to maintain compliance.

FAQs on Paying Contractors in Canada

Companies that want to hire contractors in Canada are responsible for knowing and adhering to Canadian labor laws. Here are some common issues companies come up against when hiring Canadian contractors.

Can U.S. Companies Hire and Pay Canadian Contractors?

Yes, U.S. companies can hire and pay Canadian contractors. If a U.S. company wants to hire a Canadian contractor, they must ensure they correctly classify their talent.

A contractor classification solution helps companies ensure they are correctly classifying talent as contractors or employees under Canadian labor laws. A classification solution helps U.S. companies avoid fines, legal fees, and business interruptions that come from misclassifying talent.

U.S. companies can pay Canadian contractors by using a contractor payment solution, which allows for automated contractor payments across international markets.

Do I Need to Withhold Taxes When Paying Contractors in Canada?

No, foreign companies do not have to withhold taxes when paying contractors in Canada. Contractors will be responsible for reporting their income and paying their own Canadian taxes.

However, employers must follow their local country’s tax regulations. For example, U.S. companies that hire in Canada must give their contractors a W-8BEN form so they aren’t double-taxed.

Normally, foreign individuals that work for a U.S. company and receive U.S. income are subject to a 30% tax withholding rate. But, because the U.S. has an income tax treaty with Canada, individuals are protected from being double-taxed. The W-8BEN form ensures that protection is in place.

Onboard and Pay Your Contractors in Canada

It’s not difficult to onboard and pay contractors in Canada, as long as you understand the challenges and particulars.

Velocity Global’s Contractor Payments solution helps global companies onboard and pay contractors with ease. The contractor payments solution is an automated payroll platform that lets companies pay contractors across multiple global markets so you can grow your business with confidence.

Contact Velocity Global today to learn how to pay contractors in Canada.

Topic:

Contractors