Companies that expand into the Philippines are at an advantage: Its fast-growing economy and broad English-speaking workforce make the Philippines an excellent place to engage contractors.

Ready to seek out flexible talent in the Philippines? This guide highlights everything you need to know to securely pay your Filipino contractors, as well as how to hire and manage them.

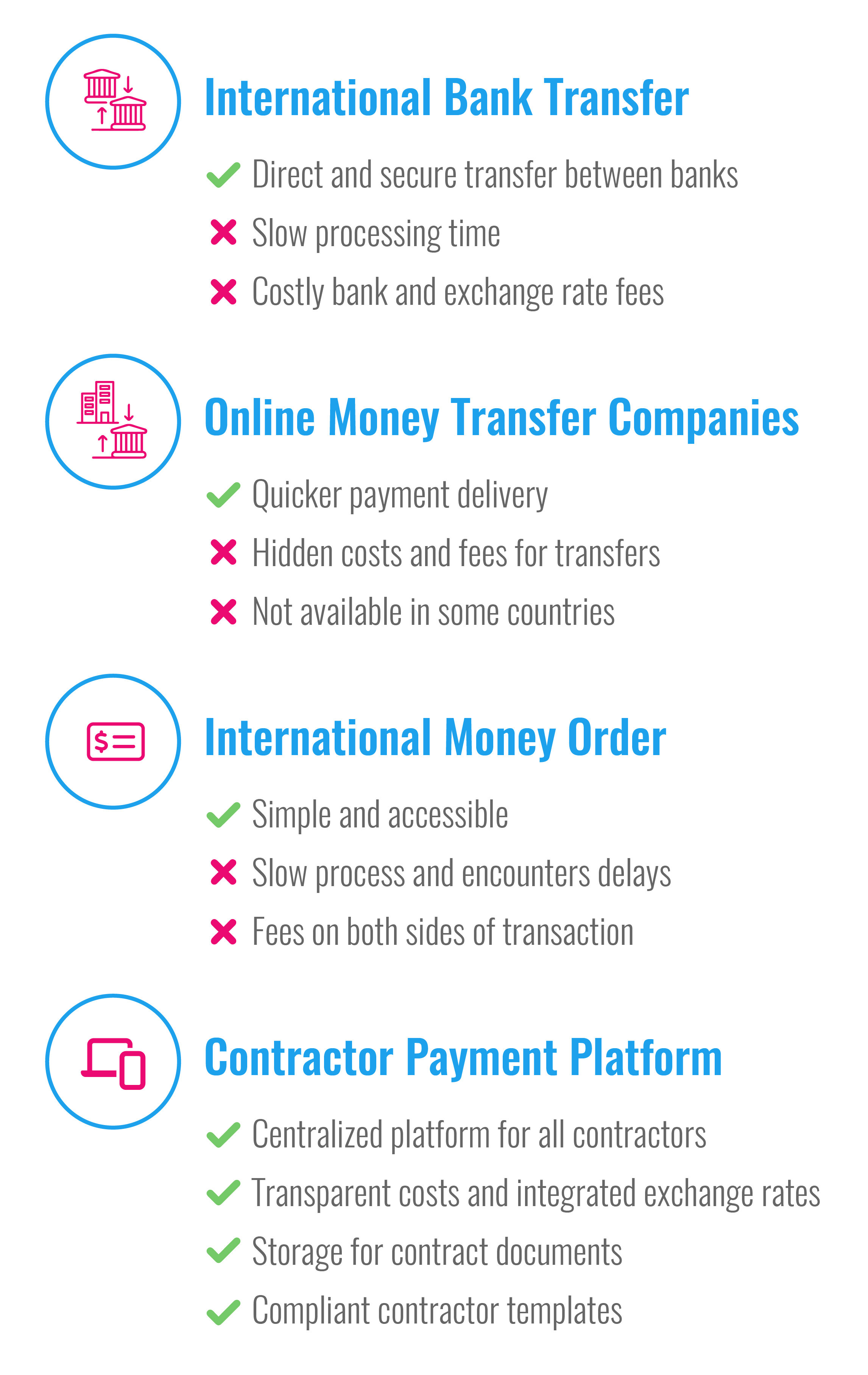

4 Methods for Paying a Filipino Contractor

There are four customary approaches companies can take to pay Filipino contractors: through an international bank transfer, online money transfer provider, international money order, or contractor payment platform. We discuss the benefits and drawbacks of each below.

International Bank Transfer

An international bank transfer is one of the most common payment methods businesses use to pay contractors overseas. Also known as wire transfers, bank transfers electronically move money from your bank account to your contractor’s bank account through the Society for Worldwide Interbank Financial Telecommunication (SWIFT) network.

While bank transfers through SWIFT are secure and straightforward, they can take up to five business days to complete. Additionally, this payment method comes with hefty banking and exchange rate fees.

Online Money Transfer Provider

Online money transfer providers like PayPal, Venmo, and Wise offer a quick and easy way for companies to pay contractors online. They also typically offer lower fees compared to banks.

However, even though their fees may be lower than other payment alternatives, online money transfer providers often tack on percent-based fees and add markups to exchange rates. Plus, these services are not accepted in all countries.

International Money Order

Another way to pay Filipino contractors is with international money orders, or prepaid checks. Employers can purchase a money order at a bank, post office, or grocery store and mail it directly to the contractor.

Unfortunately, payment deliveries can experience delays due to postal service issues. Plus, contractors may not have a location nearby to cash the order. International money orders also add markup fees on both sides of the exchange.

Contractor Payment Platform

A contractor payment platform is a cloud-based payment solution that allows businesses to quickly pay contractors overseas. This payment method automatically integrates foreign exchange fees into the payment and transfers funds to your contractors in just a few clicks.

Some contractor payment platforms even include additional features, such as locally compliant contract templates and secure document storage.

Keep in mind that a contractor payment platform only handles pay and not classification compliance. To avoid the fees and reputable damage that come with misclassification, you may want to consider a contractor management solution instead.

FAQs on Hiring Independent Contractors in the Philippines

As you hire Filipino talent, it’s important to be familiar with and adhere to Filipino employment law and contract regulations. Below are some common hiring questions that companies face when engaging Filipino contractors.

Is an Independent Contractor an Employee in the Philippines?

No, an independent contractor is not an employee in the Philippines. According to the Philippines' Department of Labor and Employment (DOLE), a contractor is defined as someone who:

- Performs work using their own equipment, under their own responsibility, and according to their own method

- Has complete control over their own work and daily activities

The contractor agreement must clearly outline these terms. If the terms are violated and the contractor is misclassified, an employer could face fines or legal consequences.

How Do You Hire Independent Contractors in the Philippines?

1. Review Philippine Labor Laws to Ensure Compliance

First, an employer must understand Philippine labor laws before hiring Filipino contractors. Most importantly, an employer should review particulars around misclassifying employees as contractors to ensure compliance.

2. Prepare a Clear Contractor Agreement

Once you understand misclassification nuances, prepare a contractor agreement for your contractor. The DOLE requires a written agreement between the employer and contractor that outlines the following:

- Job description

- Contract duration

- Place of work

- Terms and conditions governing the contracting arrangement

3. Establish a Payment Structure and Timeline

Finally, an employer must establish a payment structure and timeline for the contractor. These terms may differ based on the circumstances and what works best for both the company and the contractor.

Do U.S. Companies Hiring in the Philippines Need to Withhold Taxes?

No, U.S. companies hiring contractors in the Philippines do not need to withhold taxes. However, Filipino contractors will need to complete a Form W-8BEN to ensure they do not get double-taxed in the Philippines and the U.S.

Employers are responsible for providing a W-8BEN form to their international contractors. The contractor must then complete the form and submit it back to their employer before their first payment for it to take effect.

Learn more extensive information on employment law in the Philippines here.

Onboard and Pay Your Filipino Contractors With Ease

Managing contractors overseas is much simpler when businesses partner with Velocity Global.

Velocity Global’s Contractor Payments solution is an automated payment platform that provides everything you need to easily onboard and pay international contractors. Deliver accurate and compliant payments on time, and provide your flexible workforce with an optimal experience no matter where they are.

Contact Velocity Global to learn more about how our Contractor Payments solution simplifies onboarding and paying contractors in the Philippines.

Topic:

Contractors