Compliantly pay teams everywhere

Pay locally and grow globally with one easy-to-use global payroll platform. Ensure accurate, on-time payments in 185 countries.

Streamlined process

Our streamlined global pay process eliminates common international payroll mistakes so you can reliably pay your talent on time, every time.

Transparent pricing

There are no hidden fees or surprises with our all-in-one pricing. You get clear, upfront costs, full visibility, and a lower total cost of ownership.

Statutory benefit enrollment

From pensions to social security, our experts ensure your people are enrolled in all mandatory benefits based on their location.

Adaptable payment methods

Whether paying by ACH or wire, to digital wallets or traditional banks, our flexible payment solutions work for you and your talent.

Time and expense management

Centralize your global talent’s time and expenses for simplified global payroll processing, accurate reporting, and streamlined management.

Unmatched customer support

Our international payroll experts guide you through the ins and outs of global regulations and employment laws. Local support is always on call when and where you need it.

Real-time reporting

Real-time reporting and analytics help you manage your global operations with accurate payroll metrics.

Easy documentation

Instantly generated payslips and documentation help streamline your multi-country payroll process, reducing errors and saving you time.

World-class expertise for smooth, global payments

You want to work with teams everywhere. We want to make it easy for you. Our global payroll solution connects you with world-class expertise, eliminating the hassle and risk of managing complex payroll operations internationally.

Integrations remove bottlenecks

Our platform integrates with your existing HRIS, payroll, and management systems to stay on top of your talent’s pay, taxes, and benefits in real time.

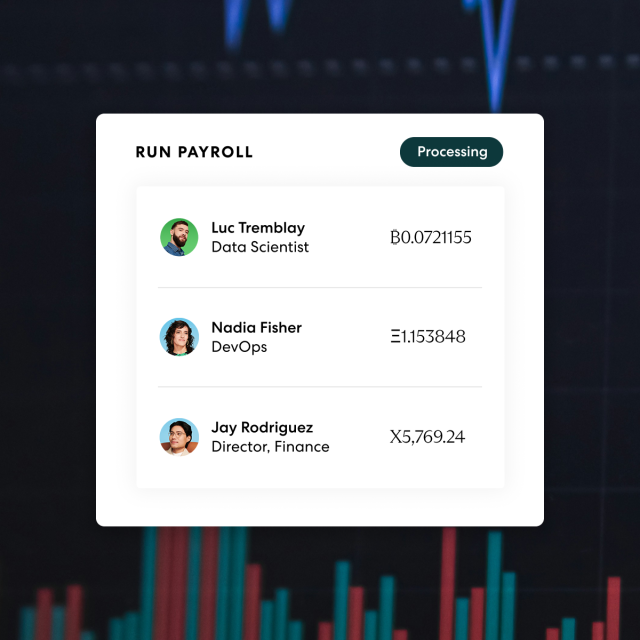

Flexible crypto solutions

Acquire and retain top talent with modern crypto solutions they expect. Direct deposits to digital wallets allow for seamless conversions to cryptocurrency of choice.

Comprehensive calculations

We process your workforce data, using expert insights on local tax laws and regulations to calculate and manage payments, taxes, and deductions for your global talent.

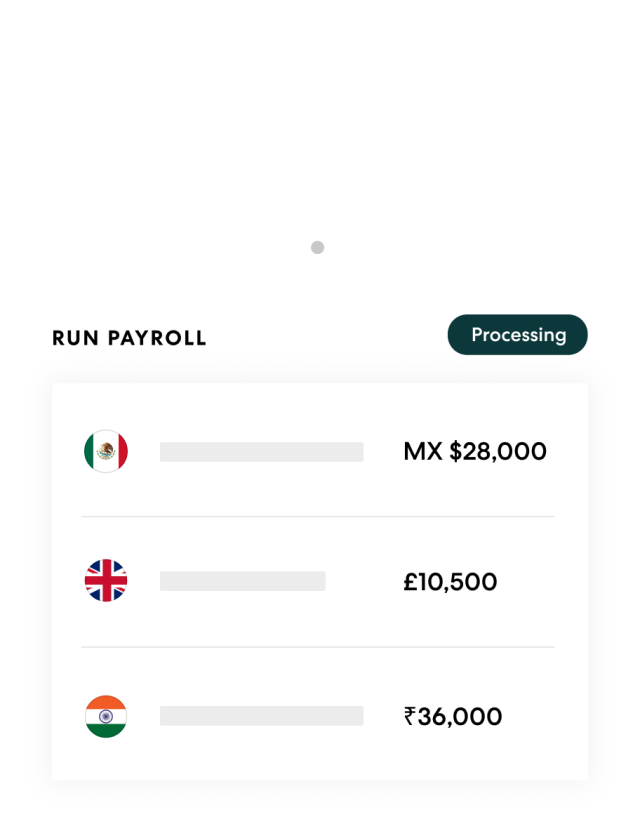

We pay all of your people

Our international payroll service accurately and automatically pays your talent in local currency—on time, every time in over 185 countries.

Accurately budget payroll costs for your global team

Get reliable insights into employee costs and country-specific contributions so you can compliantly expand your global workforce with confidence.

Please fill out your contact information and hiring details, and an expert from our team will be in touch with you shortly.

Payroll you can grow with. Payment your people can trust.

Scale confidently anywhere in the world, knowing your people will be paid accurately and on time. See how we can give your business the speed and compliance to go farther.

Time and money savings

By combining your global payroll management with one solution, you can say goodbye to the stress of making sure everyone gets paid on time, no matter where they are.

Payment your teams can trust

Avoid payday mix-ups and delays. Our global payroll solution ensures your international team members’ pay arrives accurately and on time.

Complete payroll compliance

Get expert guidance on global payroll regulations in 185+ countries. As your employer of record (EOR), we handle all necessary documents, payroll deductions, taxes, and contributions to ensure local compliance and reduce risk for every employee.

Get global payroll insights and resources

FAQ

-

What does the global payroll process entail?

The global payroll process often involves navigating tricky hour and wage rules and, in some instances, multiple languages, adding to its complexity.

-

What are the benefits of global payroll software?

International payroll software can help you save time and give your business easy access to critical information. Wherever your team is based, global payroll lets you pull the data you need quickly and at any time.

-

What is the difference between global and local payroll?

Global payroll involves managing employee pay across multiple countries and navigating different tax laws, currencies, and local labor regulations. In contrast, local payroll focuses on processing pay within a single country, adhering only to that nation’s specific legal and regulatory requirements. While global payroll requires handling multiple currencies and varying tax systems, local payroll is confined to one set of rules and doesn’t require currency conversions.