Colombia’s highly skilled, educated, and bilingual talent pool is a valuable resource for global companies interested in expansion into Latin America.

Before engaging talent in this market, international businesses must take extra precautions to ensure compliance. Navigating local employment and tax regulations, such as worker classification and permanent establishment, is especially risky for foreign employers.

This guide covers everything you need to know about hiring employees in Colombia, from understanding your local corporate tax liability to running compliant global payroll. Plus, learn how to hire employees in Colombia without setting up a legal entity.

How can I hire employees in Colombia?

To hire employees in Colombia, foreign companies must establish a legal Colombian entity. If you don’t want to undergo incorporation, you can partner with an employer of record (EOR) or engage Colombian contractors instead. The best approach for your business depends on your budget and long-term plans for the Colombian market.

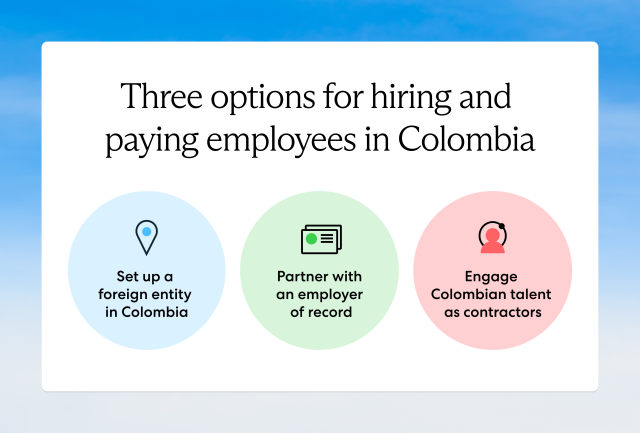

How to hire employees in Colombia: 3 options

Global companies have three options for hiring employees in Colombia: setting up a legal entity, partnering with an employer of record (EOR), or engaging contractors.

We discuss each approach in detail below.

Set up a local entity in Colombia

International companies that want to hire Colombian talent directly must first establish a legal entity in the country. Entity establishment is the traditional approach to hiring talent overseas, and while it involves unique advantages, it also has drawbacks.

Establishing a legal entity allows you to reduce risk exposure and maintain control over the hiring process, from onboarding to running global payroll.

Still, entity establishment is a time-consuming and costly process that requires a sizable up-front investment. It often takes several months before you can legally hire local talent. Plus, your company remains fully responsible for ensuring compliance with local employment, tax, and payroll regulations.

Entity establishment makes sense if you’re eyeing long-term expansion into the Colombian market. However, if you’re not ready to invest in physical infrastructure or undergo lengthy incorporation procedures, consider partnering with an employer of record (EOR) instead.

Partner with an employer of record (EOR)

The easiest way to hire employees in Colombia is to partner with an EOR. An EOR is a third-party entity that makes it easy for global companies to quickly and compliantly hire talent worldwide.

Think of an EOR as your global HR team—they handle all of the heavy lifting associated with managing international teams while ensuring compliance with local employment regulations along the way. Plus, by partnering with an EOR, you can forgo entity establishment.

An EOR partner ensures compliant onboarding, handles immigration, and runs compliant global payroll while offering ongoing HR support to your international team on your behalf. An EOR also crafts locally tailored benefits, ensuring your company remains an attractive landing spot for top local talent.

By partnering with a Colombian EOR, you can easily hire local employees, maintain flexibility, and test the waters of the Colombian market before making long-term investments.

Learn more: What Is an Employer of Record (EOR)?

Engage Colombian contractors

Another option for engaging talent in Colombia is to hire local contractors. This option simplifies the hiring process and offers added flexibility.

By engaging local contractors, global companies can source specialized talent for one-off projects and save time and resources they would otherwise invest in onboarding, training, and paying full-time employees.

However, companies that hire international contractors risk misclassification. While you may correctly classify your contractors at the start of your working relationship, it’s easy for foreign employers to violate Colombia’s classification laws over time as workforce dynamics change and local regulations evolve.

For instance, simply offering your contractors work equipment or influencing their work schedule can amount to an employer-employee relationship and expose your company to fines, litigation, and reputational damage.

We cover this topic in greater detail later on.

Read also: Hire a Contractor vs. an Employee: Which Is Best For Your Business?

How much does it cost to hire an employee in Colombia?

The cost of hiring an employee in Colombia ranges from roughly 50% to 58% of an employee’s base salary due to mandatory employer contributions to a pension fund, health insurance, unemployment insurance, welfare, and the National Training Service. The cost percentage also includes mandatory 13th-month pay and vacation accrual contributions.

Still, total employee cost and contribution caps in Colombia vary widely based on factors like salary range and type, job title, industry, and occupational risk.

Interested in hiring employees in Colombia? Use our employee cost calculator below to get reliable insights into employee costs and payroll contributions in Colombia:

Employment considerations to know before hiring in Colombia

Global companies that want to build a distributed team in Colombia should familiarize themselves with the country’s employment laws.

While some of the local regulations may be similar to those in your home country, understanding the nuances of Colombia’s Labor Code can help you avoid noncompliance penalties down the road.

Below, we outline the employment regulations all companies hiring in this market should know:

- Minimum wage. As of 2024, the minimum wage in Colombia is US$334 (COP 1,300,000) per month.

- Working hours. A standard workweek in Colombia is 46 hours. Employees receive 125% of their standard wage for overtime, capped at two hours per day.

- Probationary period. Article 78 of the Colombian Labor Code states that the maximum probationary period for indefinite contracts is two months. For fixed-term contracts, it’s one-fifth of the contract term.

- Annual leave. Employees receive 15 days of paid annual leave and must take at least six days off each year. They can transfer the remaining days to the next year or receive pay in place of time off.

- Maternity leave. Employees in Colombia receive 18 weeks of paid maternity leave starting one week before the due date.

- Paternity leave. Fathers in Colombia receive two weeks of paid paternity leave.

- Sick leave. Qualifying employees can take up to 540 days of paid sick leave.

Employers pay compensation for the first two days of illness, and social security covers the rest. - Termination. For early terminations, employers must give 30 days’ notice to employees on fixed-term contracts. Advanced notice is not mandatory for indefinite contracts.

- Severance. For indefinite contracts, severance payments range from 20 to 30 days’ standard wages for the first year of service plus 15 to 20 days’ wages for each additional year, depending on the salary size. Employees on fixed-term contracts receive the wages they’ve earned up to the dismissal date.

- Public holidays. In addition to annual leave, employees in Colombia enjoy 18 paid public holidays.

Compliance risks when hiring employees in Colombia

Some of the most common compliance risks global companies face when hiring employees in Colombia involve worker classification, permanent establishment, payroll tax regulations, and immigration.

We discuss each of these in detail below and offer useful tips for mitigating risk.

Misclassification

As previously mentioned, hiring Colombian contractors is an affordable and flexible alternative to hiring full-time employees. However, engaging international contractors involves serious misclassification risk.

Contractors pay their own taxes and benefits, which translates to fewer hiring costs. However, contractors also enjoy several freedoms, such as the right to work with multiple clients at once and the freedom to set their own work schedule.

Colombian regulators have established strict and highly nuanced worker classification laws to prevent employers from hiring contractors for cost savings while treating them like employees.

The primary factors determining whether a worker is a contractor or employee in Colombia include autonomy, ownership of tools, and subordination. For instance, if you maintain an exclusive relationship with a contractor, offer them work equipment, or influence their work schedule, they are an employee.

Plus, it’s not enough to classify talent once at the beginning of your contract. Workforce dynamics change, and classification laws in Colombia regularly evolve. Your HR team must conduct regularly scheduled audits to ensure ongoing compliance.

It’s relatively easy for foreign employers operating in the Colombian market to accidentally establish an employer-employee relationship with a contractor and face hefty fines, back pay, tax arrears, and extensive litigation.

If you choose to engage Colombian contractors, dedicate extra time and resources to familiarizing yourself with the country’s classification regulations. Or, consider partnering with a third-party legal expert, such as an EOR, to mitigate risk.

Read more in our complete guide to employee misclassification.

Inaccurate payroll contributions

One of the most challenging issues global companies face when hiring talent overseas is ensuring global payroll compliance.

Statutory payroll taxes and contributions in Colombia vary from those in other countries, creating added risk for foreign employers unfamiliar with local regulations.

Colombian payroll tax comprises income tax and contributions to social security. Income taxes range from 0% to 39% of the employee's monthly salary, depending on their income bracket.

Social security comprises pension, healthcare, and employment risk. Total contribution rates amount to roughly 28.5% of the employee’s base salary, although only about 8% are withholdings.

Employer contributions break down as follows:

- Healthcare: 8.5% (0% if the employee earns less than 10 times the minimum monthly wage)

- Pension: 12%

- Employment risk: 0.348% to 8.7%, depending on the job type

- Payroll tax: 9% (only on salaries over 10 times the minimum monthly wage)

Employee contributions to social security break down as follows:

- Healthcare: 4%

- Pension: 4%

- Solidarity fund: 1% to 2% (only on salaries over four times the minimum monthly wage)

Employers calculate income taxes and social security contributions as percentages of the employee's base salary and withhold and remit payments to the federal government.

The above percentages serve as general guidelines. Taxes and contribution rates vary depending on salary size and relevant tax benefits for single or married couples with dependents.

Due to the complexity of Colombian payroll tax regulations, global companies must exercise due diligence to ensure timely and accurate payments to their Colombian team. Many foreign employers partner with a third-party legal expert with experience in local payroll and tax regulations to ensure compliance.

Read also: Complete Guide to Payroll Tax: Definition, Costs, and Calculation

Permanent establishment

A company’s corporate tax liability in a foreign jurisdiction usually depends on local permanent establishment (PE) regulations.

Consider the Netherlands, for instance: any foreign entity conducting ongoing business from a physical location in the country is a PE and must pay corporate taxes. However, if a foreign company only performs ancillary activities there, such as operating a storage space or conducting research, it isn’t a PE and is free of local taxation.

In Colombia, the situation is different. Any foreign company that generates income in the country faces taxation, regardless of whether or not it is a PE. In other words, PE status is not a threshold that determines your corporate tax liability in Colombia, like in many countries.

If you engage Colombian talent from abroad, be sure to exercise due diligence and determine if your operations qualify as income-generating activity. If so, you’ll have to fulfill your local tax liability. Plus, if you have PE status, you’ll face further obligations, such as filing income tax returns and maintaining accounting books.

Overlooking your corporate tax obligations in Colombia can result in hefty fines and legal penalties. If you partner with an EOR, you don’t need to worry about compliance—they handle it for you.

However, if you employ talent directly via a local entity, or you engage local contractors, compliance is your responsibility. Leaning on the expertise of a third-party legal organization is a reliable way to mitigate risk.

Immigration requirements

Most talent you hire in Colombia will be local citizens or individuals with Colombian residence permits.

Still, the world of work is becoming more decentralized. Top talent values the freedom to move, making global mobility a critical aspect of talent retention. At some point, you may need to relocate a domestic employee to Colombia.

You may also need to hire a foreign national who doesn’t hold a Colombian work visa. Regardless of your situation, your HR team must be ready to navigate Colombian immigration procedures to acquire necessary work visas and permits for your team.

Immigration doesn’t pose a serious compliance risk, per se. However, choosing the correct visa, collecting necessary documents, acquiring authorizations, and scheduling appointments is time-consuming.

Lengthy immigration procedures can lead to operational delays and cause talent to consider employment elsewhere. Ensuring your HR team can quickly secure work permits is critical for avoiding workflow interruptions and reducing employee churn.

Compliantly hire employees in Colombia with Velocity Global

While Colombia is an exciting landscape for growing international companies, ensuring compliance and navigating incorporation procedures can be overwhelming. Fortunately, you don’t have to go it alone.

Velocity Global's EOR solution allows global companies to quickly and compliantly build international teams in over 185 countries, including Colombia, without setting up legal entities.

We handle everything from hiring, onboarding, compliance, and immigration to running global payroll, administering global benefits, and offering ongoing HR support to your international workforce on your behalf.

With Velocity Global at your side, you can source top Colombian talent and build your dream team in the country while your business continues running on all four cylinders.

Contact Velocity Global today to learn how to hire employees in Colombia with ease.

Topic:

Country Guides