Permanent establishment is a dense subject that can be confusing to even the savviest of business professionals. We’ve created a simplified guide to help break down the topic and provide guidance on how to avoid permanent establishment risk.

Key takeaways:

- A permanent establishment is an international tax concept, which means a business could be subject to tax in foreign countries where they conduct business.

- There are a few common types of permanent establishments, including fixed places of business, sales agents, and service.

- An employer of record (EoR) can help you navigate and avoid permanent establishment risk.

Definition of Permanent Establishment

A permanent establishment (PE) is when a business has an ongoing and stable presence in a country or state outside of its home base and is, therefore, liable to taxes imposed by that jurisdiction. In short, a PE is a corporation that creates a taxable presence outside of its territory. If a business creates a PE in a country by doing business there that creates local revenue, then the host country can impose local corporate tax rates.

This is an important concept for any corporation that does business in foreign countries to understand. It ultimately decides how much tax you are charged for each country you do business in. Failing to understand permanent establishment can leave taxes unpaid and cause legal issues later.

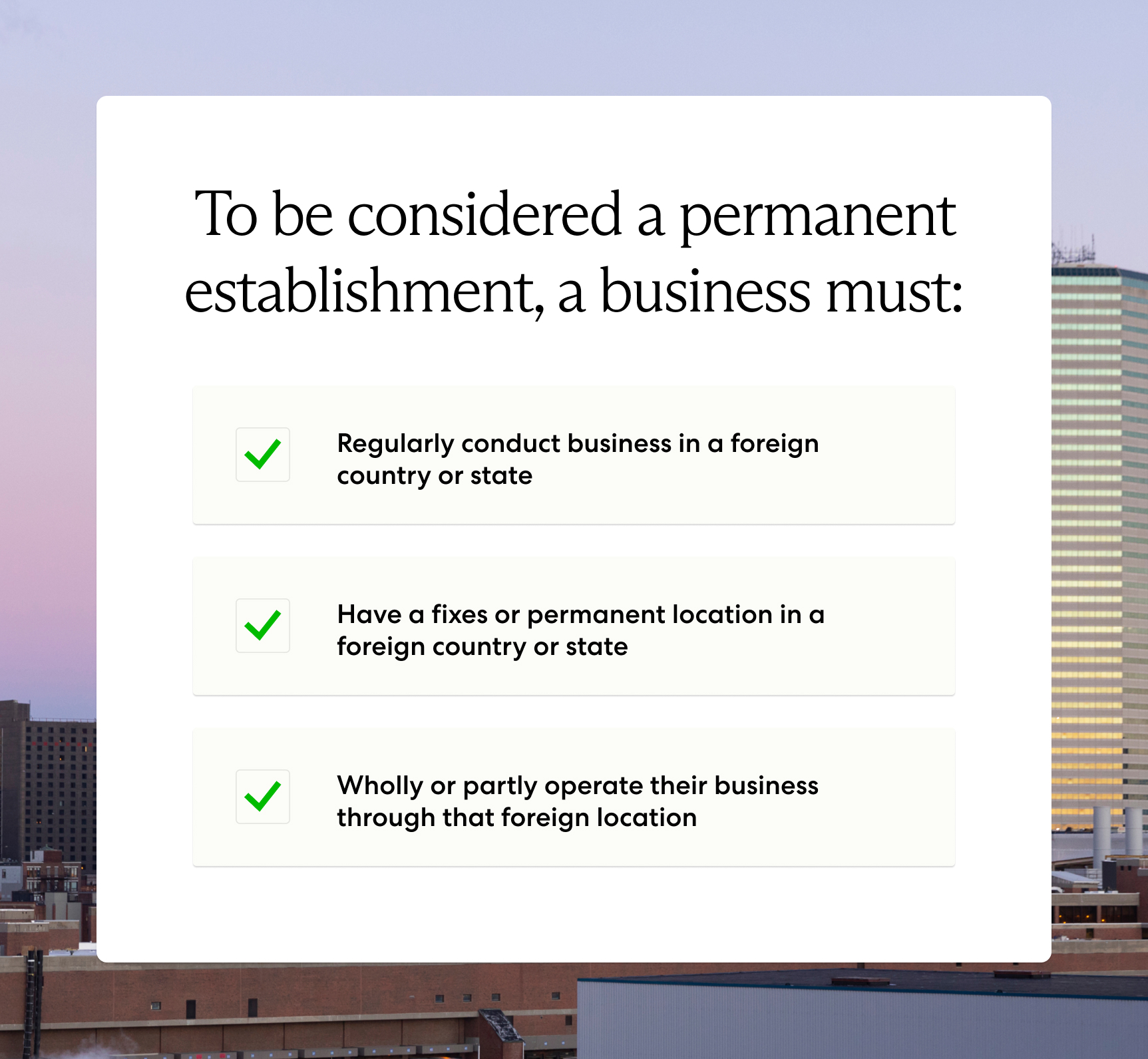

The criteria for a permanent establishment are the following:

- A place of business has been established in a foreign country

- The place of business is “fixed” or permanent

- The business is wholly or partly operated through that fixed establishment

How Does Permanent Establishment Work?

If your corporation has a fixed location in another country while also generating revenue there, you have a permanent establishment. This means you will be charged tax in that jurisdiction.

There are different tax treaties between home and host countries that define the tax rate. This prevents the company from being double-taxed. Corporations register in their host country and, most often, pay indirect taxes such as goods and services tax (also called value-added tax). A goods and services tax is an indirect tax levied on products or services sold for human consumption or use.

Types of Permanent Establishments and Examples

Permanent establishment types continue to evolve with the growth of technology and ever-changing business mediums. Though they continue to change to fit today’s standards, here are a few common types of permanent establishments.

Fixed Place of Business Permanent Establishment

A fixed place of business is the most common type of permanent establishment. This means having a physical business presence in a foreign country.

These fixed places of business include but are not limited to:

- Factories

- Offices

- Branches

- Mines

- Oil wells

- Workshops

Example: Fashion companies will often have their corporate offices in their home country while having their factories in a foreign host country. The fashion company will be charged different taxes in both territories, as the company is doing business and generating revenue in the foreign host country.

Sales Agents

It is possible that your company's sales agents can create a permanent establishment in another country. If they have assignments in a foreign country in the name of an enterprise, you may now have a permanent establishment in that country. Factors that determine this include the frequency with which the employee is there and the majority of negotiations occurring in the host country. Sales agents are common in the fashion, cyber security, and pharmaceutical industries.

Example: A company's sales agents are consistently making deals with an establishment in another country, causing them to stay there for negotiation periods and more. This company has created a permanent establishment there.

Service Permanent Establishment

A service PE includes situations where a company provides managerial technical services to an entity outside of its own home country. This will create a permanent establishment without a physical location in the foreign country.

Example: A consulting service that provides its service in a country outside of its home country is technically generating revenue in a host country; therefore, it will owe taxes in the host country.

Permanent Establishment Risk

There are many rewards for companies that create a permanent establishment, but like any reward, risks are also present. Being aware of permanent establishment risk is an important part of global expansion, as it helps avoid mistakes. Below are some permanent establishment risks to be aware of when going global.

Associated Tax and Tax Regulation Liabilities

The most common risk is not paying your taxes. This most often happens when companies don’t realize that they have even created a PE. This can result in back taxes, interest, and penalties for the company.

Tip: Each country has its own rules on taxes for permanent establishments, so it is best to consult with a professional with knowledge of the foreign country you will be doing business in.

Associated Employer Liabilities

Employers who may have accidentally created a PE often don’t realize there are obligations they are meant to follow. These obligations include registering for an employer ID and payroll taxes. Once again, this can result in back taxes and penalties for the company.

Tip: Speak to a global business professional before doing any business internationally so you can be fully aware of any fees, rules, or regulations that a foreign country may apply to your business.

Reputational Damage

Failing to pay taxes in a host country will significantly hurt the reputation of the company in that jurisdiction. This will negatively affect your relationship with regulators, as well as the public.

Tip: If you do fail to pay taxes due to not knowing you had created a PE, improve your reputation by filing early in the coming years and complying with any other regulations imposed on your business.

See our checklist for permanent establishment risk.

How to Manage Permanent Establishment Risk

Companies who are looking to capitalize on the benefits of the global marketplace can do so safely by preparing for permanent establishment risk.

Obtain Early Advice on the Effect of a PE

Look into permanent establishment regulations in a country before starting a business there. Sometimes creating a PE is a good thing. The rules vary by country, but permanent establishments in some countries eliminate the need to file taxes in the company’s home country. This is particularly great if the host country has lower tax rates than the company’s home country.

Set Up Headquarters in a Foreign Country

If you’re looking to do business abroad, you can mitigate permanent establishment risk by establishing a legal entity in your target market. This requires enough foresight to recognize that you want to expand globally but can help you reap the rewards of global teams without having to navigate the tax implications of separate offices in separate countries.

Engage With a Professional

Oftentimes, the best thing to do before creating a PE in another country is to talk with a professional. Tax professionals are very knowledgeable about permanent establishments in other countries and can help you make the best decision before you decide to expand your business.

Use an Employer of Record

This is a common method used for hiring foreign employees. An employer of record (EoR) takes on a range of compliance obligations for your employees in a particular territory. Partnering with an EoR doesn’t prevent a permanent establishment from being created but instead can provide an audit trail for taxes and help demonstrate that your business’s activities are compliant.

Learn more: What Is an Employer of Record?

I Have a Permanent Establishment: What Are My Next Steps?

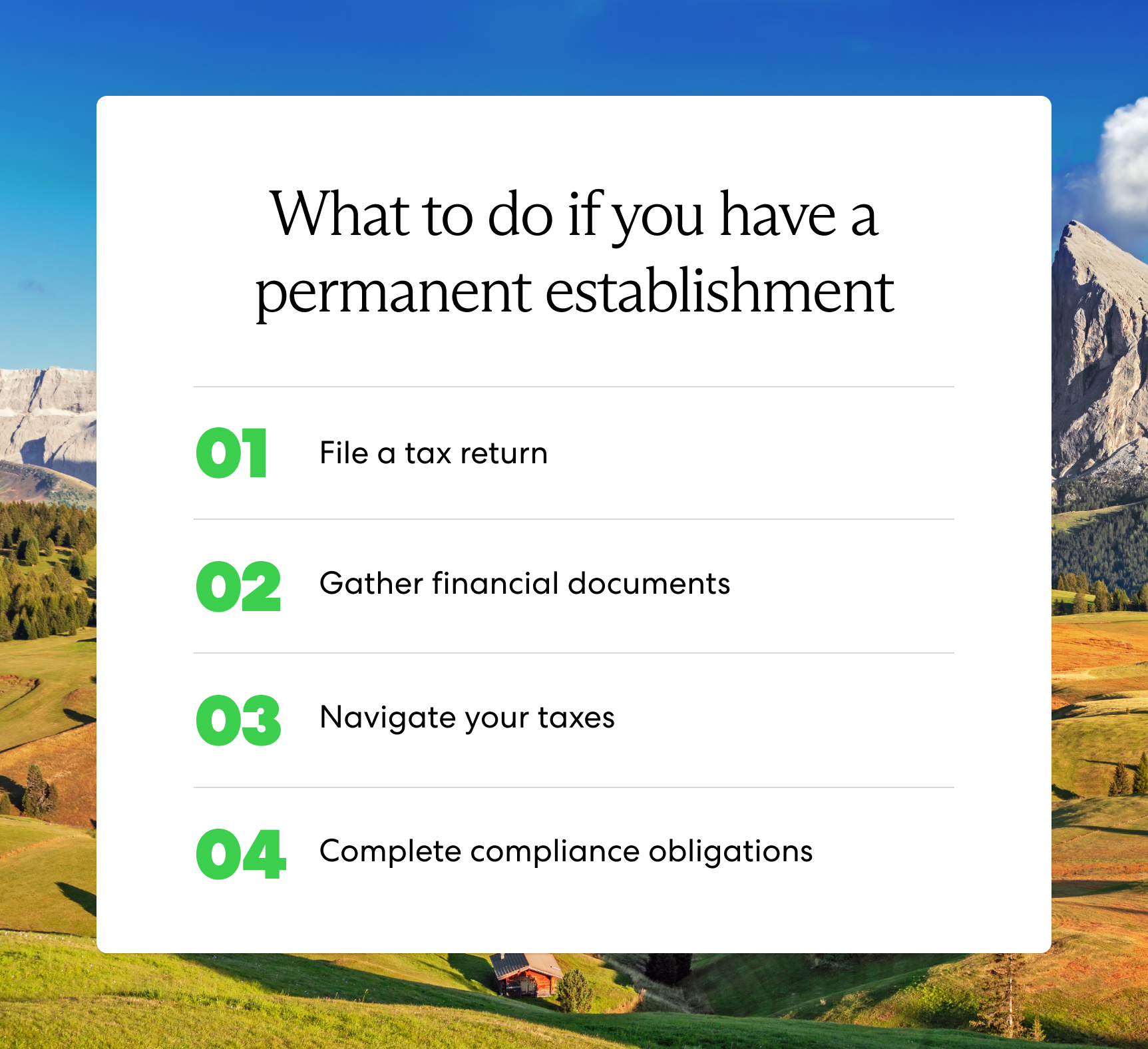

Does the concept of a PE seem familiar? No need to hit the panic button. Taking a few steps to legitimize your foreign entity can keep you out of hot water. These steps will also help manage the risks that having a PE carries. These simple considerations are typical next steps upon discovering you have a permanent establishment:

- File a tax return

- Gather documentation as to why profits were attributed in certain ways

- Work out which types of taxes apply to your business

- Complete compliance obligations

Frequently Asked Questions

What Causes Permanent Establishment?

Permanent establishment is caused by a company having a fixed place of business creating revenue in a territory outside of their home country. The business is creating taxable revenue in a country, so they are a permanent establishment that the host country can tax and regulate.

Is a Subsidiary or Franchise a Permanent Establishment of the Parent Company?

Business structures, such as foreign subsidiaries or branches, can be charged corporate income taxes in the jurisdiction where they are located. This doesn’t automatically make them a PE of the parent company. In certain situations, they can become a PE, such as if the subsidiary begins acting as a dependent agent of the parent company.

Learn more: What Is a Foreign Subsidiary? Pros & Cons for Global Employers

How Are Permanent Establishments Taxed?

Permanent establishments are taxed differently depending on the country. The treaty made between a company’s home and host country will determine which taxes a company pays where in order to prevent the company from being double taxed.

Can an Individual Have a Permanent Establishment?

Yes. An individual can have a permanent establishment if they are a dependent agent completing work in another country. When this individual frequently enters into contracts in the name of a company, they are considered a fixed presence of the company in that country.

Permanent establishment is a confusing but necessary topic that companies with a foreign presence need to be aware of. Companies that complete business habitually overseas and have a fixed presence there need to be aware that they could be a PE there. Taxes and liabilities can pile up on companies that are unaware of this.

Simplify Global Expansion With Velocity Global

It is best to get professional advice upon expanding into foreign countries to help determine if your company has created a permanent establishment. This will give you peace of mind, as well as help you manage the risks of creating one. As long as you manage your entities well, your business is likely to thrive even with permanent establishment.

If you are looking to reap the benefits of expanding into other countries, Velocity Global is here to help. Contact us to learn how we can help you achieve your global expansion goals.