In today’s age of remote work, the world is connected more than ever, and businesses are in a position to hire talent from anywhere.

Hiring international employees is a great stepping stone for U.S. companies exploring new markets, targeting specialized talent, and expanding their global presence.

Read on to learn everything you need to know about hiring globally from other countries, including your options and common regulatory challenges to avoid.

Can a U.S. company hire international employees?

Yes, a U.S. company can hire international workers abroad. However, hiring overseas employees comes with unique challenges, such as navigating foreign tax and employment regulations, correctly classifying international workers, and running global payroll.

To simplify international hiring, many companies partner with an employer of record (EOR) or engage global contractors instead.

Below, we outline the most common challenges U.S. companies face when hiring international employees:

- Permanent establishment. If a U.S. company has a fixed location in another country and generates revenue there, this usually triggers permanent establishment, subjecting the company to local corporate taxation. Companies that overlook their permanent establishment obligations face fines, tax arrears, and litigation.

- Unfamiliar labor laws. Labor and employment regulations worldwide usually differ significantly from U.S. regulations, creating a serious compliance risk for U.S.-based companies. Failure to draft compliant international employment contracts that satisfy things like statutory benefits requirements, leave entitlements, and overtime regulations when hiring employees in foreign countries results in fines, limited business opportunities, and other noncompliance penalties.

- Payroll setup and accurate contributions. Payroll for international employees requires employer contributions to more state-backed insurance programs compared to the U.S., such as healthcare and retirement benefits. Fines and other penalties result if a U.S. company doesn’t correctly calculate payroll taxes and contributions for their foreign employees or satisfy local payroll regulations, like following the appropriate payroll cycle or reporting regulations.

- Misclassification risk. Misclassification is most common when a company engages a contractor but treats them like a full-time employee. For example, if you start managing your contractor’s work schedule or pay them a fixed salary, local authorities will see the contractor as an employee under local labor regulations, subjecting you to back taxes, back benefits, and potential fines.

Read our complete guide to employee and contractor misclassification.

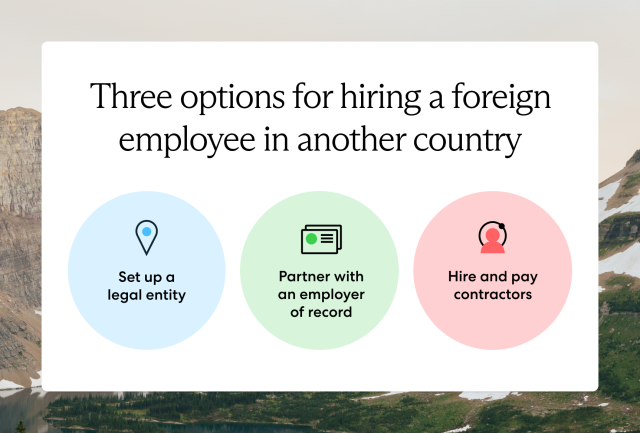

Three options for hiring international workers from another country

Despite the challenges of hiring overseas employees, companies have several options for hiring international workers, including setting up a legal entity, partnering with an employer of record, and engaging contractors.

We discuss each of these options in detail below.

1. Set up a legal entity

Setting up a legal entity in the target market is the traditional approach global companies take for hiring remote employees in other countries and building a long-term, global presence. Establishing a foreign entity allows you to hire and pay local employees directly.

Entity establishment is a desirable option if your company has a large budget, plans to hire a sizable workforce in another country, and is ready for long-term investments.

Still, entity establishment is expensive and time-consuming. It also requires extensive expertise in local legal, corporate, and payroll regulations. Entity establishment is usually more trouble than it’s worth if you don’t have the bandwidth or capital investment or only plan to hire a few employees in your target market.

Learn more: How to Hire Foreign Workers Without Setting Up a Legal Entity

2. Partner with an employer of record

A simpler, more streamlined approach to hiring international employees is to partner with an employer of record. An employer of record is a third-party entity that acts as the legal employer of your international workforce, allowing you to quickly and compliantly hire and pay remote employees in foreign countries without setting up local entities.

An EOR serves as your global HR team, handling the heaviest tasks associated with building international teams, including hiring, onboarding, compliance, global benefits administration, running global payroll, and providing ongoing HR support so you can build an international workforce without the added burden.

An EOR is an ideal solution for companies that want to hire international employees and test a foreign market before making long-term investments. It’s also a great bridge employment solution for companies that are undergoing entity establishment but don’t want to wait months or years until they can hire employees in their target market.

Learn more: What Is an Employer of Record (EOR)?

3. Hire and pay contractors

An alternative to hiring full-time international employees is to engage global contractors instead. Contractors provide their services as self-employed individuals. Using and paying a contractor allows you to work with global talent, target specialized skills, and benefit from cost savings and flexibility.

Engaging global contractors is also a great way to test a foreign market. Should you want to convert your international contractors to employees down the road, an EOR easily facilitates this as well, ensuring compliance and forgoing entity establishment requirements along the way.

However, as mentioned earlier, engaging contractors creates misclassification risks. Many countries have unique worker classification regulations, but in general, companies cannot attempt to control the work methods or schedules of their contractors. If this happens, the employer can face fines, employee back pay, reputational damage, and even imprisonment.

FAQs on hiring international employees in other countries

When hiring remote employees in other countries, U.S. employment laws do not apply since these employees are non-U.S. residents. Understanding the ins and outs of hiring international employees is essential for eliminating headaches and ensuring compliance while building a global team.

Below, you can find answers to some commonly asked questions regarding hiring and paying overseas employees.

How much does it cost to hire a foreign worker?

U.S. companies sometimes find it less costly to hire abroad than to hire domestic employees. Still, the cost of hiring a foreign employee varies drastically, depending on factors like job role, cost of living, employment laws, and payroll contributions.

Do you want to calculate how much it costs to hire a foreign employee? Use our employee cost calculator below to get reliable insights into employee costs and payroll contributions around the globe:

When considering the total cost of hiring international employees, be sure to factor in the following:

- Visa sponsorships. If an employee is not a resident in their country or if you need to relocate talent to another country, you must follow specific immigration requirements, like obtaining authorizations, securing relevant permits, paying fees, and ensuring compliance with the visa application and process.

- Compensation. Total compensation-related costs for foreign employees vary based on the employee’s role, their experience level, local minimum wage laws, the local cost of living, and local statutory employee benefits like 13th-month pay.

- Mandatory employer costs. Along with monthly salaries, employers must contribute to social security and other mandatory insurance programs for their foreign employees according to local regulations. Contributions and rates vary between jurisdictions.

- Competitive benefits. Many employers offer supplemental benefits to improve their employees’ quality of life and secure top talent. Supplemental benefits include things like additional private health insurance, supplemental retirement plans, and extended leave.

- Cost of living. When calculating competitive wages and deciding which supplemental and fringe benefits to offer a foreign candidate, employers should consider the cost of living in their candidate’s country of residence and what financial challenges they face.

- Work arrangement. Because of the mandatory payroll tax contributions and benefits associated with employment, the cost of hiring international employees is generally higher than engaging foreign contractors. Still, engaging contractors creates a misclassification risk, which leads to back pay and hefty fines, and it limits your ability to create a strong, unified team over time.

Learn more in our complete guide to employee cost.

Does an international employee have to pay U.S. taxes?

Remote foreign employees legally residing and working abroad do not have to pay U.S. taxes even though a U.S. company employs and pays them. Because foreign employees are tax residents in a foreign country, they are subject to local laws, and U.S. taxes do not apply.

Keep in mind that U.S. citizens who work abroad are still subject to U.S. income taxes unless they can prove their tax home is in a foreign country and that they qualify for foreign-earned income exclusion.

Is a U.S. company responsible for withholding U.S. taxes or reporting wages of international workers?

U.S. companies that hire international workers abroad are not responsible for withholding U.S. taxes from their foreign employees' wages or reporting their earnings to the IRS. According to the IRS, wages earned by a nonresident for services performed outside of the U.S. are foreign source income and are, therefore, not subject to U.S. tax reporting or withholding.

Does an international employee need a visa to work for a U.S. company?

Foreign employees who work for a U.S. company do not need a U.S. visa or work permit if they reside and work outside of the U.S. However, should the employee relocate to the U.S. or come to the U.S. for training purposes or a business trip, their employer would need to acquire an appropriate visa for them, such as the H1-B visa.

Is a U.S. company responsible for providing benefits to hired international employees in another country?

Yes—U.S. companies that hire internationally are responsible for providing benefits to their foreign employees according to local employment regulations. Statutory benefits requirements vary worldwide, and U.S. companies must comply with the requirements of each country where their employees reside.

However, if a U.S. company engages global contractors instead of hiring employees, they needn’t offer benefits.

How do I hire international employees in another country?

Global companies have three options for hiring international workers:

- Establish a local entity. Entity establishment reduces risk exposure and simplifies the hiring process, but it is a lengthy and costly undertaking.

- Partner with an employer of record. An EOR allows you to quickly and compliantly hire and pay international employees without undergoing entity establishment—an ideal option for testing a foreign market or hiring overseas employees before finishing local incorporation.

- Engage global contractors. Engaging contractors is a low-commitment option for targeting foreign talent with specialized skills while reducing hiring costs, but it comes with hefty compliance risks.

Hire international employees with Velocity Global

Hiring international employees opens up a world of opportunity for global businesses, but the burden of maintaining global hiring compliance deters many companies from ever starting. Hire employees in foreign countries with ease by partnering with Velocity Global.

Our EOR solution allows global companies to quickly and compliantly hire, pay, and support international talent in 185+ countries without establishing foreign entities. With worldwide in-country expertise, we ensure compliance with local tax and employment regulations as you build a global workforce, no matter which country you hire from.

Lean on us to handle everything from hiring, onboarding, immigration, and relocation to global benefits administration and running global payroll while offering ongoing HR support so you can quickly grow your team and enter new markets without the added burden.

Ready to easily and compliantly hire international employees anywhere? Contact us today to get started.

Topic:

Country Guides