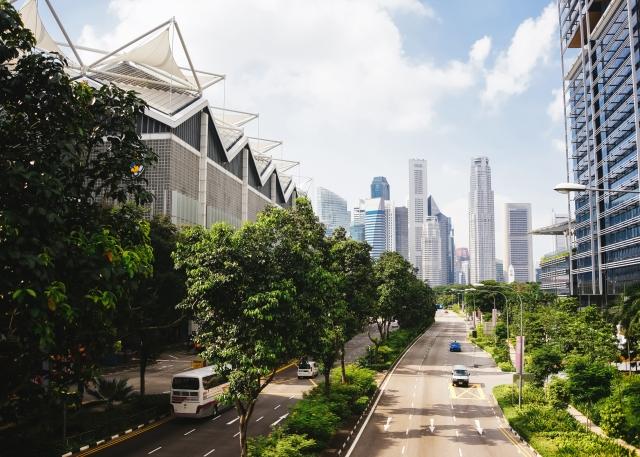

Accessing top talent is critical for unleashing your global potential. With one of the world’s most highly skilled talent pools, Singapore’s workforce is an invaluable resource for global companies.

The country’s thriving economy and strategic location also make it an ideal target market for global companies eyeing further expansion into Southeast Asia.

Still, hiring employees in Singapore involves unique challenges, from ensuring regulatory compliance to navigating complex immigration procedures. Fortunately, engaging talent in this market doesn’t have to be overwhelming.

This guide explains everything global companies need to know about hiring employees in Singapore, from calculating total employee cost to ensuring compliance. Plus, find out how to hire talent in Singapore without establishing a legal entity.

Can a foreign company hire employees in Singapore?

Yes, foreign companies can hire employees in Singapore. By establishing a legal Singaporean business entity, hiring international contractors, or partnering with an employer of record (EOR), global companies can quickly and compliantly engage Singaporean talent and enjoy the many benefits this market has to offer.

How do you hire employees in Singapore?

Global companies that want to hire employees in Singapore must complete the following steps:

- Register their business in Singapore

- Apply for a Central Provident Fund Submission Number (CSN)

- Create and sign compliant work contracts

- Purchase work injury compensation insurance

- Incorporate new hires into company payroll

However, hiring foreign nationals requires additional steps, such as setting up a Work Pass Account or registering with the Employment Pass eService, depending on your candidate’s work visa.

How you hire employees in Singapore ultimately depends on your expansion strategy. As previously mentioned, global companies can engage talent in this market using one of three methods: establishing a legal business entity, hiring international contractors, or partnering with an employer of record (EOR).

Each approach involves a slightly different hiring process. For instance, if you establish a local business entity, you handle all hiring formalities internally. However, if you engage local contractors, you don’t need to apply for a CSN, or if you partner with an EOR, they handle all hiring formalities on your behalf.

We discuss each approach in detail below.

Set up a legal entity in Singapore

The traditional way to hire employees in Singapore is to set up a legal business entity in the country and employ local talent directly. This approach involves several benefits, especially for companies ready to make significant upfront investments and hire a large Singaporean team.

Entity establishment allows you to hire local talent directly and maintain all HR functions internally, from hiring and onboarding to running global payroll. With a legal entity, you save on long-term hiring costs and maintain oversight of your employment relationships.

However, entity establishment also requires substantial time and cost commitments. Businesses that choose this route must find and hire a resident director, commit thousands of dollars to upfront investments, and pay ongoing compliance, servicing, and administration fees. Plus, employers have to wait several months before legally engaging local talent.

If you’re not ready to make long-term investments in the Singaporean market, consider a more agile approach, such as hiring international contractors or partnering with an EOR.

Engage contractors in Singapore

Hiring international contractors is a streamlined approach to engaging talent overseas that offers flexibility and low commitments.

Hiring contractors in Singapore allows you to source local talent with unique skills for one-off, short-term projects, allowing you to remain flexible as you expand your local footprint. With this approach, you also save time and resources you would otherwise invest in hiring and paying a team of full-time employees.

While some businesses thrive with large teams of dedicated contractors, this approach involves unique challenges. For instance, hiring contractors limits your ability to build the cohesive, committed workforce you need to support steady, long-term growth.

Plus, it involves a serious misclassification risk. Misclassification occurs when employers incorrectly classify talent according to local worker designations. Foreign employers may struggle to navigate Singapore’s complex classification regulations on their own, which can lead to hefty fines and legal setbacks.

We discuss misclassification in greater detail later on.

Read also: Hiring Contractors vs Employees: Which Is Best for Your Business?

Partner with an employer of record

A flexible and straightforward approach to hiring employees in Singapore is to partner with an employer of record (EOR).

An EOR is a third-party entity with access to global infrastructure and international legal expertise that makes it easy for companies to hire overseas without undergoing entity establishment or worrying about violating local employment and tax laws.

Think of an EOR as a global HR partner—they handle everything from hiring, onboarding, immigration, and compliance to running global payroll, administering global benefits, and offering ongoing HR support to your team, no matter their location. With an EOR at your side, you can hire talent worldwide without the added burden.

Some of the global HR duties an EOR handles include the following:

- Onboarding tasks such as drafting compliant employment contracts

- Timely and accurate payroll processing and tax withholdings

- Compliant and competitive locally-tailored benefits packages

- Regulatory compliance

- 24/7 HR support for your team in their local language

For instance, if a British tech company wants to hire Singaporean software engineers without establishing a legal entity, they can partner with an EOR. Their EOR partner will onboard, employ, and pay their team on their behalf while ensuring compliance with local labor regulations.

By partnering with an EOR in Singapore, you can test the waters of the local market before making long-term investments and easily pivot your strategy as needed.

Learn more: What Is an Employer of Record (EOR)?

How much does it cost to hire an employee in Singapore?

The cost of hiring an employee in Singapore is roughly 17.25% of an employee’s base salary due to mandatory employer contributions to Singapore’s Central Provident Fund (CPF) and Skills Development Levy (SDL).

Still, total employee cost in Singapore varies widely based on factors like employee age, occupation, and income.

Interested in hiring employees in Singapore? Use our employee cost calculator below to get reliable insights into employee costs and payroll contributions in Singapore:

Employment laws to know before hiring employees in Singapore

Local employment laws in Singapore vary greatly from other regions, posing a unique compliance risk for foreign employers.

Here’s what you should know before engaging talent in this market:

- Compensation. Unlike many countries, there is no minimum wage in Singapore. While bonuses aren’t compulsory, 13-month pay is common.

- Working hours. A standard work week in Singapore is nine hours per day, five days per week.

- Probationary period. Federal law doesn’t require minimum probationary periods, but employers usually implement them for three to six months.

- Annual leave. Employees receive seven days of paid annual leave in their first year of employment. They earn an extra day for each additional year of continuous service up to a maximum of 14 days.

- Maternity leave. Employees receive 16 weeks of paid maternity leave if they have worked for their employer for at least three months, and their child is a Singaporean citizen. If the child is not a Singaporean citizen, they receive 12 weeks.

- Paternity leave. Qualifying fathers of children born or adopted after January 1, 2024, receive four weeks of Government Paid Paternity Leave (GPPL). Previously, it was two weeks.

- Sick leave. After three months of continuous service, employees receive five days of paid sick leave. After five months of service, they receive 11 days.

- Severance. Federal law does not require severance payments, although most employers offer two weeks’ to one month’s wages per year of service. Collective agreements can stipulate severance pay, and employers must specify severance provisions in their work contracts.

- Benefits. Singaporean employees are covered by the CPF, a social security savings program funded by employers and employees that maintains retirement pensions, housing, and healthcare.

- Public holidays. In addition to their annual leave entitlements, all employees in Singapore enjoy 10 paid annual public holidays.

Immigration requirements

Singapore has strict foreign immigration laws and complex visa qualification criteria. Should you need to hire a foreign national currently residing in Singapore or relocate a domestic employee to the country, you’ll need to familiarize yourself with local immigration requirements.

Singapore offers various work visas for foreign nationals, ranging from semi-skilled visas to executive and artist permits. The most common Singapore work visas include the S Pass, Employment Pass (EP), and Overseas Networks & Expertise Pass (ONE Pass).

Consider the EP, for instance—a work visa for professionals, managers, and executives. The EP allows its holders to compliantly work in Singapore for up to two years, open a bank account, rent property, and access local medical facilities.

EP eligibility hinges on the following criteria, split into two stages:

Stage 1

All applicants must have the following:

- Job offer in Singapore

- Position in a managerial, executive, or specialized job

- Qualifying minimum salary, dependent on the sector

Stage 2

Stage 2 is a points-based Complementarity Assessment Framework (COMPASS). Candidates must earn a minimum of 40 points to pass Stage 2. Foundational criteria include salary level, qualifications, diversity incentives, and local workforce opportunities.

Candidates can earn bonus points for filling job shortages or working in sectors with economic incentives, such as government investment programs. Applicants must pass both stages to qualify for the EP.

With such complex visa application procedures, relocating employees to Singapore can overwhelm HR teams, resulting in delays and unexpected costs. Partnering with a local immigration expert, such as an EOR, enables quick and compliant immigration processing for your international team.

Read more: Employment Pass vs. Permanent Residence in Singapore

Compliance risks of hiring employees in Singapore

Ensuring compliance with local labor and tax regulations is critical for your success as you expand globally. Key compliance risks global companies face when hiring talent in Singapore include employee classification, payroll taxes, and permanent establishment.

We discuss each of these in detail below and offer tips on mitigating risk.

Misclassification

Misclassification results when an employer incorrectly classifies talent as an employee or contractor. This usually occurs when an employer designates a worker as a contractor but unknowingly establishes an employment relationship with them.

As previously mentioned, engaging contractors involves fewer commitments than hiring employees. To prevent organizations from hiring contractors for cost savings while treating them like employees, Singaporean authorities have established highly nuanced worker designation regulations that leave ample room for interpretation. Due to the complexity of these regulations, foreign employers face significant risks.

Consider the following example: a British IT company hires a team of remote Singaporean IT specialists on a contract basis. Should the company begin controlling its contractors’ work schedule or maintain an ongoing, regular payment schedule, this may constitute an employment relationship according to local regulations.

Misclassification penalties in Singapore include hefty fines, ranging from SGD 5,000 to SGD 50,000 per misclassified worker. If you employ multiple contractors, this adds up quickly.

Understanding local classification regulations is critical for avoiding setbacks as you build a remote workforce in Singapore. If you choose to hire contractors, enlist an experienced HR team and provide them with the necessary resources to ensure ongoing compliance.

Read more in our complete guide to employee misclassification.

Incorrect payroll contributions

Running payroll for international teams is one of the most challenging aspects of global talent management. Familiarizing yourself with Singapore’s payroll tax regulations and providing your team with timely and accurate payments is critical for avoiding operational delays, financial penalties, and employee churn.

Statutory payroll contributions in Singapore include the following:

- Central Provident Fund (CPF). The CPF covers retirement, housing, and healthcare. Employers contribute 17% and employees contribute 37%, although rates vary for employees aged 55 and over.

- Skills Development Levy (SDL). The SDL funds workforce upgrading programs and employee training grants under the National Continuing Education Training system. This is an employer-only contribution of 0.25%, capped at SGD 11.25.

If you hire foreign nationals in Singapore, you must also contribute to the foreign worker's levy (FWL). FWL rates vary drastically, depending on worker qualifications and the number of foreigners an organization employs. For instance, the daily FWL in the construction sector ranges from SGD 8.22 to SGD 29.59 per worker.

Employers in Singapore must also withhold income taxes from employees’ gross salaries. Income tax rates range from 0% to 24%, depending on the employee's tax bracket.

Permanent establishment

Doing business in a foreign market in any capacity can trigger permanent establishment (PE) status and subject your company to local corporate taxation. Global companies hiring talent in Singapore must perform due diligence to clarify their local tax obligations.

Any foreign entity that conducts the following business activities in Singapore is a PE:

- Owning a building site or assembly project

- Conducting supervisory activities connected with a building site or assembly project

- Offering services, such as consultancy, through local employees or other personnel in the country

- Hiring a local agent who habitually exercises the authority to negotiate and close contracts on behalf of the foreign company

In other words, even if you don’t establish physical infrastructure through a local entity, hiring remote talent in Singapore can still trigger PE status.

However, having a PE in Singapore doesn’t always mean added costs. Singaporean PEs only pay tax on income they generate from local business activity, rather than on global income. PEs also gain access to the country’s Tax Treaty Network which helps them avoid double taxation.

With the country’s low corporate tax rates, having a PE in Singapore can help international companies reduce their global tax burden.

Remember, overlooking your PE status and violating local corporate tax regulations can result in fines of up to SGD 5,000 and even lead to imprisonment. Consider partnering with a legal expert with experience in local corporate tax law to confirm your PE status and ensure compliance as you enter this market.

Simplify hiring employees in Singapore with Velocity Global

Singapore’s stable political environment, talented workforce, and strategic location make it an ideal target market for global companies looking to build a workforce in Southeast Asia. Simplify your hiring efforts and eliminate the risk by partnering with Velocity Global.

Our EOR solution makes it easy for global companies to hire talent in over 185 countries, including Singapore, without establishing legal entities or worrying about violating local employment and tax regulations.

Our team of experts offers legal and HR support at every step of the way as you build and manage a distributed workforce in Singapore. We handle everything from hiring, onboarding, compliance, and immigration to running global payroll, administering global benefits, and offering ongoing HR support to your team in their local language.

Let us handle the heavy lifting so you can build your dream team in Singapore without skipping a beat—contact us today to get started.

Topic:

Country Guides