Hiring contractors has many benefits and offers more flexibility in market expansion. Employers can engage contractors for specialized projects, save time and money that would otherwise go toward hiring employees, and test new global markets without entity establishment.

However, hiring contractors comes with misclassification risks. Misclassifying workers leads to fines, employee entitlement back pay, and other legal headaches. Additionally, employment regulations vary globally, so the risks increase when engaging international talent.

In this guide, learn the risks of misclassifying independent contractors, how to avoid them, and how to ensure compliance for your global workforce.

What is worker misclassification?

Worker misclassification refers to the illegal practice of categorizing employees as contractors, which denies them their entitlement to benefits, tax withholdings, and other legal protections.

A worker's legal employment status, whether contractor or full-time employee, depends on factors such as the worker’s financial relationship with the company and the degree of control over their work.

Whether an employer intentionally misclassifies workers to avoid taxes and benefits administration—or unintentionally misclassifies workers—it can negatively impact both parties.

Is your workforce compliantly classified? Use our contractor risk assessment checklist to find out and learn how to avoid misclassifying your talent:

What are the risks and consequences of misclassifying employees as independent contractors?

The risks and consequences of misclassifying employees as independent contractors include legal, financial, and operational penalties. While classification regulations vary worldwide, some common negative consequences of misclassifying workers include the following:

Legal fines and penalties

Misclassifying employees as contractors can trigger fines from government agencies like tax authorities and labor departments. It can also lead to class action lawsuits, and employers may incur costs from liquidated damages and attorney fees.

Back pay and benefits

Employers must pay misclassified workers any back pay and overtime they should have received as employees. The employer must also pay any benefits owed to the employee, such as worker’s compensation, retirement, medical insurance, vacation, and sick pay.

Unpaid taxes

Employers must pay back any mandatory national, state, and local employment taxes and contributions for misclassified workers, such as social security. Back taxes may also accrue interest and fines, and employers may lose certain tax benefits associated with proper classification, like deductions and credits.

Labor law violations

Misclassifying workers violates an employee’s federal protections that ensure employment benefits such as overtime pay, unemployment, disability coverage, and minimum wage requirements. An employer could face criminal penalties and fines for misclassifying an employee and violating their labor law entitlements.

Loss of employee legal protections

Misclassified workers may lose other legal protections, such as anti-discrimination rights, workers' compensation benefits, and health and safety regulations. An employer who misclassifies employees could be held responsible for unfair labor practices, exploitation, and discrimination.

Reputational damage

If an employer violates labor laws or is known to engage in improper employment practices, they risk a negative standing among industry peers, customers, and prospective talent.

A high-profile misclassification case might damage a company’s reputation enough to prevent investors from considering future partnerships or discourage potential employees and contractors from working with it.

Contract breaches

If employees believe they are misclassified and did not receive certain benefits or protections, they may bring claims against the employer for breach of the employment contract. An employer may face a class-action lawsuit from the employee seeking punitive damages and associated attorney fees.

Decreased employee morale

When denied their entitlements, pay, and benefits, a misclassified worker may become disgruntled with their employer and dissatisfied with their employment situation.

Misclassifying your talent might also cause existing employees to protest in support of the misclassified co-workers and leave. This unrest could lead to a hostile work environment and decreased employee morale company-wide.

Competitive disadvantages

Employers who misclassify workers may face higher labor costs, recruitment challenges, and competitive disadvantages than competitors who comply with employment laws. Prospective talent may want to avoid association with companies involved in misclassification to protect their rights and chances of future employment.

Read more: Employee Misclassification Penalties: What Employers Should Know

How to avoid the risks of misclassifying employees as independent contractors

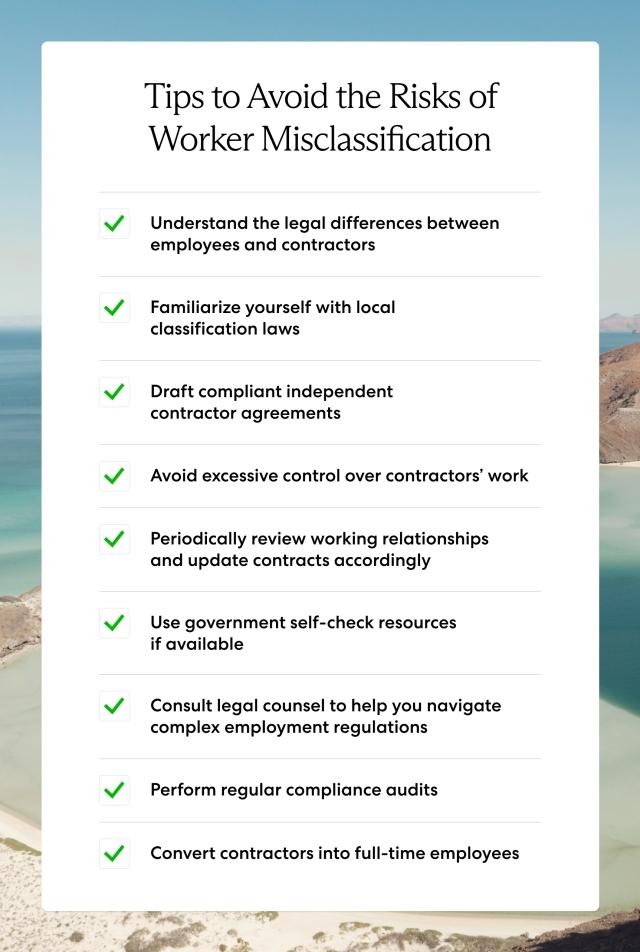

Despite the severe consequences of misclassifying employees as independent contractors, mitigating the risks is possible with due diligence. The following steps help employers avoid misclassifying employees as independent contractors.

Understand the difference between employees and contractors

Key differences distinguish common-law employees from contract employees. Employers must understand these variations for proper classification.

Some differences between employees and contractors include the following:

- Employees are entitled to statutory benefits, such as social security, paid time off, and health insurance, while contractors do not receive benefits from their clients.

- Employers withhold taxes from their employee’s salaries, while contractors pay and file their own taxes.

- Employees work under the direction and control of the employer, while contractors generally have more independence and autonomy over their work.

- Employees typically use company resources, training, and supplies, while contractors use their own tools and equipment.

- Employees typically work for one employer, while contractors may have multiple clients.

- Employees often receive long-term, role-specific training, while contractors are responsible for their career development.

Read more: Hire a Contractor vs. an Employee: Which Is Best For Your Business?

Familiarize yourself with local applicable laws

Classification laws differ between countries, states, and regions. If you're interested in market expansion and plan to hire and engage a distributed workforce across borders, you must understand these classification differences to avoid noncompliance risks.

For example, rules that dictate the classification of 1099 workers in the U.S. differ from rules that dictate IR35 misclassification in the U.K.

Draft compliant independent contractor agreements

Establishing a clear and comprehensive contractor agreement is critical to defining the terms of service and the nature of the contractor/client relationship.

The contractor agreement must also follow country-specific regulations, adhere to contractor tax requirements, and specify the contractor’s responsibilities, duties, and scope of work.

Avoid control over work

Avoid micromanaging or exerting too much control over contract labor to ensure the contractor maintains autonomy to determine how and when they complete their work.

For example, say a contractor feels their client has too much control over their work because the client tells them when and how to perform their duties. In that case, the contractor may claim they are an employee, are misclassified as an independent contractor, and are not receiving employment entitlements.

Regularly monitor the working relationship

Periodically review the relationship with the contractor to ensure that it aligns with the original contractor agreement. Update the contract if the working relationship changes.

Use self-check resources

Many countries provide guidelines to help employers avoid the risks of misclassifying independent contractors. For example, the Internal Revenue Service (IRS) outlines three categories for determining contractor classification in the U.S.:

- Behavioral. Does the employer control or have the right to control what the worker does and how the worker does their job?

- Financial. Does the payer control the business aspects of the worker’s job, such as determining how to pay the worker, providing equipment, or reimbursing work-related items?

- Type of relationship. Will the employer/worker relationship continue after the work is complete, and is the work performed a vital aspect of the business? Does the worker receive employee-type benefits, such as a pension plan, insurance, or vacation pay?

Consult legal counsel

Relying on local classification guidelines does not guarantee an employer’s safety from risks.

Consult a legal expert or global HR professional like an employer of record (EOR) for assistance with independent contractor compliance. A knowledgeable and experienced partner can help you navigate complex employment regulations, provide guidance on specific circumstances, and ensure compliance with local laws.

Perform regular compliance audits

Assess the classification of your workforce by performing regular compliance audits and classification reviews of all employees and contractors. Capture any changes in your workforce's job duties and update company policies and employment contracts to reflect evolving country regulations.

Convert contractors to full-time employees

To avoid the risks of misclassifying independent contractors, consider converting your contractors into full-time employees.

Converting contractors to employees provides the following benefits:

- Compliance with international classification laws

- Intellectual property protection

- Top talent attraction via competitive benefits packages and perks

- A stable workforce that helps you meet long-term business goals

- A compliant workforce that helps maximize valuation to potential investors

Learn more: How to Convert Contractors to Employees

Hire compliantly around the world with an EOR

While engaging a contingent workforce helps scale your business and test new markets in the short term, it puts you at risk of misclassifying independent contractors.

Prepare for long-term growth and avoid noncompliance by converting your global contractors to full-time employees with help from Velocity Global.

Our employer of record (EOR) solution helps you reduce your hiring risk in 185+ countries—no entity establishment required. We handle everything you need to quickly and legally convert your contractors to employees, from streamlining onboarding and administering payroll to offering competitive benefits packages and ensuring compliance with local regulations.

Contact us to learn more about our contractor conversion solution and how we help you ensure hiring compliance when building a globally distributed team.