Statutory benefits vary from country to country. Businesses looking to expand their global presence and build a distributed workforce must consider the mandatory employee benefits of each international market.

The following guide walks you through what statutory benefits are and the different types of mandatory benefits around the world.

Statutory benefits meaning

Statutory benefits are employee benefits required by law. Each country has its own set of requirements that employers must abide by. These legally mandated benefits often include medical insurance, pension, and time off.

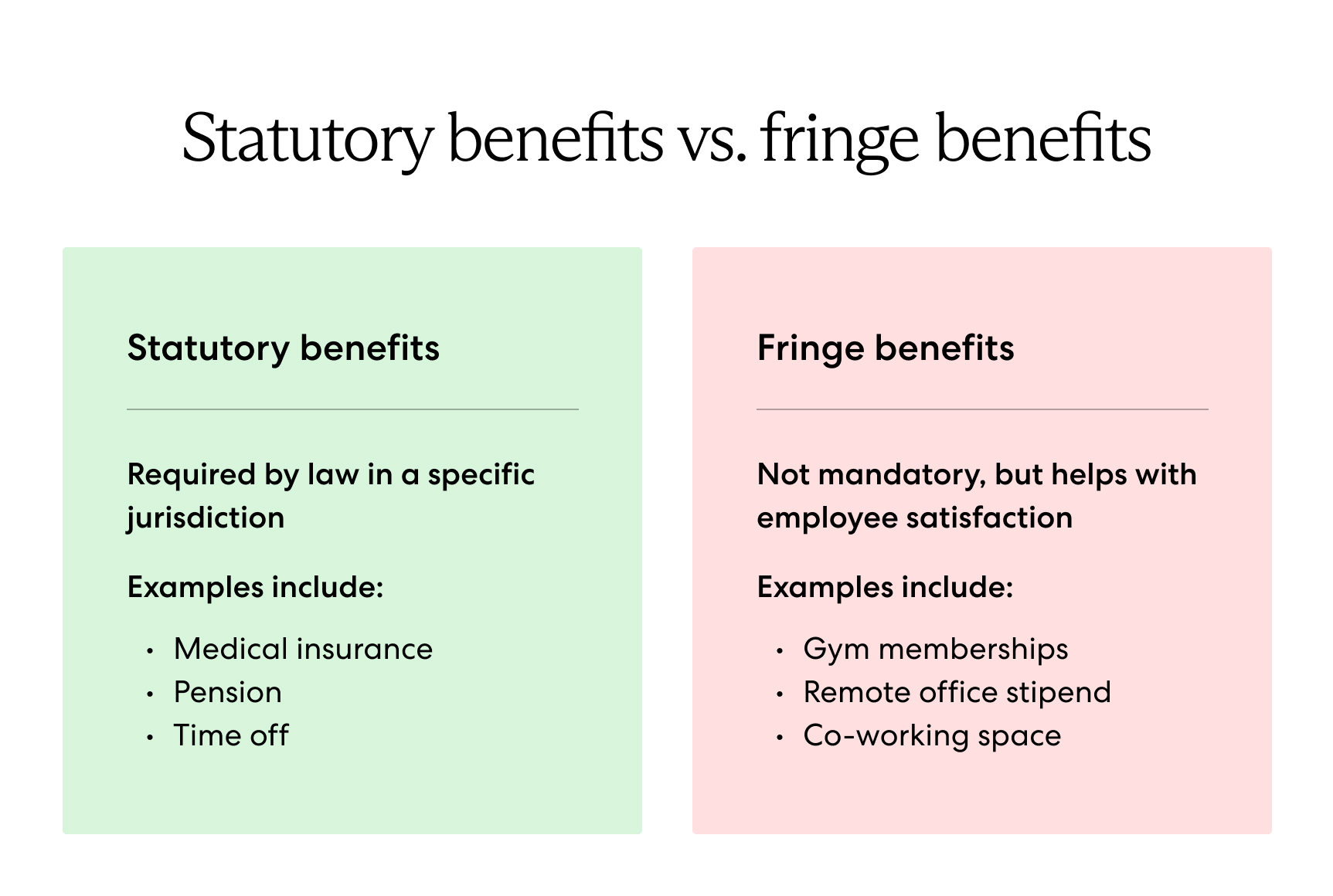

Other types of benefits include supplemental and fringe benefits. Employers are not required to provide these benefits, but they are often used to increase employee satisfaction. Supplemental benefits enhance or supplement a country's social or national healthcare system. A fringe benefit supplements an employee’s salary for costs related to their work or health and wellness expenses.

Learn more: What Are Supplemental Benefits? and What Are Fringe Benefits?

Here's a quick look at statutory benefits compared to fringe benefits.

Learn more about the different types of benefits in this Complete Guide on Global Employee Benefits.

Types of mandatory employee benefits around the world

While statutory benefits are different in each country, there are many similarities. Some examples of mandatory benefits worldwide include:

Health insurance

Health insurance is a form of indirect compensation that pays for health and medical expenses. Depending on the country and the insurance, health insurance covers some or all medical care costs. Health insurance can include medical, vision, dental, and other health services and support.

For example, statutory employee benefits in Germany include universal health insurance, which is provided by the country's national health system. The general contribution rate of 14.6% is shared equally between the employer and employee. Medical expenses related to injury, illness, maternity, paternity, disability, and death are covered, and the employee’s family can also benefit from the coverage.

Read also: The Differences Between Public vs. Private Healthcare

Leave entitlements

Leave entitlements allow employees to take time off work, including paid days off, unpaid, or partially paid time off. Types of leave benefits include vacation days, public holidays, maternity leave and paternity leave, and sick days.

In the U.K., employees receive 5.6 weeks of paid annual leave and eight public holidays each year. U.K. employees are also entitled to maternity, paternity, adoption, and shared parental leave and pay. Employees must take at least two weeks after birth, and eligible employees can be paid for up to 39 weeks and take up to 52 weeks of maternity leave.

Pension

A pension commits an employer to contribute regular payments to an employee’s retirement fund. The pension plan may also require contributions by the employee, which are deducted from their wages. A pension plan can either guarantee monthly payments for life or provide a lump sum payment to the employee after retiring.

For example, the Canada Pension Plan (CPP) retirement pension is a monthly, taxable benefit that replaces part of a Canadian worker’s income when they retire. Qualified employees receive a lifetime CPP retirement pension based on average earnings (a minimum earning of $3,500), contributions to the CPP (11.4% for 2022), and the age they decide to start CPP retirement pension (as early as age 60). The required 11.4% contribution is split equally between the employer and employee.

Learn more about employee benefits in Canada.

13th-month salary

13th-month salary, also known as 13th-month pay or 13th-month bonus, is additional compensation to an employee’s annual salary, typically paid at the end of the year. 13th-month pay is often only a customary benefit, but in some countries, it is required by law.

Calculation methods for 13th-month pay vary, such as:

- Dividing the total salary by 13 months

- Awarding a bonus based on the highest-paying month

- Averaging the bonus amount based on the employee’s most recent three-month salary

In the Philippines, employers must pay 13th-month salary. The compensation amount is equivalent to one month’s pay or 1/12th of the employee’s annual salary. Employers must provide the 13th-month payment by December 24 each year.

Workers’ compensation

Workers’ compensation is insurance that provides medical care and wage replacement benefits for employees who are injured or become ill as a direct result of their job. The employer pays workers’ compensation to help cover an employee's medical costs and lost wages resulting from their injury.

More than 136 countries participate in workers' compensation programs. In the United States, the Department of Labor provides workers’ compensation to injured federal workers and their dependents, including wage replacement benefits, medical treatment, and vocational rehabilitation.

Disability and death insurance

Disability insurance provides partial income to employees who are too sick or injured to work. A disability could be due to an injury from an accident, pregnancy, mental health, or long-term illness. Employees qualifying for disability insurance must be unable to work in their current condition.

Death insurance, also called life insurance, is a sum of money that an employee’s beneficiary receives when the employee passes away. In exchange for regular payments, the insurance company pays a death benefit to the beneficiaries of the deceased.

Accidental Death and Dismemberment (AD&D) is insurance for accidental death or a severe injury from an accident, such as loss of a limb, paralysis, or blindness. AD&D insurance pays benefits to the beneficiary if the cause of death is an accident. AD&D is typically less expensive than traditional life insurance. In some cases, employers add AD&D to supplement existing life insurance policies.

In Australia, employees receive superannuation contributions from their employer on top of their salary and wages. The superannuation fund (super) is typically available after retirement, but some payments can be provided early, as with disability. Circumstances for early payments include:

- A terminal medical condition

- Temporary incapacity because of a physical or mental medical condition

- Permanent incapacity to perform required work.

Death benefits are also provided through Australia's super if the type of fund allows it. When eligible, nominated beneficiaries of the deceased employee receive a death benefit income stream.

Housing fund

In some countries, employers and employees make statutory contributions to a housing fund. Typically, this provides access to a government loan for a home’s purchase, construction, repair, remodeling, or improvement.

In Mexico, the National Housing Fund Institute (INFONAVIT) is a government housing assistance agency that grants housing loans to workers in Mexico. Employers must contribute 5% of each employee’s daily wage.

Gratuities

Gratuity is a type of retirement benefit that employees receive from their employer after leaving the job. Typically, salaried employees are entitled to the gratuity payment after completing a certain period of employment with their employer. Employees receive the amount once they retire, resign, or are laid off. In the case of an employee’s death, the employee’s beneficiary or heir receives the allotted gratuity.

In India, under the Payment of Gratuity Act, employers pay employees gratuity after leaving a job if they have completed a minimum of five years of full-time service with an employer. The gratuity amount is equivalent to 15 days of the employee’s salary per year worked.

Stay compliant: The risks of legally mandated benefits

Navigating statutory benefits in various countries is overwhelming and confusing. Additionally, staying up-to-date with the latest statutory benefits is challenging as international markets continuously change their rates, contributions, and requirements.

However, staying compliant with the benefits regulations of a new market is critical to expanding your workforce. Neglecting to provide statutory benefits for your employees can result in fines, penalties, imprisonment, and potential legal action from the affected employees. Make sure you understand the risks of a foreign market and take the necessary steps to ensure compliance with local statutory regulations.

Statutory benefits, simplified.

Ensuring compliance with statutory benefits in a foreign market doesn’t have to be complicated. Working with an experienced partner helps you support your distributed workforce and manage unfamiliar benefit requirements.

As your global employer of record (EOR), Velocity Global makes understanding foreign statutory benefits easy. Our team of experts is well-versed in the local requirements of over 185 countries. Our Global Benefits solution ensures accurate calculations and offers your workforce competitive benefits packages tailored to their specific country.

Contact us to learn how our benefits solution helps you stay on top of statutory and supplemental benefits around the world.