Engaging skilled independent contractors for specialized work offers global companies many benefits—from time and cost savings to increased efficiency and the ability to quickly test new markets.

However, hiring independent contractors also means taking on misclassification risks and facing potential operational consequences. The following guide reviews the pros and cons of independent contractors and how to avoid the associated risks when hiring them.

What is an independent contractor?

A domestic or global independent contractor, also often called a contract employee, is a self-employed individual who provides goods, labor, or services to a business or organization. An independent contractor is not an employee; a company hires contractors to perform temporary work or projects.

Companies often engage independent contractors when they require talent with specialized skills, need someone to complete a short-term project or work independently, or want to save costs associated with hiring full-time employees.

How do independent contractors differ from employees?

There are key differences between independent contractors and employees that employers and HR teams should know. We detail some of these differences below.

An independent contractor:

- Works for one or more clients

- Determines how, where, and when to perform their work

- Receives pay according to a contract agreement with each client

- Does not receive benefits from their clients

- Pays and files their taxes

- Uses their own work equipment

- Is responsible for their career development and training

- Has a temporary relationship with their clients that ends when work is complete

An employee:

- Works for one employer

- Follows the employer's rules for how and when to perform the work

- Receives an hourly or salary wage

- Is entitled to statutory benefits from their employer

- Relies on the employer to withhold and file taxes

- Uses company-owned work equipment

- Receives career development opportunities that help them grow professionally

- Invests in a continuing relationship with their employer

Wondering if your contractors are correctly classified? Check out our free contractor risk assessment checklist:

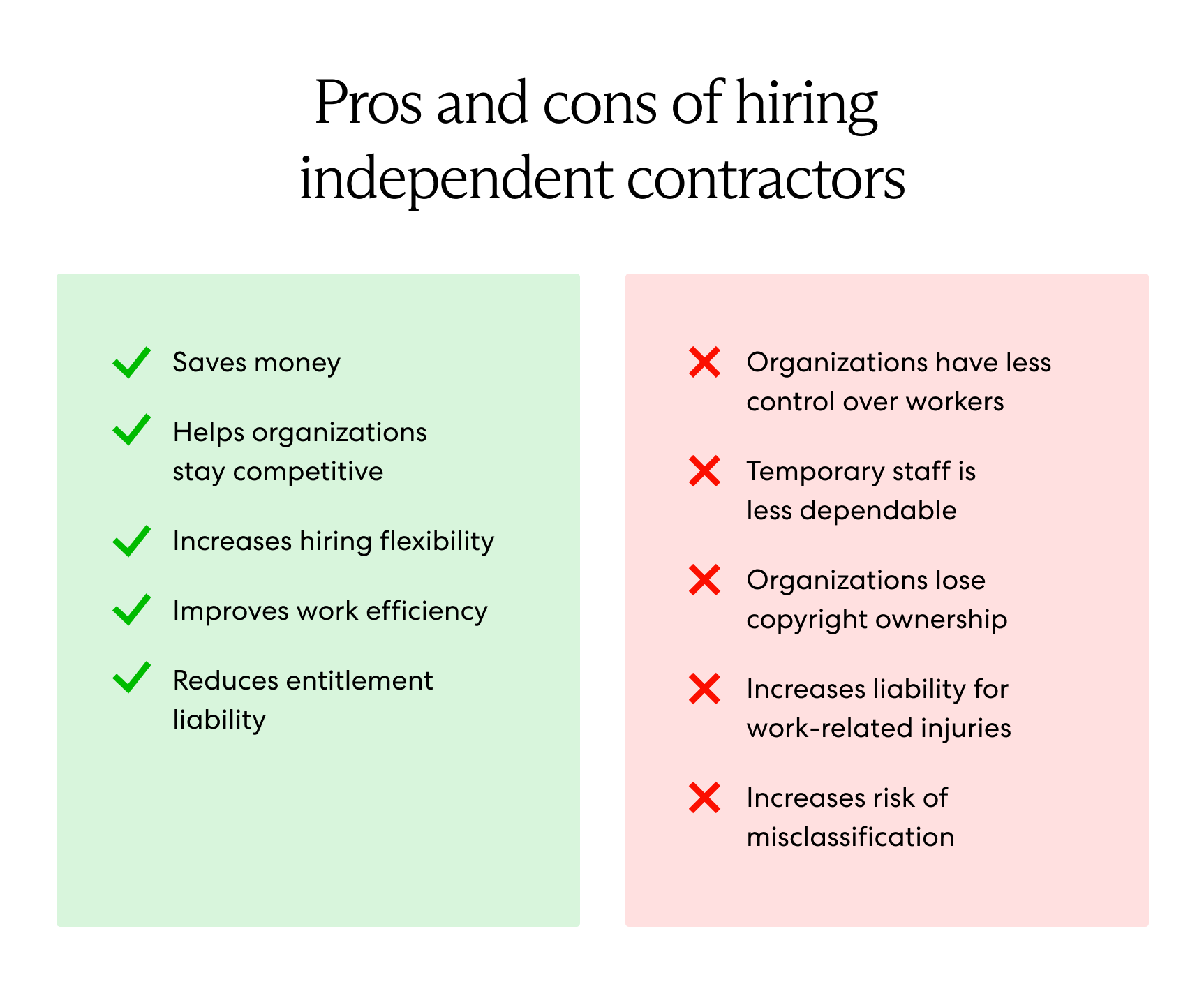

Pros and cons of hiring independent contractors

The following are some advantages and disadvantages of hiring independent contractors.

Pros of hiring independent contractors

Saves businesses money

Employers pay several expenses for full-time employees, such as salaries and bonuses, payroll taxes, statutory and supplemental benefits, work equipment, training, and paid time off.

On the other hand, contractors are responsible for their own taxes, benefits, work equipment, time off, and training. They also receive payment according to their contract agreement, which is typically less than an employee’s salary since they don’t work full-time hours.

As a result, businesses can save 20-30% by hiring independent contractors over full-time employees.

Helps businesses stay competitive

Working with remote independent contractors helps companies stay competitive globally and quickly broaden their talent pool without entity establishment. By engaging international contractors, organizations can find the right talent for the job, regardless of location.

Because companies don’t need a foreign entity to hire an international contractor, it’s often easier to engage contractors than full-time employees in other countries. As a result, companies can test new markets quickly while investing the money they would use for entity establishment into other areas of their business.

Increases flexibility

Contract labor gives employers more flexibility to meet their short-term needs. Employers engage independent contractors for specific projects and offboard them when the work is complete. Contractors can also be quickly re-engaged if they’re available.

Once the independent contractor’s project or term is complete, the commitment between the contractor and company ends. The employer does not have to take additional legal steps when terminating a contractor as they typically do when terminating an employee, such as providing notice periods, severance, or unemployment payments.

This onboarding and offboarding flexibility is especially valuable in foreign markets, as many countries have complex legal requirements for terminating employees.

Improves efficiency

Employers engaging independent contractors seek specific skills to address their unique business needs. Independent contractors already bring specialized skills and experience to a project without the need for additional training. As a result, the onboarding process is fairly simple and quick, and it requires less administrative time and effort.

Additionally, independent contractors can jump into a project immediately and typically complete the work faster because they have one targeted focus, unlike employees who may have a broader range of tasks, roles, and responsibilities to fulfill.

Reduces entitlement liability

Employers must provide statutory benefits to employees, including annual leave, overtime pay, workers’ compensation, protection from employment discrimination or wrongful termination, and more. Companies that fail to offer the required benefits face legal and financial penalties.

On the other hand, employers do not owe correctly classified contractors the same entitlements as full-time employees. Instead, contractors are responsible for their own benefits, which eliminates potential legal and financial penalties employers may face if they don’t offer employees statutory benefits according to local and national employment law.

Cons of hiring independent contractors

Despite the advantages, engaging independent contractors also presents the following challenges:

Companies have less control over contractors

Independent contractors have more work autonomy than employees and can decide how best to accomplish tasks, with what tools, and in what timeframe. An employer risks misclassification if they interfere too much in their independent contractor’s work.

Also, because an independent contractor’s work is temporary and they may also work with more than one client, they might not have the same passion and investment in the company’s long-term goals that an employee might demonstrate.

Employers who want significant oversight and control of their talent’s work schedule or methods must correctly classify them as employees.

Contractors come and go

Most employers use independent contractors as needed for specific or short-term projects. Once the project is complete, independent contractors take on additional assignments or move on to work with other clients. This constant coming and going of independent contractors can be inconvenient or disruptive to a company’s workflow and culture.

Independent contractors also bring levels of uncertainty and inconsistent availability because they work for multiple clients and may not be available for the company’s next project.

Companies that want to invest in the same talent for ongoing projects would benefit from hiring employees instead of contractors.

Increases liability for work-related injuries

In most countries, employers must provide workers’ compensation insurance for employees who become injured on the job. Under workers’ compensation insurance, employees typically waive their right to sue their employers in exchange for the benefits they receive for their injuries.

However, most employer workforce compensation does not cover independent contractors, and contractors do not usually purchase their own workers’ compensation insurance. As a result, contractors can sue their clients for damages related to injuries suffered on the job.

Loss of copyright ownership

Employers typically own the copyright for any intellectual property their employees create, which ensures sensitive information stays safe and doesn’t get into competitors’ hands.

Conversely, because contractors are not employed by their client’s company and act as their own company, they own the copyright for the intellectual property they create on the job.

The employer is only considered the owner of any work their contractors complete if the contractor agreement explicitly indicates a copyright ownership transfer.

Risk of worker misclassification

Hiring independent contractors comes with severe misclassification risks. Contractor classification laws vary tremendously from country to country, so companies must follow the rules of the country where the work is performed or risk fines and reputational damage.

Independent contractor misclassification is the illegal practice of categorizing an employee as a contractor, which denies them their entitlement to benefits and other legal protections. If an employer intentionally or unintentionally misclassifies their talent, they face risks and financial liabilities, including:

- Unpaid taxes. Employers must pay back national, state, and local taxes.

- Back benefits. Employers are liable for statutory benefits owed to the employee, such as medical insurance, annual leave, and sick pay.

- Legal fines. Employers may incur costs from class action lawsuits, attorney fees, and liquidated damages.

- Reputational damage. Employers risk negative standing among industry peers and prospective talent.

Employers must do their due diligence to understand the employment and contractor regulations worldwide when engaging with independent contractors. Seeking in-country expertise helps ensure compliance with local country regulations.

Read more in our complete guide to employee misclassification.

Mitigate misclassification risk with an employer of record

Engaging contractors is a flexible and cost-effective solution for testing new international markets and meeting immediate needs. However, companies seeking to invest in long-term goals while avoiding misclassification risks would benefit from engaging employees instead.

Still, keeping up with evolving employment laws around the world requires time and expertise that your HR team might not have. That’s where an employer of record (EOR) can help.

An EOR correctly classifies your workforce

An EOR partner provides in-country insight and works on your behalf to hire international talent, create compliant employment contracts, correctly classify your workforce, and ensure full compliance with evolving labor laws.

An EOR converts contractors to employees

If you already have a contingent workforce, the right EOR can help you quickly convert your contractors into full-time employees. An EOR onboards your talent as employees on your behalf using their global network of entities, speeding up and simplifying the conversion process.

An EOR also handles HR responsibilities such as payroll, benefits planning and administration, and ongoing support—all while you maintain day-to-day control of your team.

Avoid the risks of engaging contractors and work with an EOR to seamlessly and compliantly hire full-time talent around the globe or convert existing contractors into employees.

Learn more: What Is an Employer of Record (EOR)?

Start building your compliant global workforce

Contact Velocity Global to learn how we help you hire top candidates across borders, draft compliant employment contracts, and quickly expand your business into new markets while lowering your risk in more than 185 countries.

Topic:

Contractors