Malaysia sits at the heart of the Asia-Pacific Rim and is a key member of the ten-nation ASEAN Free Trade Area. Whether you seek affordable, highly skilled talent or want to tap into lucrative regional trade opportunities, Malaysia is a valuable resource for any business.

Still, hiring in Malaysia involves unique hurdles, from navigating complex labor codes to clarifying your corporate tax liability. Global companies must ensure compliance with local legislation to avoid fines, damaged business reputation, and even imprisonment when hiring in this market.

This guide covers everything you need to know about hiring employees in Malaysia, from ensuring regulatory compliance to managing a global workforce. Plus, discover how to engage talent in Malaysia without setting up a legal entity.

Can a foreign company hire employees in Malaysia?

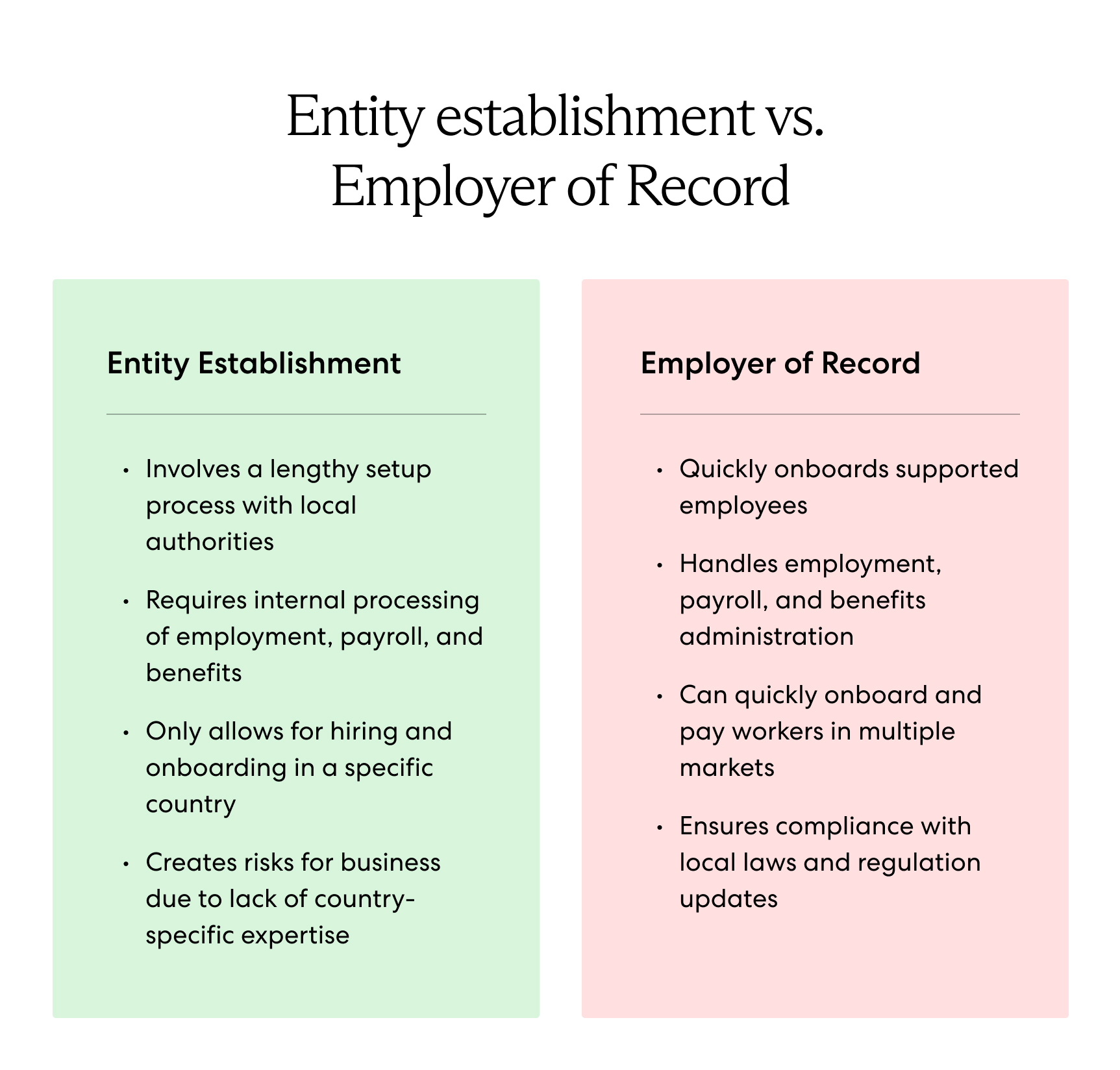

Yes, foreign companies can hire employees in Malaysia. Global companies have two main options for hiring Malaysian employees: establishing a legal entity or partnering with an employer of record (EOR). The best option for any business depends on its unique circumstances, including its budget and expansion goals.

How do I employ someone in Malaysia?

Global companies can employ Malaysian talent in one of two ways: setting up a legal business entity in the country or partnering with an international expansion expert, such as an employer of record (EOR). A third option is to hire Malaysian contractors.

Entity establishment is ideal for companies that foresee a long-term presence in the Malaysian market and can make sizable upfront investments. However, partnering with an EOR or hiring contractors offers greater flexibility.

We discuss each option in detail below, including their advantages and disadvantages.

1. Set up a legal entity

Setting up a legal business entity is the traditional approach to hiring employees in Malaysia.

The most common corporate structure among foreign investors is the private limited company (SDN BHD), a separate legal entity that allows 100% foreign ownership. However, global companies can choose from various other incorporated and unincorporated structures, including the public limited company (BHD), unlimited company (SDN), and limited liability partnership (LLS).

With a legal entity, you can directly hire local talent and handle the entire employment process internally, from hiring and onboarding to running local payroll. While this reduces long-term hiring costs, it also leaves you fully responsible for ensuring compliance, requiring extensive in-country knowledge of local labor and tax codes.

Plus, entity establishment is costly and time-consuming. Upfront costs for incorporation, licensing, banking, and other formalities in Malaysia can reach up to MYR 70,000 (US$14,857), while annual fees can exceed MYR 500,000 (US$106,000), including filings, compliance, and professional services.

Unless you plan to hire a large Malaysian team and can make long-term investments in the Malaysian market, entity establishment is usually more trouble than it’s worth. Companies that want to test the waters of the Malaysian market and remain agile as they expand should consider partnering with an EOR instead.

2. Use an employer of record in Malaysia

Partnering with an employer of record (EOR) is the most straightforward option for quickly and compliantly hiring employees in Malaysia. This approach allows you to build a cohesive, committed team of full-time employees while remaining flexible and on budget as you expand.

An EOR is a third-party legal entity with global infrastructure and international legal expertise that simplifies hiring and expanding across borders. By serving as the legal employer of your global workforce, an EOR partner allows you to jump-start operations overseas without waiting months to undergo lengthy incorporation procedures.

Plus, an EOR acts as your global HR team, handling everything from hiring, onboarding, compliance, and immigration to running global payroll, administering global benefits, and offering ongoing HR support to your team in their native language on your behalf.

With market-specific expertise, a Malaysian EOR can simplify market entry and accelerate growth. For instance, they can craft locally tailored benefits packages to make your company an attractive landing spot for top Malaysian talent.

By partnering with an EOR in Malaysia, you can unlock the benefits of global expansion without increasing your workload or risk exposure.

Learn more: What Is an Employer of Record (EOR)?

3. Engage contractors in Malaysia

An alternative to hiring full-time employees in Malaysia is to engage local contractors. Many foreign employers choose this route because it offers lower commitments and added flexibility.

By hiring contractors, global companies can source highly skilled talent for short-term, one-off projects while forgoing the costs of hiring, paying, and supporting a team of full-time employees.

However, setting up work contracts and classifying contractors without professional guidance exposes you to misclassification risk. While misclassification is relatively straightforward, worker designation laws in Malaysia are complex and leave ample room for interpretation, creating a major risk for foreign employers unfamiliar with the local law.

Whether a business intentionally or accidentally misclassifies talent, the penalties include fines of up to MYR 20,000 (US$4,244) and even six months imprisonment.

We discuss misclassification risk in greater detail later on.

Read more: Should You Hire a Contractor or Employee?

Employment laws to know before you hire in Malaysia

Familiarizing yourself with local employment regulations in Malaysia ensures your employees receive the rights and protections they are entitled to and helps your company avoid noncompliance penalties.

Businesses hiring employees in Malaysia must meet the basic provisions of the Employment Act of 1955, which covers work agreement terms, statutory leave entitlements, standard working hours, mandatory notice periods, severance pay, and other protections.

Below, we outline the employment regulations that all businesses operating in this market should know:

- Work agreements. Employees must formalize any employment arrangement that lasts longer than one month with a written contract. Contracts must specify key terms, such as job duties, workplace location, benefits, and wages.

- Leave entitlements. Annual leave ranges from eight to 16 days, while paid sick leave ranges from 14 to 22 days, depending on the employee’s length of service. Employees also receive 11 paid public holidays, 98 days of paid maternity leave, and seven days of paid paternity leave.

- Minimum wage. The minimum wage in Malaysia is MYR 1,500 (US$318) per month.

- Working hours. A standard workweek is up to 45 hours maximum but usually consists of five eight-hour workdays.

- Overtime. Any work over eight hours per day or 45 hours per week is overtime, for which employees receive 150% of their regular wages. Employees can work up to four overtime hours per day or 104 overtime hours per month.

- Probation. There is no statutory limit for probationary periods, although three to six months is common practice.

- Termination. Employers and employees must provide termination notices. The minimum notice period ranges from four to eight weeks, depending on the employee’s length of service.

- Severance. Except in cases of gross misconduct, employees are entitled to severance pay. The amount ranges from 10 to 20 days’ wages for each service year, depending on the employee’s total length of service.

Compliance risks to know before you hire in Malaysia

Some aspects of Malaysian employment law present greater compliance risks than others. For instance, foreign employers must perform extra due diligence when navigating worker classifications, payroll contributions, corporate tax policies, and immigration.

We discuss each of these in detail below.

Misclassification

Companies that hire Malaysian contractors instead of full-time employees must be aware of their misclassification risk. Misclassification occurs when an employer designates a contractor as an employee while establishing an employment relationship with them.

While some companies intentionally misclassify contractors for cost savings, many businesses find themselves non-compliant by accident. As previously mentioned, misclassification penalties in Malaysia are relatively serious, including fines of up to MYR 20,000 (US$4,244) and even imprisonment.

The primary difference between an employee and an independent contractor in Malaysia is that a contractor maintains greater financial and managerial independence from their employer. Still, determining whether or not your working relationship is compliant can be difficult.

Malaysian employment law does not provide a fixed formula for determining a worker’s correct classification. In case of litigation, the Industrial Court hears each dispute individually, considering all of the relevant facts and circumstances, including the following:

- The degree of control the client has over what, when, and how the contractor works

- The contractor’s degree of integration with the client’s organization

- The contractor’s risk exposure when undertaking a project

- Whether the contract terms reflect those of an employment relationship

Due to such ambiguity, many employers hiring in Malaysia rely on a third-party legal expert, such as an EOR, to ensure compliance.

Read more in our complete guide to employee misclassification.

Incorrect payroll contributions

Making timely, accurate payroll contributions is critical for avoiding financial penalties and operational delays as you build a global workforce. It also helps maintain employee satisfaction and reduces turnover.

To run compliant payroll in Malaysia, global employers must familiarize themselves with the country’s statutory public insurance programs, clarify employer and employee contribution rates, and confirm their employees’ income tax brackets.

Payroll taxes in Malaysia comprise the Social Security Organization (SOCSO), the Employees’ Provident Fund (EPF), and the Employee Insurance System (EIS), plus income taxes.

We outline each program in detail below.

Social Security Organization (SOCSO)

SOCSO consists of two funds: the Employment Injury Scheme and the Invalidity Scheme. These funds provide income support and cover medical costs for employees who can’t work due to workplace accidents and non-work-related chronic illnesses and injuries.

Employees under 60 pay 0.5% of their gross monthly earnings, while employers contribute 1.75% on their behalf. Once employees reach 60, they stop paying into SOCSO, and the employer contribution rate drops to 1.25%. Noncompliance penalties include fines of up to MYR 10,000 (US$2,122) and two years of imprisonment.

Employees Provident Fund (EPF)

The EPF is Malaysia’s public retirement fund. Contribution rates range from 4% to 13% for employers and 0% to 11% for employees, depending on the employee’s age, resident status, and income level.

Non-permanent residents may choose to contribute to the EPF, but it’s not required.

Employee Insurance Scheme (EIS)

The EIS offers income support and job placement assistance to people who are unemployed due to circumstances beyond their control. Employers and employees each contribute 0.2% of the employee’s gross monthly earnings to EIS.

Human Resources Development Fund (HRDF)

All employers with 10 or more Malaysian employees must contribute 1% of gross employee earnings to the Human Resources and Development Fund (HRDF).

HRDF supports vocational training and employee upgrading opportunities to help businesses and their teams remain competitive and adaptable.

Income tax

Malaysia uses a progressive income tax system based on the following brackets:

| Income bracket (MYR) | Tax on earnings up to the minimum threshold (MYR) | Tax on excess (%) |

|---|---|---|

| 0 to 5,000 | 0 | 0 |

| 5,001 to 20,000 | 0 | 1 |

| 20,001 to 35,000 | 150 | 3 |

| 35,001 to 50,000 | 600 | 6 |

| 50,001 to 70,000 | 1,500 | 11 |

| 70,001 to 100,000 | 3,700 | 19 |

| 100,001 to 400,000 | 9,400 | 25 |

| 400,001 to 600,000 | 84,400 | 26 |

| 600,001 to 2,000,000 | 136,400 | 28 |

| 2,000,001 | 528,400 | 30 |

The rate (%) applies to remaining earnings after the tax on the minimum threshold.

For instance, imagine an IT technician earns a monthly salary of MYR 40,000 (US$8,483). They would pay MYR 600 (US$127) on the first MYR 35,000 (US$7,422) of their monthly salary, plus 6% on the remaining MYR 5,000 (US$1,060) for a total of MYR 900 (US$191) in monthly income tax.

Foreigners working in Malaysia pay flat income tax rates ranging from 10% to 30% depending on their industry and length of stay in the country.

Learn more: Complete Guide to Payroll Tax + How to Calculate

Permanent establishment

Clarifying your corporate tax obligations abroad is critical for avoiding hefty noncompliance penalties while managing a global team.

In most countries, if a foreign entity conducts ongoing business operations from a fixed place of business within the country, this triggers permanent establishment (PE) status and subjects the company to local corporate taxation.

However, what constitutes a ‘fixed place of business’ varies worldwide. In many jurisdictions, it even includes local agents doing business on behalf of a foreign organization.

According to domestic law, an entity operating in Malaysia has PE status if it satisfies any of the following conditions:

- The company wholly or partly carries out business operations from a physical location, such as a factory, farm, mine, distribution center, or place of natural resource extraction.

- A local agent regularly exercises the authority to conclude contracts in Malaysia on behalf of the company.

- A local agent maintains a stock of goods in Malaysia and regularly fulfills orders on the company’s behalf.

- The company carries out ongoing supervisory activities in Malaysia relating to a construction, installation, or assembly project.

Engaging Malaysian talent in any capacity, including hiring contractors, can trigger PE status and subject your company to local corporate taxation.

Keep in mind, that the conditions determining a fixed place of business in Malaysia vary slightly between Double Taxation Avoidance Agreements (DATs). If your home country has a DTA with Malaysia, clarify the specific conditions in that agreement. If there is no DTA, the domestic law applies.

Many companies operating in this market partner with a third-party legal entity to clarify their corporate tax obligations on their behalf.

Read more: Permanent Establishment Checklist for Global Companies

Immigration requirements

Most employees you hire in Malaysia will be local citizens or residents who can legally reside and work in the country.

However, the world of work has become more globalized, and talent has become mobile. Many countries, including Malaysia, are home to an increasing number of foreign nationals looking to gain new experiences through relocation. At some point, you may need to hire a foreign national in Malaysia.

For example, you may want to relocate a domestic employee to Malaysia as a part of your company’s global mobility offering. Regardless of the situation, you’ll need to navigate Malaysian immigration procedures to secure the necessary work visas and residence permits.

The three most common work visas in Malaysia include the following:

- Employment pass. This visa is for highly skilled individuals in technical or managerial positions in Malaysian firms. The visa is valid for up to five years and is renewable.

- Temporary employment pass. This is a limited, two-year employment visa for individuals in the agriculture, manufacturing, construction, plantation, and service industries and foreign domestic helpers from approved countries.

- Professional visit pass. This visa is for foreign nationals who provide services or undergo training with a Malaysian business on behalf of an overseas company for up to 12 months.

Remember, immigration procedures can be costly and time-consuming, often leading to operational delays and employee churn.

Enlisting an HR team with the experience and resources needed to swiftly navigate immigration, acquire necessary authorizations, and ensure ongoing compliance is critical for building a strong, motivated international team as you expand.

If navigating immigration on your own seems overwhelming, consider partnering with a global immigration expert, such as an EOR, to ensure compliance on your behalf.

FAQ about how to hire employees in Malaysia

Below, you can find answers to commonly asked questions about hiring employees in Malaysia.

What is the procedure to hire workers in Malaysia?

Global companies that want to hire workers in Malaysia must complete the following steps:

- Establish a local business entity or partner with an employer of record (EOR)

- Draft compliant work contracts

- Register employees with SOCSO, EPF, and EIS

- Add talent to the company payroll

- Ensure accurate withholdings and contributions with each payroll cycle

How to hire expats in Malaysia?

Businesses must complete the following steps to compliantly hire expats in Malaysia:

- Check if you operate in a qualifying industry. Only companies in the agriculture, manufacturing, construction, plantation, service, and mining sectors can hire foreign nationals.

- Conduct a labor market test. Advertise the vacancy to local citizens for at least 14 days.

- Obtain approval from the Malaysian Director General of Labor (DGL). Apply for permission to hire a foreign national via the DGL’s online portal.

- Obtain a quota from the One Stop Centre (OSC). Apply for a foreign worker quota through the OSC portal.

- Register with the Expatriate Service Division (ESD). Create an account and register your organization on the ESD online portal.

- Obtain Immigration Security Clearance (ISC). The employee must undergo a biometric security check at an ISC center in their home country and obtain a certified PASS result.

- Obtain an employee health report. The employee must obtain a health checkup from a medical center in their home country.

- Apply for a work pass. Choose the appropriate employee work pass and apply via the MYXpats CENTRE online portal.

- Endorse your employee’s passport. Submit your employee’s passport for endorsement at the MYXpats CENTRE within 30 days of their arrival in Malaysia.

- Onboard your employee. Sign your work agreement, introduce the employee to company procedures, register them with SOCSO, and add them to the company payroll.

Compliantly hire employees in Malaysia with Velocity Global

Malaysia is a hotspot for top talent and an ideal entry point into Southeast Asia. Don’t let complex labor and tax regulations stop you from building your dream team in this lucrative market. Partner with Velocity Global to eliminate risk and streamline your expansion.

Velocity Global’s EOR solution makes it easy for global companies to hire talent in over 185 countries, including Malaysia, without establishing legal entities or worrying about non-compliance.

With local infrastructure and a team of international legal experts, we can offer comprehensive legal and HR support as you build a Malaysian workforce. This includes hiring, onboarding, immigration, compliance, running global payroll, administering global benefits, and providing ongoing support for your local team on your behalf.

Let us handle the heavy lifting of hiring employees in Malaysia while you focus on sourcing top talent and expanding your footprint without the added burden. Contact Velocity Global today to get started.

Topic:

Country Guides