In 2021, the Kingdom of Saudi Arabia (KSA) made sweeping labor reforms to empower employers and employees.

While these reforms made strides in turning Saudi Arabia into an attractive place to work for Saudi nationals and expats alike, they can be confusing for foreign businesses operating in the country or digital nomads looking to work there.

Read on for a breakdown of the latest reforms, employment regulations, and termination procedures in KSA labor law.

Recent labor law reform

Saudi Arabia’s labor reforms focused on employee mobility. Resolution No. 51848/1442, which went into effect in March 2021, made it easier for employees to search for, change, and leave their jobs.

Before the reforms, foreigners working in Saudi Arabia needed their employer’s permission to change jobs and complete other administrative tasks, such as opening a local bank account.

Under Resolution No. 51848/1442, employees can now:

- Leave their job without their employer’s consent when the contract ends

- Leave their job before the contract expires if they have been in the country for a year and give their employer 90 days' notice

- Change their job within their first year of employment under certain conditions

- Use an electronic portal to see job offers, submit notifications, and input transfer requests

Previously, foreign employees living and working in Saudi Arabia on an Iqama visa and work permit also couldn’t exit the country without permission from their employer. Now, they can access the Saudi government’s online portal to make their exit/re-entry request.

Foreign employees also no longer need permission to exit the country permanently and emigrate back to their home country.

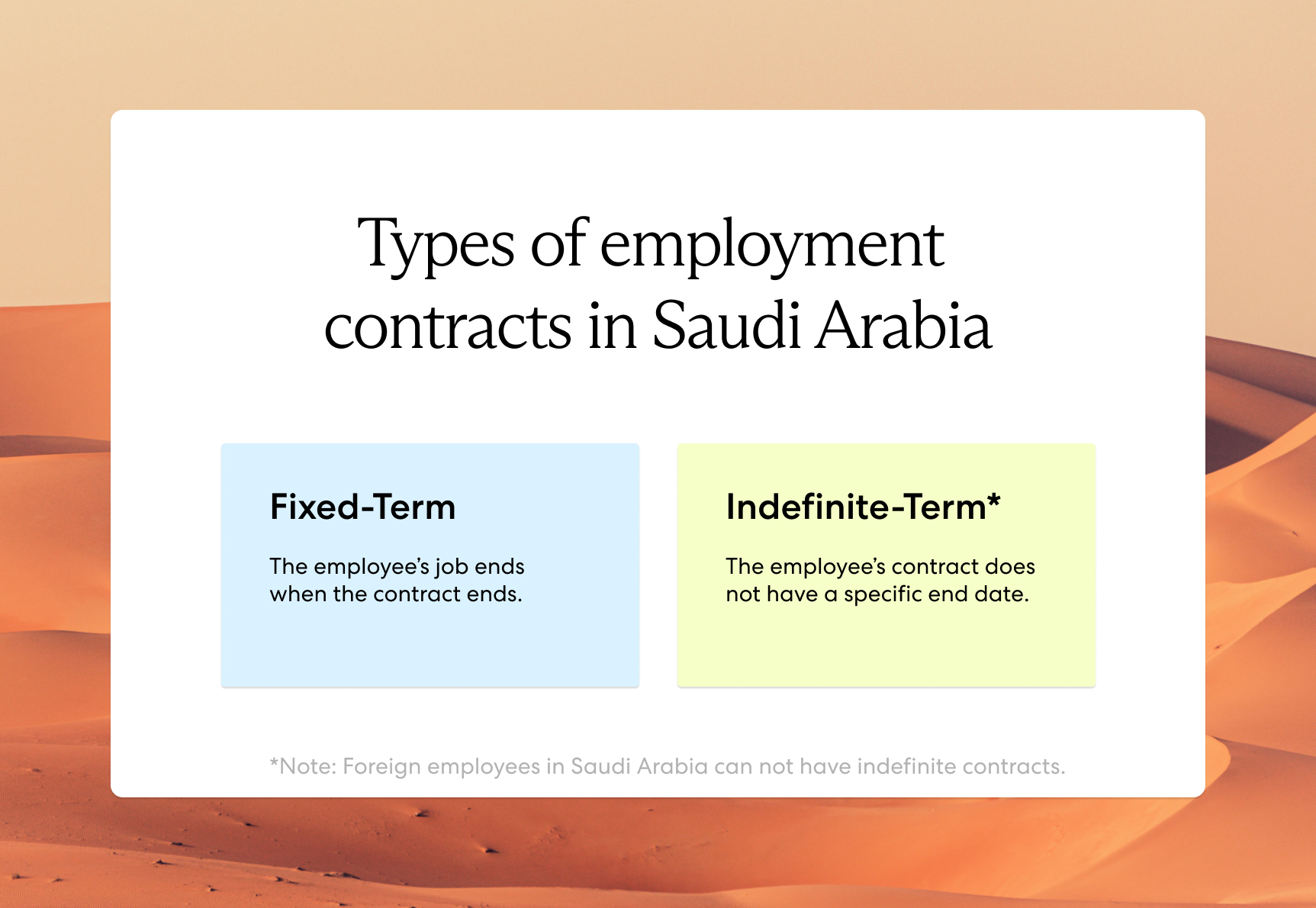

Types of employment contracts in Saudi Arabia

Employees in Saudi Arabia can have either fixed-term contracts or indefinite contracts. Fixed-term contracts end at a specific date unless renewed, while indefinite contracts have no end date.

Technically, foreign employees in Saudi Arabia can only work under fixed-term contracts. If an employer and a foreign national agree to an indefinite contract, KSA labor law treats it as a fixed-term agreement that ends when the foreign national’s work permit expires.

At the end of a fixed-term contract, employees have the freedom to choose one of the following:

- Renew their contract

- Not renew their contract

- Convert the contract to indefinite (Saudi nationals only)

If the employer chooses not to renew the contract, they must provide appropriate notice according to the work contract or give 60 days’ notice if the contract doesn’t specify a notice period.

How to terminate employees in Saudi Arabia

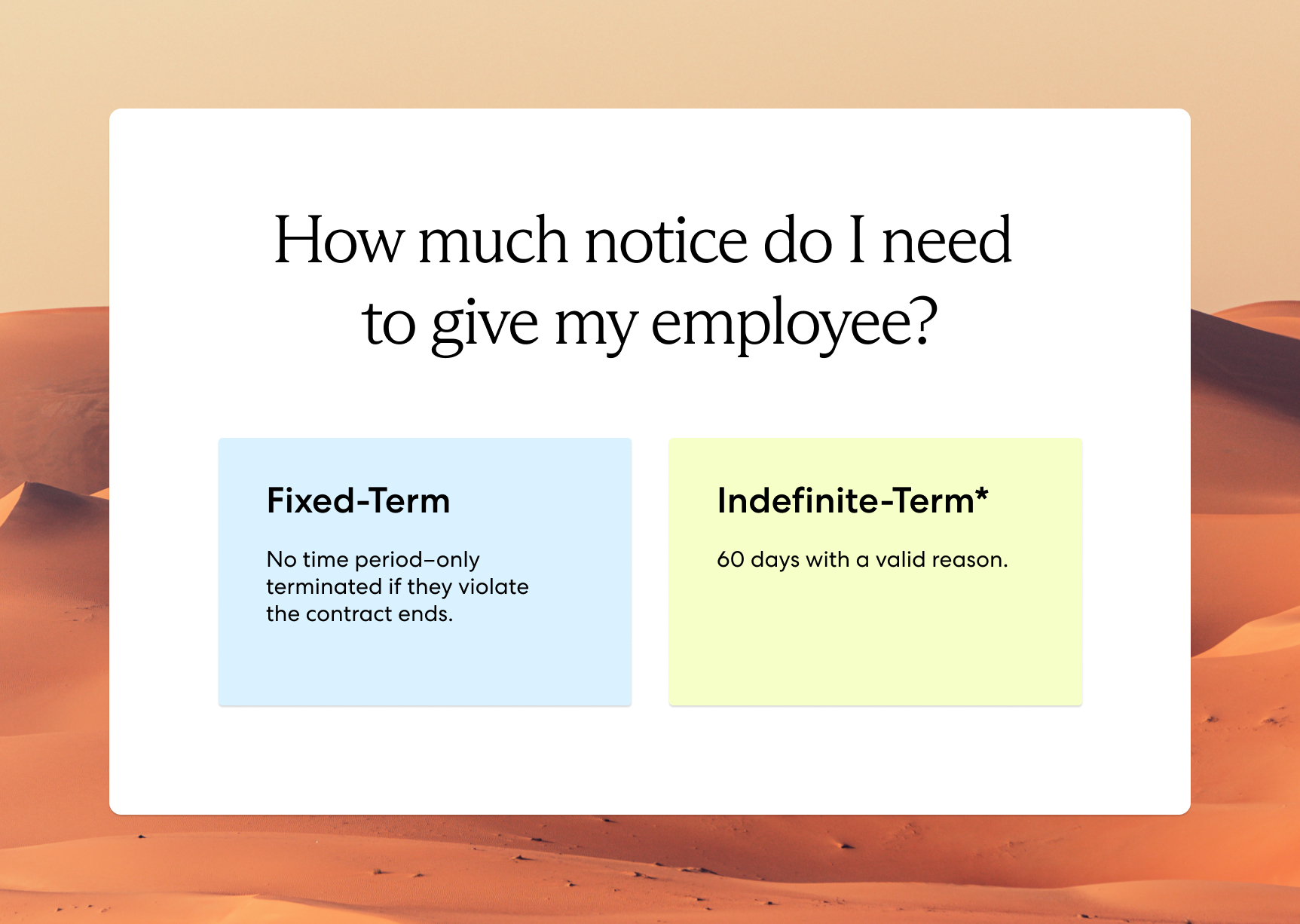

Employers in Saudi Arabia can terminate employees on indefinite contracts only if they have just cause, such as employee misconduct. The notice period in Saudi Arabia is 60 days for employees who receive monthly salaries and 30 days otherwise. Still, work contracts may stipulate a longer notice period, and employers may offer pay in lieu of notice.

Similarly, employers can terminate fixed-term contracts in Saudi Arabia with just cause. However, the assumption is that employers won’t renew a fixed-term contract after its end date as a form of termination. According to KSA labor law, both parties must agree on the notice period in the contract. If the work contract doesn’t specify the notice period, it is 60 days.

What are the penalties for improper termination?

The penalty for breaking an employment contract in Saudi Arabia depends on the employment contract terms. Article 77 of the KSA labor law applies if the contract doesn't specify the penalties.

Under Article 77, if one party terminates an employment contract, the harmed party is entitled to compensation as follows:

- Indefinite term contracts: Fifteen days’ wages for each year of the worker’s employment, or two months’ wages, whichever is greater.

- Fixed-term contracts: Total wages for the remaining contract period, or a minimum of two month’s wages, whichever is greater.

In other words, if an employee terminates their work contract without cause, the employer is entitled to compensation according to the above terms and vice versa.

Severance pay in Saudi Arabia

When an employment contract ends, or if the employer terminates the contract early, Saudi labor law entitles all fixed-term and indefinite employees to a KSA end-of-service award.

The end-of-service award is a token of appreciation for the employee’s service, amounting to 15 days of regular wages for each year of employment up to five years and a full month’s pay for each following year, calculated based on the employee’s last noted wage.

If an employee resigns early, they still receive an award, but the award size depends on their length of service at the time of resignation, according to the following conditions:

- Two years of service or less. The employee receives no award.

- Two to five years of service. The employee receives one-third of the award.

- Five to 10 years of service. The employee receives two-thirds of the award.

- Ten years of service or more. The employee receives the full award.

Additional employment rights in Saudi Arabia

In addition to the above-mentioned employment rights, employees in Saudi Arabia also have entitlements to minimum wage protections, working hour regulations, overtime protections, and various statutory benefits.

We briefly discuss each of these rights below.

Minimum wage

As of 2023, there is no minimum wage for expats working in the private sector in Saudi Arabia. The minimum wage for Saudi nationals working in the private sector is SAR4,000 (USD1,066) per month, and in the public sector, it’s SAR3,000 (USD800).

Working hours and overtime

Saudi labor law sets the standard workday at eight hours and the standard workweek at 48 hours, except during Ramadan when work hours cannot exceed six hours a day or 36 hours per week.

The maximum number of work hours in a single day is 11 hours, and employees receive 150% of their regular wages for overtime hours and hours they work on weekly rest days, feast days, and official holidays.

Statutory benefits

Employees in Saudi Arabia are entitled to statutory benefits, including life insurance, short-term disability, long-term disability, unemployment insurance, paid leave, and old-age pensions.

Leave entitlements

Saudi Arabia’s labor law guarantees employees 21 days of annual paid leave after completing a full year of employment. After five years of employment with one employer, they receive 30 days. Employees in Saudi Arabia also receive paid leave for covered events like maternity, paternity, illness, marriage, and the death of a spouse, parent, or child.

Payroll rules in Saudi Arabia

The payroll cycle in Saudi Arabia is either monthly or weekly, depending on the work contract. Employers must pay daily workers once per week and salaried employees once per month before the 10th day of the following month. Employers can pay 13th-month salaries and other bonuses at their discretion.

Stay compliant with Saudi Arabia labor law

Like any country, Saudi Arabia’s labor law poses a significant compliance risk for global companies that want to source top talent from the country’s highly skilled workforce. Simplify hiring and paying Saudi employees by partnering with Velocity Global.

Our employer of record (EOR) solution makes it easy for global companies to compliantly hire and pay talent in 185+ countries, including Saudi Arabia, without setting up a legal entity or worrying about violating local labor laws.

Think of us as your global HR team—we handle the heavy lifting involved with engaging talent in Saudi Arabia from abroad so you can focus on your team’s day-to-day responsibilities as you enter this new market.

Backed by in-country experts and a suite of employment solutions, we handle everything from hiring, onboarding, relocation, and immigration to global benefits administration, running global payroll, and providing HR support for your remote employees so you can build a distributed workforce in the country with ease.

Contact us today to get started.

Disclaimer: The intent of this document is solely to provide general and preliminary information for private use. Do not rely on it as an alternative to legal, financial, taxation, or accountancy advice from an appropriately qualified professional. © 2024 Velocity Global, LLC. All rights reserved.

Topic:

Country Guides