Choosing to hire a contractor vs. an employee depends on your unique business goals and circumstances.

Engaging contractors is a cost-effective and efficient option for hiring expert talent for short-term projects. However, by hiring employees, organizations build a connected company culture, generating ongoing business contributions that often outweigh the higher associated costs.

This guide lists the primary differences between contractors and employees and explains why employers often choose one option over the other.

Plus, find a cost comparison for each approach and answers to commonly asked questions.

What is an independent contractor?

A domestic or global independent contractor, also often called a contract employee, is a self-employed person or entity that provides goods, labor, or services to another individual or organization as a non-employee.

Independent contractors generally do not receive the same protections and rights as employees under local labor laws and are responsible for paying their income tax, insurance, and other statutory contributions on their own.

What is a full-time employee?

A full-time employee is an individual who works under an employment agreement with an entity—usually for 30 to 40 hours per week—and receives full protection under local labor laws.

Unlike independent contractors, full-time employees receive entitlements related to minimum wage, paid overtime, and paid leave, plus mandatory employer contributions to state insurance funds and pension plans.

The number of hours constituting full-time employment differs between organizations and jurisdictions, but it usually ranges from 30 to 40 hours per week. For example, in the U.S., a full-time employee performs at least 30 hours of service per week or 130 hours per month.

Have you classified your talent correctly? Use our contractor compliance checklist to learn about worker misclassification in global markets and assess the risk it poses to the success of your business:

Contractors vs. employees: Key differences

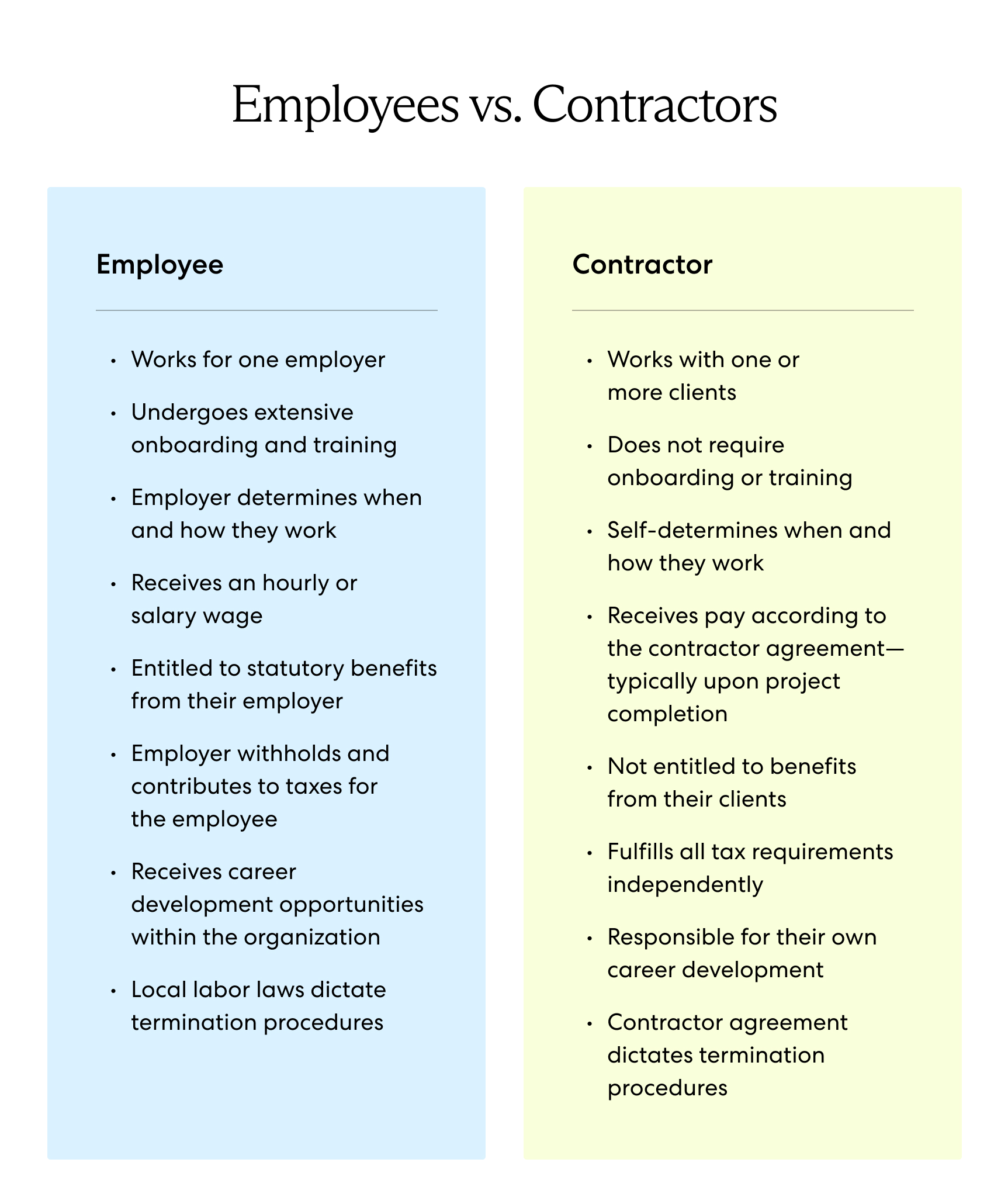

A worker's legal employment status depends on factors related to the financial and behavioral relationships between the employer and the worker.

Plus, the elements associated with hiring employees versus engaging contractors differ in various ways, such as in their onboarding procedures, training, payment schedules, and career development opportunities.

Below we outline these differences in detail.

Onboarding

Onboarding employees requires much more time and resources than onboarding contractors.

After applying for employment with a company, a candidate must pass an initial HR screening before completing several rounds of interviews. Upon receiving a job offer, the employee undergoes several weeks of in-person or virtual onboarding, meeting the team, and learning about job duties.

Conversely, independent contractors often skip the initial HR screening, undergo fewer interview rounds, and usually start working right away—without undergoing onboarding.

Training

When a company hires a new employee, part of the onboarding process involves a lengthy training period.

During this time, a hiring manager teaches the new hire about their team’s workflows, acquaints them with company tools, involves them with job-related skills development, and helps them get familiar with their new responsibilities.

However, because organizations usually hire independent contractors for their expertise on short-term assignments, contractors generally do not require training.

Payment method

Employees are on the company payroll and receive a consistent wage or salary; however, contractors are not on the payroll, and their payment schedule varies from job to job.

Contractors may charge their clients an hourly or per-project rate and usually receive an upfront deposit followed by milestone payments or full payment upon project completion.

Benefits

Employees are entitled to various statutory benefits, such as health insurance, paid leave, and a 13th-month salary, depending on the local labor laws and their employer’s individual policies.

Conversely, contractors are not entitled to most of the same statutory benefits and generally do not receive supplemental benefits from clients. Contractors usually have to purchase any critical or desired additional insurance policies, such as unemployment insurance, on their own.

Taxes

Employers pay income taxes and statutory contributions on their employees’ behalf, such as for social security and health insurance. However, contractors must fulfill all income tax and additional contribution requirements independently.

For example, in the U.S., independent contractors must pay income and self-employment taxes on their own, which covers Medicaid and Social Security.

Work autonomy

Common-law employees must follow a fixed work schedule and abide by employer regulations regarding how and where they conduct their work.

However, contractors enjoy greater work autonomy. They can set their own schedule, decide which tools they use to complete the job, and may even choose their location, depending on the nature of the project. They may also work for several clients at once.

Career development

Employers often make significant investments in ongoing employee career development to reduce employee churn and retain top talent.

This process involves identifying opportunities for upskilling employees and scheduling training sessions focused on skill development throughout the employee’s tenure with the company.

However, because organizations generally hire contractors for their expertise on short-term projects, ongoing career development doesn’t apply.

Termination

In most countries, local labor laws regulate when and how an organization may terminate its employees. These laws generally include a list of circumstances that allow for termination and the required notice periods.

By contrast, terminating an independent contractor is generally much more straightforward as long as the employer and contractor have specified the termination provisions in their work contract.

So, should you hire a contractor or an employee? Let’s look at key reasons why employers choose to hire independent contractors or full-time employees.

Why employers hire independent contractors

A contractor is a popular choice for organizations that need to hire someone to work independently on a short-term assignment with established expertise in the project area.

By engaging independent contractors, employers enjoy many benefits, such as low commitment beyond the contract terms, quick onboarding, and no additional costs, such as payroll tax, statutory contributions, and supplemental benefits.

Additionally, an organization usually doesn’t need a local branch or entity to engage international contractors and can pay these contractors remotely from their home country.

However, many of these advantages often obscure the risks of engaging contractors overseas, such as misclassification, non-compliant payments, and reputational damage.

Why employers hire full-time employees

Despite facing additional costs and administrative procedures, companies that hire full-time employees enjoy numerous benefits that make this route more attractive than engaging independent contractors.

By hiring employees, an organization secures long-term workers and creates continuity in its talent base, facilitating ongoing contributions to its business. By hiring employees, organizations also avoid employee misclassification risks.

However, when hiring employees abroad, companies must undergo many nuanced administrative procedures and face unique risks, such as noncompliance with local labor laws. Organizations must also set up legal entities in the countries where they seek to hire international talent.

When hiring international talent, many companies partner with a third-party expert, such as an employer of record (EOR), to shorten their time-to-market, eliminate the need for foreign entity establishment, and mitigate compliance risks along the way.

Learn more: What Is an Employer of Record (EOR)?

Cost considerations for hiring contractors vs. employees

In addition to the differences between engaging contractors and hiring employees, these two options also involve several differences related to employee cost.

These cost differences include taxes, onboarding, misclassification penalties, and risks associated with reputational damage. Below we outline each of these differences in detail.

Salaries, benefits, and taxes

When hiring employees, businesses face significantly higher upfront costs than when engaging contractors.

With employees, a business must pay regular salaries plus taxes and benefits, such as workers’ compensation, health insurance, and paid leave.

On average, employee benefits cost companies roughly 25% to 40% of an employee’s base salary. An employee who makes US$100,000 a year could cost their company US$25,000 to US$40,000 in benefits.

By retaining available self-employed workers, businesses can eliminate some of these costs.

Onboarding, training, and team building

Another cost associated with hiring employees comes from time spent onboarding, training, and team building.

As we mentioned above, engaging contractors usually doesn’t involve these stages. As a result, employers enjoy significant time savings by engaging contractors.

Misclassification penalties

Hiring contractors comes with costs, too. If a business engages contractors abroad, they must pay special attention to worker classification laws in the jurisdiction in which they hire. Otherwise, they face hefty misclassification penalties.

For example, Italian labor law provides detailed conditions that govern contractor classification. If a foreign employer supervises their Italian contractor’s work or offers fixed monthly payments, local authorities may classify their talent as an employee, subjecting the business to social contribution backpay, fines, and barred business activity.

Reputational damage

By engaging contractors, an organization risks undermining its company ethics and reputation as a reliable service provider.

Hiring contractors with fewer protections than employees may eventually undermine the ethics of a business that values full-time team members and aims to create a connected company culture.

Also, because some contractors may not have the same skills as trained employees, contractors risk diluting the quality of a product or service, which can hurt the company’s reputation.

To mitigate this risk, HR teams must be diligent when vetting contractors to ensure they have a history of providing quality work.

Legal considerations for hiring contractors vs. employees

When deciding between hiring contractors or employees, organizations must carefully consider the legal implications of each option. Labor laws differ significantly for contractors and employees, and misclassification can lead to steep penalties.

The U.S.

In the U.S., the distinction between contractors and employees is primarily determined by the degree of control the employer exerts over the worker. The Internal Revenue Service (IRS) uses a 20-factor test to assess this relationship, considering aspects such as behavioral control, financial control, and the nature of the relationship.

Some of the most common legal pitfalls that organizations encounter include:

- Misclassifying employees as contractors to avoid paying benefits and taxes

- Exerting too much control over contractors' work methods and schedules

- Providing contractors with employee-like benefits or equipment

To mitigate these risks, employers should:

- Develop clear, comprehensive contracts for contractors

- Avoid giving contractors employee-like titles or integrating them into core business functions

- Regularly review and update classification policies

European Union

In the EU, talent classification laws vary by country, but the EU also has overarching employment regulations. A professional could be classified as a contractor under national law but still be considered an employee under EU law.

Key considerations include:

- The degree of control the company has over the professional

- The professional’s economic dependence on the company

- The nature and duration of the work performed

Asia-Pacific (APAC)

APAC countries have diverse approaches to talent classification. In Australia, for example, employees can claim underpayments for six years. Companies operating in this region should be prepared to navigate varying regulations and consult local experts.

Latin America

Many Latin American countries apply the principle of “primacy of reality,” which means the actual circumstances of the working relationship take precedence over the formal agreement. This approach often leads to a presumption of employment relationships, even for contractors.

To minimize risks when hiring in Latin America:

- Avoid exclusivity clauses in contractor agreements

- Implement comprehensive termination agreements

- Include explicit representations and warranties in contracts

Canada

Canadian laws vary by province, but they generally consider factors similar to those of other jurisdictions. The Canada Revenue Agency provides guidelines for determining employment status. Recent developments have seen increased scrutiny of gig economy professionals and their classification.

Across all jurisdictions, organizations should conduct thorough risk assessments, stay informed about legal developments, and consider partnering with global employment experts or partnering with an EOR to ensure compliance.

Compliance challenges with international contractors

Hiring international contractors offers businesses flexibility and access to a global talent pool. But, taking a global approach also presents significant compliance challenges.

- Talent classification. Each country has unique criteria for determining talent status. Proper classification is vital to avoid penalties and legal disputes.

- Payment regulations. Tax withholding, currency exchange, and payment methods vary across jurisdictions, complicating financial transactions and requiring careful management.

- Employment rights and benefits. Recognizing the differing rights and benefits afforded to employees versus contractors in each jurisdiction is crucial for compliance and fair treatment.

- Reporting requirements. Businesses must stay informed about diverse obligations, as many countries require specific reporting for foreign contractor payments, often with strict deadlines.

- Contract complexities. Compliant contracts demand expertise to balance local laws with company interests, especially for international engagements.

- Cultural dynamics. Global teams require clear communication and embracing diversity to optimize collaboration. This can proactively minimize friction that could otherwise lead to compliance issues.

- Data and IP protection. Safeguarding sensitive information across different legal frameworks requires additional consideration and may involve country-specific regulations.

These challenges stem from the variable landscape of labor laws, tax regulations, and reporting requirements across different countries. Ensuring compliant payments to international contractors is particularly challenging, as companies must recognize different tax withholding requirements and payment methods across jurisdictions. Incompatibility with these regulations can result in financial penalties and reputational damage.

Businesses must carefully weigh their options when comparing the risks and benefits of hiring international contractors versus setting up foreign subsidiaries. While engaging contractors offers greater flexibility and lower initial costs, it also carries higher compliance risks. And while establishing entities requires significant up-front investment and ongoing management, it can provide greater control and better legal protection.

An EOR can ease the compliance burden for businesses working with international contractors. An EOR like Velocity Global takes on the responsibility of employment, handling payroll, taxes, and compliance with local labor laws.

Hiring contractors vs. employees: FAQs

Below you can find answers to several commonly asked questions about engaging contractors versus hiring employees.

What are the pros and cons of engaging contractors?

Organizations receive numerous benefits from engaging contractors, such as low commitments, quick onboarding, cost savings, increased flexibility, and added efficiency.

However, engaging contractors entails significant risks as well, such as misclassification, lack of control over workers, increased liability for on-the-job injuries, and inconsistent worker availability.

Read more: The Pros and Cons of Independent Contractors

Can I convert contractors to employees?

Most companies can transition existing contractors into employment roles within their organization, depending on the nature of the contractor’s role and the employment laws in the country in which the contractor resides.

The process of converting contractors to employees varies between countries and is usually a complicated procedure that requires familiarity with local employment laws. In some cases, you may need to undergo the costly and time-consuming process of entity establishment.

Many businesses partner with a third-party expert, such as an employer of record (EOR), to quickly and compliantly convert contractors worldwide to employees without setting up local entities.

What is a 1099 employee in the U.S.?

A 1099 employee in the U.S. is another term for an independent contractor, self-employed worker, or freelancer.

The term 1099 comes from the form clients must fill out and file with the IRS before the end of the tax year, indicating payments they made to an independent contractor throughout that year.

What’s the difference between a contractor and a part-time employee?

The primary difference between a contractor and a part-time employee is that a part-time employee works for an organization under an employment contract and receives similar labor protections as a full-time employee.

For example, unlike contractors, part-time employees in the U.S. receive minimum wage, overtime, and family and medical leave guarantees. Their employers must also pay income tax and make statutory contributions, such as workers’ compensation and social security, on their behalf.

Compliantly build your dream team with Velocity Global

In reality, your business likely benefits from both hiring employees and engaging contractors to meet growth and operational goals—quickly and compliantly build your dream global workforce with Velocity Global.

No matter your business size or staffing plans, Velocity Global gives you access to a best-of-breed HR technology platform to compliantly hire, pay, and manage every aspect of your workforce in 185+ countries.

Plus, stay compliant and avoid risks like misclassification and incorrect payroll contributions with Velocity Global’s unmatched compliance track record and wide network of global HR, payroll, and legal experts.

Contact Velocity Global today to learn how to build a global team with confidence and ease.