As one of the world’s largest economies, a top global trader, and home to a vast, well-educated workforce, the U.S. is a powerhouse market for global companies looking to grow their brand and expand their international presence.

Still, hiring employees in the U.S. requires due diligence. Federal employment laws in the U.S. differ from those in many other countries, and labor laws and tax codes vary drastically between U.S. states, creating major compliance risks for foreign employers.

This guide covers everything you need to know about hiring employees in the U.S. Discover three options for compliantly engaging U.S. talent from abroad, learn how to calculate employee cost for your team, and find an overview of key compliance risks.

Can a foreign company hire employees in the U.S.?

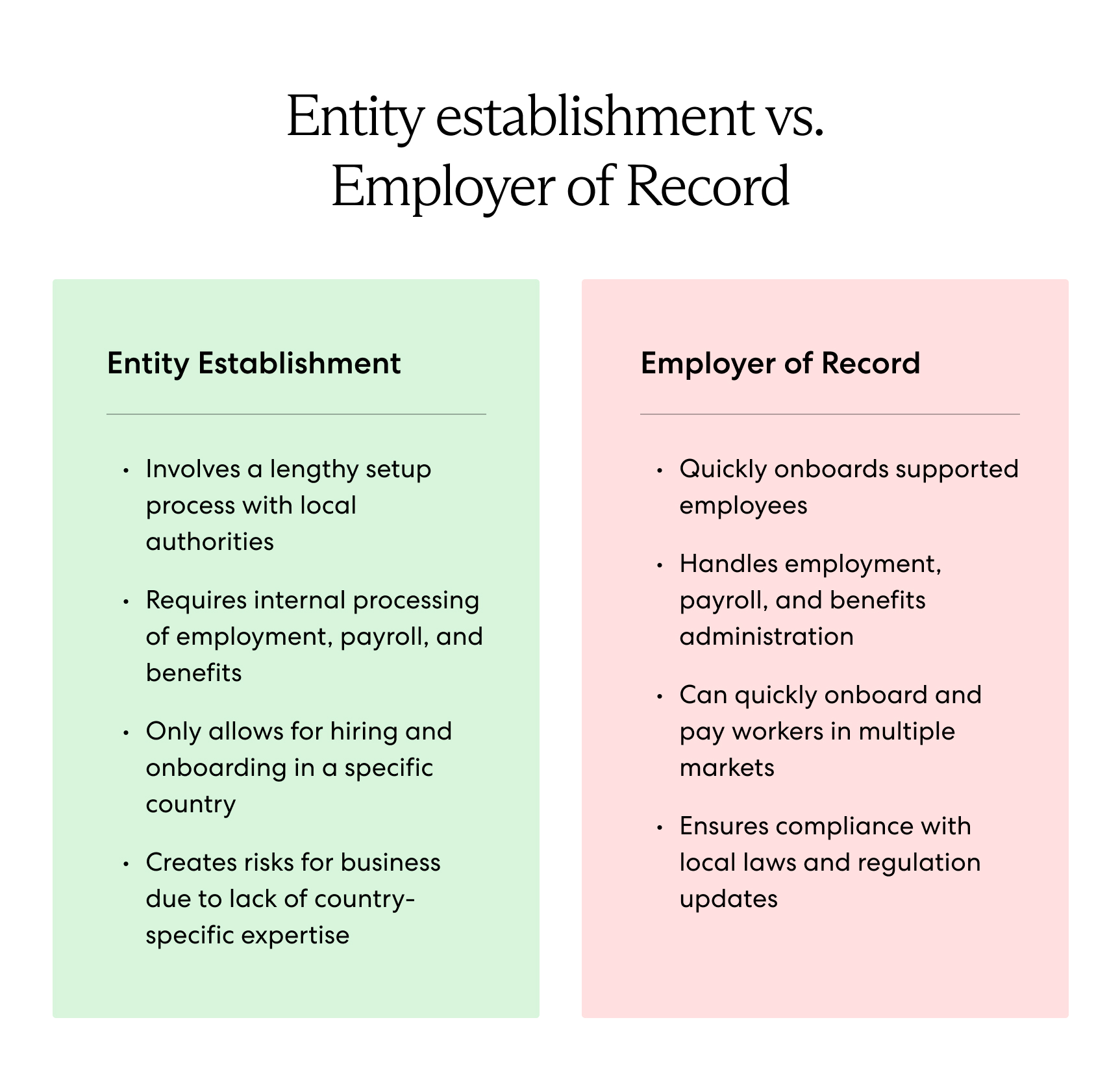

Yes, a foreign company can hire employees in the U.S. Global companies have two main options for hiring U.S. employees: setting up a legal entity or partnering with an employer of record (EOR). The best approach for any business depends on several factors, including time commitments, budget, and long-term goals for U.S. expansion.

3 options for foreign companies hiring employees in the U.S.

As previously mentioned, global companies have two main options for hiring employees in the U.S.: setting up a legal business entity in the U.S. or partnering with an EOR. A third option is to hire local contractors instead of full-time employees.

We discuss each approach in detail below, outlining their advantages and disadvantages.

1. Set up a legal entity

Establishing a legal entity in the U.S. gives you an in-country physical presence. This approach usually involves setting up a branch, C corporation, or limited liability company (LLC) and investing in physical infrastructure, such as an office, factory, workshop, or place of management in the U.S.

Entity establishment helps cut down on long-term employment costs by allowing you to hire employees directly and run payroll internally. This is a wise approach for businesses planning to hire a sizable U.S. workforce and build a long-term presence in the country.

Still, entity establishment involves significant upfront costs, ranging from US$15,000 to US$20,000, including incorporation procedures, HR training, legal counsel, and investments in physical infrastructure. Plus, annual maintenance fees can reach up to US$200,000.

This approach also leaves you responsible for ensuring compliance on your own, requiring extensive in-country knowledge of local employment and tax regulations. You should only pursue entity establishment if your team has the required bandwidth, expertise, and capital investment.

A simpler, more agile approach to hiring employees in the U.S. is to partner with a global expansion expert, such as an employer of record (EOR).

2. Use an employer of record in the U.S.

Companies that want to hire employees in the U.S. without taking on the costs and headaches of entity establishment can partner with an EOR.

An EOR is a third-party entity with global infrastructure and international legal expertise that makes it easy for companies to expand worldwide without establishing entities in each of their target markets or navigating local employment and tax codes on their own.

An EOR assumes responsibility for all major employer-related tasks on your behalf, from ensuring compliance and conducting risk assessments to managing your distributed team. Meanwhile, you maintain control over day-to-day operations.

For instance, an EOR handles everything from hiring, onboarding, and immigration to running global payroll, administering global benefits, and offering ongoing HR support to your distributed workforce in their native language.

An EOR also serves as an ideal bridge solution for companies interested in immediately engaging talent while undergoing lengthy incorporation procedures or banking delays. By partnering with an EOR in the U.S., you can quickly and compliantly build an American team while remaining agile and on budget.

Learn more: What Is an Employer of Record (EOR)?

3. Engage independent contractors in the U.S.

An alternative to hiring full-time employees in the U.S. is to hire contractors. While engaging contractors doesn’t offer the long-term growth prospects that a cohesive, committed team of full-time employees does, it involves other unique advantages, such as cost savings and flexibility.

Hiring highly skilled contractors for short-term, one-off projects allows you to remain flexible as you expand into the U.S. market. You also save time and resources you would otherwise spend hiring, onboarding, and paying a team of full-time employees.

Engaging contractors also allows you to forgo dealing with certain labor and employment regulations, such as statutory benefits and income tax withholdings. However, this approach involves a serious misclassification risk.

Worker classification refers to how you designate talent according to local regulations—as employees or contractors. Navigating U.S. classification regulations can be challenging for foreign employers since the laws are complex and leave ample room for interpretation.

The determining factors range from relationship permanence to more vague factors like how integral a contractor's work is to their client’s business. Generally, employers in the U.S. must limit their influence over their working relationship with contractors. For instance, employers cannot control their contractor’s work schedule, attire, or work methods.

While some employers intentionally misclassify talent for cost savings, others inadvertently find themselves non-compliant by overlooking nuances in the local law. In either case, penalties include hefty fines, employee entitlement back pay, tax arrears, and limited business opportunities.

We discuss misclassification in more detail later on.

Read more: Should You Hire an Employee or a Contractor?

How much does it cost to hire an employee in the U.S.?

The cost of hiring an employee in the U.S. is, at a minimum, 7.65% of the employee’s base salary because the employer must contribute 6.2% of their employee’s base salary to Social Security and 1.45% to Medicare. Additionally, the employer must pay 6% on the first $7,000 of their employee’s annual salary for Federal Unemployment Tax (FUTA).

Still, employee cost varies since individual states may have additional mandatory payroll contributions as well as varying contribution rates for State Unemployment Tax (SUTA).

Interested in hiring employees in the U.S.? Use our employee cost calculator below to get reliable insights into employee costs and payroll contributions in the U.S.:

What to know before hiring employees in the U.S.

To compliantly hire talent in the U.S., global employers must familiarize themselves with employment and tax codes at each level of government, from federal to local levels. This includes payroll tax laws, employee benefits regulations, and worker classification statutes.

We provide a detailed outline of U.S. employment law below.

Differences in federal and state employment laws

Employment law in the U.S. comprises federal and state regulations, with federal regulations being the baseline law employers must comply with. Federal law covers various rights, from minimum wage and unpaid leave to Social Security and Medicare.

However, many states implement additional protections in certain areas of the law, such as paid maternity leave, higher minimum wages, and unique paid rest requirements. Consider Oregon, for example—Oregon is one of 11 U.S. states that offers paid maternity leave.

Federal law also requires employers to calculate overtime on a weekly basis. According to the Fair Labor Standards Act (FLSA), employers must pay employees 150% of their standard wage for any hours they work beyond 40 in a single workweek.

However, some states, such as Alaska, Colorado, and Nevada, require employers to calculate overtime on a daily and weekly basis. In other words, if an employee in Alaska works over eight hours in a single day, they earn overtime pay regardless of whether or not they work more than 40 hours that week.

State income taxes also vary drastically between states. With such wide variances in state regulations, many employers seek counsel from a local legal expert to ensure compliance.

Employment law in the United States: Overview

Below, we outline the critical aspects of employment law that all businesses hiring employees in the U.S. should know:

- At-will employment and termination. Every U.S. state, except Montana, follows at-will employment, meaning employers and employees can terminate their working relationship without notice.

- Minimum wage. The federal minimum wage is US$7.25 per hour. However, some states have higher minimum wages—for example, New York’s minimum wage is US$15 per hour.

- Working hours. U.S. federal law doesn’t limit weekly working hours, but a standard workweek is 40 hours. Employees typically work eight hours a day, five days a week.

- Overtime. Employers must pay 150% of an employee’s regular wages for hours they work beyond 40 in a single workweek. Because state overtime regulations vary, employees are subject to the state or federal law that provides a higher overtime standard.

- Severance. There are no federal requirements for severance pay in the U.S. However, most employers offer severance to maintain a positive rapport with former employees, and some states require severance in situations related to facility closures or large layoffs.

Payroll tax in the U.S.

All employers in the U.S. must withhold taxes and make statutory contributions to state-backed insurance programs on their employees' behalf. These deductions support Social Security, Medicare, unemployment, and workers’ compensation.

Employers must also withhold and remit income taxes from employee earnings.

We provide a detailed breakdown of U.S. payroll taxes and deductions below:

- Social Security. Social Security provides retirement income for U.S. workers. Employers and employees each contribute 6.2%.

- Medicare. Medicare is a federal health insurance program for adults 65 or older and anyone entitled to disability benefits. Employers and employees each contribute 1.45%.

- Federal and state unemployment. The Federal Unemployment Tax Act (FUTA) and State Unemployment Tax Act (SUTA) provide income support for the unemployed. The federal tax rate is 6% on the first US$7,000 of an employee’s taxable wage base, while state rates vary from 0% to 14.03%, depending on the employer’s experience rating.

- Workers’ compensation. Workers’ compensation covers medical expenses and provides income support for employees who cannot work due to a job-related injury or illness. While a federal program exists for public employees, states oversee the private sector with rates averaging around US$45 per month.

- Income tax. Federal income taxes comprise seven brackets ranging from 10% to 37%. States income taxes range from 0% to 13.3%.

Learn more: Complete Guide to Payroll Tax + How to Calculate

Employee benefits in the U.S.

U.S. employers must provide statutory benefits to their employees according to federal and state requirements.

Federal statutory benefits in the U.S. are minimal compared to most other countries and cover only Social Security, Medicare, and unemployment insurance. However, qualifying employers must also offer healthcare and unpaid family and medical leave.

As you may expect, state-level requirements differ from federal regulations and vary drastically between states. For instance, California offers additional retirement benefits and eight weeks of paid annual leave for qualifying life events; however, Texas offers neither.

Because federal requirements are minimal, many U.S. employers prioritize supplementary compensation packages to attract and retain top talent, including additional paid leave, dental and vision coverage, and extra retirement benefits.

We discuss leave entitlements, Social Security, and health care in greater detail below.

Read more: Guide to Required Employee Benefits in the U.S.

Leave entitlements

U.S. federal law does not require paid time off. Under the federal Family and Medical Leave Act (FMLA), employers with 50 or more employees must provide eligible employees with up to 12 weeks of unpaid, job-protected annual leave for covered life events.

Covered events include the birth or adoption of a child, care for an immediate family member, and personal medical leave.

Still, some states offer paid leave entitlements on top of FMLA minimums. For instance, Arizona and Connecticut guarantee all employees 40 hours of paid sick leave per year.

Social Security

Social Security is a federally managed program for retirement, disability, and survivor benefits. Employees and employers contribute 6.2% to Social Security through payroll taxes.

Workers can collect their retirement benefits when they reach 62 and have paid into the system for 10 years or more.

Healthcare

Under the federal Affordable Care Act (ACA), companies with over 50 employees must offer at least 95% of their full-time employees an affordable minimum essential health plan. Companies that don’t comply with ACA mandates face annual fines of up to US$4,460 per employee.

Smaller companies don’t have to provide healthcare to employees, although they can offer high-quality plans via the Small Business Health Options Program (SHOP).

By offering insurance via SHOP, small businesses can control the extent of coverage they offer, determine how much they pay on premiums, and provide several plans for employees to choose from. SHOP is also a prerequisite for businesses to claim the Small Business Health Care Tax Credit.

Many states have also adopted local legislation that mirrors ACA laws or implements additional regulations. For instance, Hawaii’s Prepaid Health Care Act requires businesses with one or more employees to provide health insurance.

Learn more: How to Provide Health Insurance for Employees in Different U.S. States

Misclassification: Employees vs. contractors in the U.S.

If you hire U.S. contractors instead of full-time employees, you run the risk of worker misclassification. Misclassification arises when a company classifies a worker as a contractor while establishing an employment relationship with them.

While the concept of worker designation is relatively straightforward, classification regulations in the U.S. are highly nuanced and leave the courts ample room for interpretation, creating an added compliance risk for foreign employers.

The U.S. Department of Labor (DOL) uses the following six factors to determine a worker’s proper designation:

- The degree to which a worker can increase profits or losses due to their own managerial efforts

- The worker’s degree of investment in the project

- The work relationship’s degree of permanence

- The nature and degree of the client’s control over the work

- How integral a project is to the client’s business

- The degree of special skills or initiative a project requires

Imagine a British tech company hires a team of American IT specialists on a contract basis. Over time, the IT company starts influencing its contractor’s work schedule and develops an ongoing work relationship with them involving regularly scheduled payments.

U.S. regulators may deem the contractors as employees under local regulations and subject the company to various penalties, including back taxes, benefits arrears, and reputational damage.

In many cases, companies find themselves non-compliant by accident. To help employers determine whether a worker is an employee or contractor, the U.S. Internal Revenue Service (IRS) provides a checklist of common rules based on the extent of control, financial aspects, and the relationship between the employer and worker.

However, following this IRS checklist alone does not guarantee proper classification. Employers should consult a legal expert, such as an EOR, to ensure compliance.

Learn more: Complete Guide to Employee Misclassification.

Simplify hiring employees in the U.S. with Velocity Global

Don’t let complex federal and state employment laws prevent you from building your dream team in the U.S. Hire top American talent with ease by partnering with Velocity Global.

Velocity Global’s EOR solution streamlines international hiring, making it easy for businesses of all sizes to engage talent in over 185 countries, including the U.S., without establishing legal entities or worrying about violating local employment and tax laws.

Our team of international legal experts and global HR specialists handle the heavy lifting associated with hiring employees in the U.S. This includes hiring, onboarding, risk mitigation, immigration, running global payroll, administering global benefits, and offering ongoing HR support to your local team.

By partnering with Velocity Global, you can quickly and compliantly hire employees in the U.S. without skipping a beat—contact us today to get started.