Building a distributed workforce across the United States grants businesses many perks, including access to a broader talent pool. However, it also introduces challenges like administering competitive healthcare benefits to employees in various states.

For U.S. and international businesses, offering health insurance to employees in different states is critical for talent retention. But administering benefits country-wide and maintaining compliance with state-specific labor laws takes time and effort. Fortunately, you don’t have to go it alone.

Read our guide to learn how to administer affordable and competitive healthcare benefits to your distributed workforce across the U.S.

Can health insurance be used in different states?

Many U.S. health insurance plans cover emergency services at any hospital in the country, regardless of the state of purchase. However, depending on the healthcare plan, non-emergency care may not be covered outside of the state of purchase.

Read also: The Differences Between Public vs. Private Healthcare

The challenges of providing health insurance for remote workers in the U.S.

Providing health coverage to employees in multiple states is difficult because health insurance and providers vary across states. Researching and offering state-specific medical benefits for your employees is time-consuming and expensive; you may not have the capacity or budget to provide various health plans across states.

Challenges for U.S. companies

Below are some of the challenges U.S. companies face around administering health insurance to employees in different states:

- Research. You want to give your workforce the flexibility to work anywhere or relocate if needed but don’t know how to ensure someone is medically covered in different states.

- Affordability. You want to hire talent across the U.S. but can’t afford multiple medical plans for different states.

- Availability. You are interested in hiring just one employee or part-time employees in a different state but don’t know how to provide them with adequate medical insurance.

- Administration. You don’t know how to navigate the HR complexities of managing a remote team across the country while offering comprehensive benefits.

Challenges for international companies

Below are some of the challenges international companies face around administering health insurance for employees in different states:

- Compliance. Your remote employee is moving to the U.S. To retain this employee, you must compliantly relocate them while providing them with the same medical coverage they currently have.

- Attraction. You want to hire a sought-after candidate in the U.S. and need an advantage, such as a comprehensive and unique employee benefits package, to entice them to choose your company.

- Competition. You are interested in establishing a market presence in the U.S. and want to make your medical benefits a competitive differentiator against other top companies in your sector.

5 options for providing health insurance to employees in different states

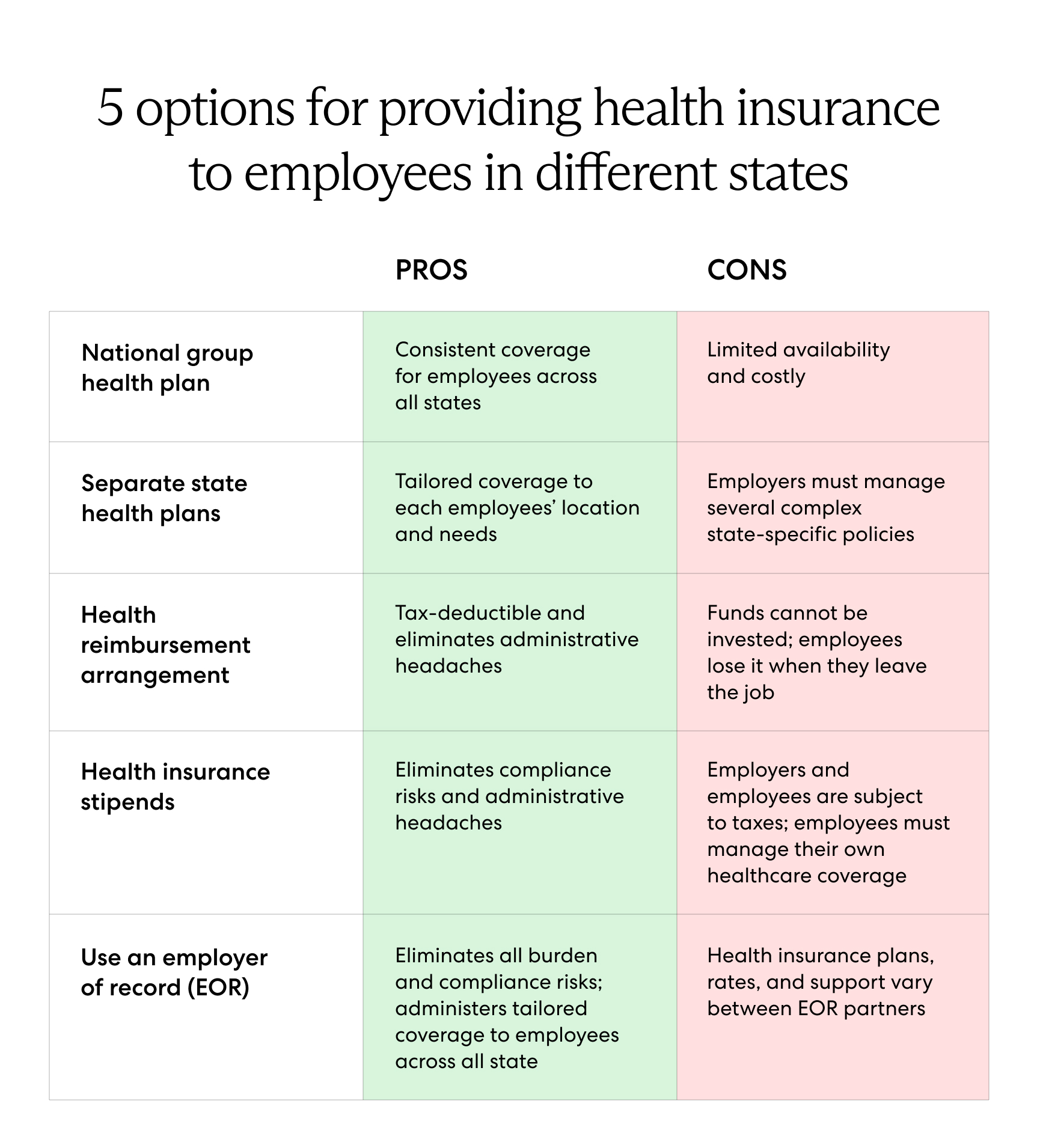

Despite the challenges, companies have several options for administering health insurance to their distributed workforce in the U.S. Below are five options and their pros and cons.

1. National group health insurance plan

Under a national group health insurance plan, all distributed employees in any state receive the same health insurance.

Pros: A national group plan eliminates the need to manage and keep track of different health insurance regulations across states. All employees receive the same coverage regardless of their state residence.

Cons: Because only a few health insurance companies offer national group plans, the selection is limited. Plus, the plans typically come with higher premiums and overall costs.

2. Separate state health insurance plans

Alternatively, you can provide your distributed employees with health insurance for multiple states by offering individual state health insurance plans.

Pros: Separate state plans allow employees to receive coverage tailored to their location, needs, and preferences. Separate state health insurance plans are good options for companies with employees located in several main clusters or regional offices.

Cons: Managing multiple policies is complicated and time-consuming. Additionally, it might not make sense to provide separate state health insurance plans if your employees are sporadically spread out across the country.

3. A health reimbursement arrangement (HRA)

A health reimbursement arrangement (HRA) allows businesses to contribute a fixed amount of money for employees to use on their individual health insurance expenses.

Pros: Employers can offer health insurance contributions without the administrative pains of managing group health insurance. HRAs enable employees to select the best local healthcare plan to fit their needs. Plus, HRA contributions are tax-deductible for employers and tax-free for employees.

Cons: Employers cannot invest the money in their HRA accounts, and employees can only receive reimbursement for eligible medical services. Employees will also lose the HRA funds if they leave the job.

4. Health insurance stipends

A stipend is an allowance added to an employee’s basic salary to cover costs such as health insurance and additional benefits. Stipends can be paid out as an annual lump sum or on a recurring basis.

Pros: Stipends are easy to administer and are not subject to compliance issues across different states. Employers have more control over the health budget, and employees can tailor their health insurance plans to fit their needs in their location.

Cons: Employers must pay payroll taxes on the reimbursements, and employees must claim the stipend as part of their income. Additionally, employees face the burden of sourcing and managing their own healthcare coverage, which is time-consuming and stressful.

5. Use an employer of record

An employer of record (EOR) is a third-party partner that serves as the legal employer of your distributed workforce and assumes all employer-related responsibilities on your behalf—including administering health benefits to your team.

While an EOR acts as the legal employer of your distributed workforce, you maintain complete control over all day-to-day management tasks, such as position duties, projects, performance reviews, and compensation.

Pros: An EOR partner provides full legal guidance and tailored healthcare administration for employees while ensuring compliance with state labor laws. As an additional benefit, an EOR partner handles hiring, onboarding, payroll, and compliance on your behalf so you can engage or relocate talent quickly and cost-effectively while providing them with top-tier benefits and support.

Cons: Not all U.S. EOR organizations provide the same plans, rates, or support. For example, some EOR organizations may work with third-party health insurance providers to source and administer benefits to distributed teams, which can increase costs. Employers should practice due diligence when researching which U.S. EOR partner best fits their needs.

Read more: What Is an Employer of Record (EOR)?

Why HR teams choose Velocity Global as their U.S. benefits partner

If you seek a simple and compliant way to administer benefits to your U.S. employees, look no further than Velocity Global. By working with a trusted partner that has one of the most competitive U.S. benefits offerings on the market, you can rest assured you'll receive:

- Inclusive coverage. Our benefits cover employees in any stage of life and employment. Whether you’re hiring one or one thousand, we support your full-time and part-time employees through customized and comprehensive coverage options. Your talent also has more access to affordable medical options and control over how they are covered.

- Competitive costs. Velocity Global has well-negotiated group rates that translate to a lower bottom line for employers. We provide affordable and competitive coverage—and access to group policy pricing at an individual level. Employers also have the flexibility to choose a contribution level that best fits their budget.

- Transparent pricing. Our plans offer affordable and transparent pricing, allowing full visibility into benefits costs. Your employees will also know their medical costs well in advance of office visits and medical procedures.

- Compliance. You will have peace of mind knowing that your medical benefits adhere to local regulations. With global employee benefits expertise across the U.S. and more than 185 countries, we do the heavy lifting to comply with state-specific labor laws so that you don’t have to.

- Full-service support. Our plans accommodate a wide range of talent needs, and our experts offer fast, local support to you and your distributed workforce around the clock.

Simplify benefits administration anywhere in the U.S. with Velocity Global

Whether you are a U.S. company looking to expand across state lines or an international company hiring talent in the U.S., providing health insurance for employees in different states is crucial to attracting and retaining a highly skilled, remote workforce. Don’t let the difficulties of employee benefits administration stand between you and hiring top talent. Trust Velocity Global to handle U.S. employee benefits for you.

As your EOR partner, we ensure your distributed workforce has the highest standard of benefits available. Our industry-leading Global Benefits solution offers competitive, compliant, and comprehensive packages tailored to your employees’ needs and their local markets. Velocity Global removes the HR complexities and headaches so you can hire, onboard, and relocate top talent anywhere in the U.S. and beyond.

Attract top candidates globally with benefits that matter. Contact Velocity Global to get started.

Topic:

Employee Benefits