The main differences between an independent contractor and a sole proprietor are the way income is tracked and how the product is delivered to the customer.

Independent contractors often provide services to clients and track their income on a 1099 form. Sole proprietors, on the other hand, often provide a product to a customer and are responsible for their own income tracking.

Though both are business models for those looking to be self-employed, there are a few key things that set them apart. Before you start up your own business, you’ll need to know which type of business owner you are so you can make sure you’re staying compliant with regulations for your business type.

What is a sole proprietor?

A sole proprietor is a person who owns and operates an unincorporated business by themselves. Under a sole proprietorship, the business owner earns all of the business’s profits and is also accountable for any incurred debts.

Examples of sole proprietors include:

- Freelance writers or graphic designers

- Florists

- A local artist

- Web designers

- Food truck operators

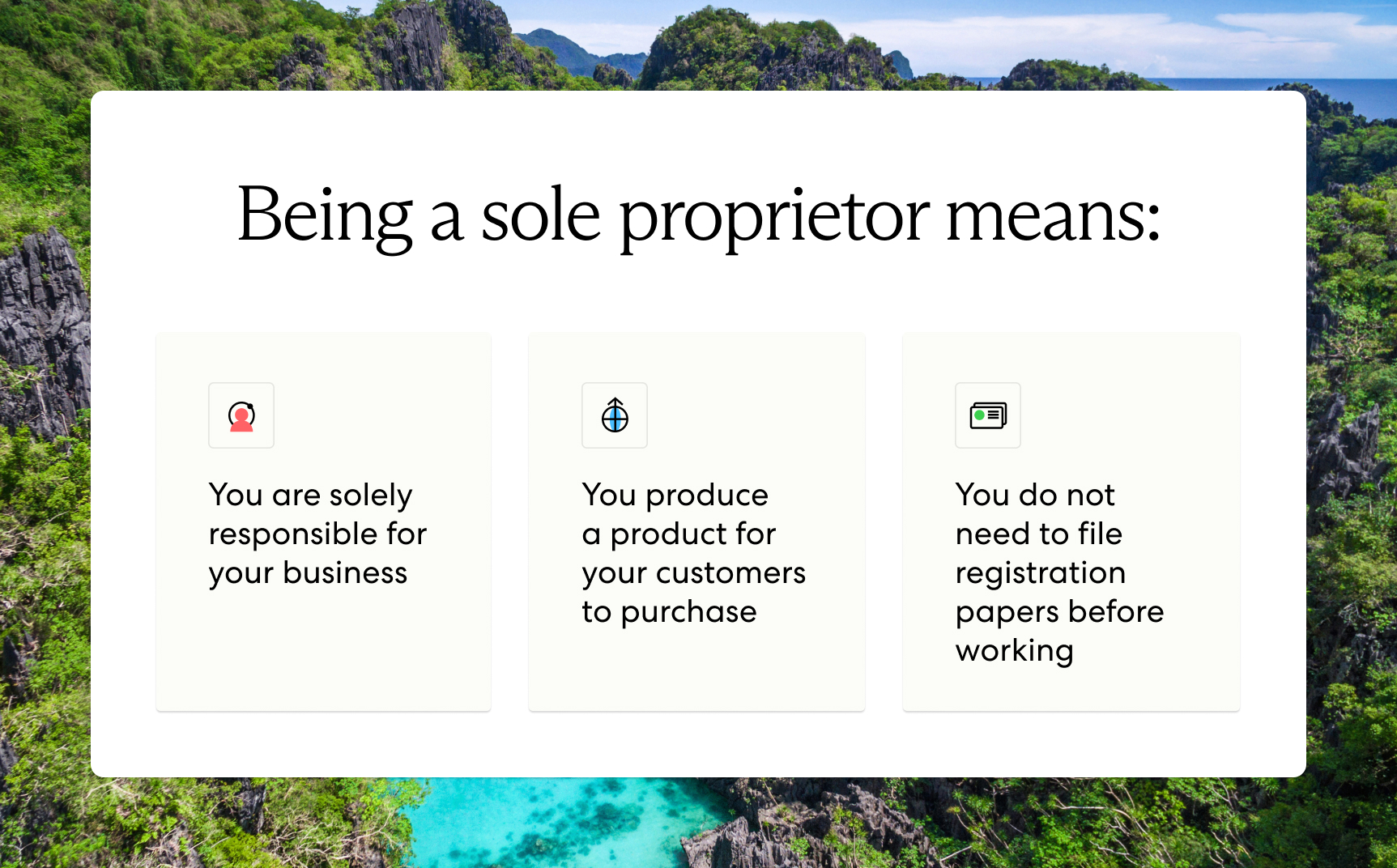

What makes a sole proprietor different from other business owners?

Sole proprietorship is the most common type of business in the U.S. This is a unique business model because it encompasses anyone who runs an unincorporated business, from freelance writers to local artisans.

Sole proprietors differ from other business owners in a few key ways:

- They are the sole influence of the business: The sole proprietor is the only entity responsible for business management, dealings, and decisions.

- They are not legally separate from their business: Businesses run by sole proprietors are not registered with the state, and therefore the business owner is personally responsible for profits, debts, damages, etc.

- No legal paperwork is required: A sole proprietor can get to work as soon as they have their business idea. No legal paperwork is required.

Do sole proprietors get a 1099?

Sole proprietors typically do not receive a Form 1099-NEC. A 1099-NEC form is a tax form that the Internal Revenue Service (IRS) uses to record compensation received by someone other than an employer throughout the year. As self-employed individuals, or 1099 workers, typically don’t have an employer, these forms are common among those running their own businesses.

This is another way sole proprietors differ from other types of self-employed people or business owners. Sole proprietors typically do not receive this form, though some long-term clients may provide one to a sole proprietor. Usually, though, sole proprietors track their own business expenses and file their own taxes.

Read also: Form 1099-NEC vs. Form 1099-MISC

Pros of being a sole proprietor

Being a sole proprietor puts you in the driver’s seat. A few advantages of running this type of business include:

- Quick start-up: No paperwork or registration means you can start your business as soon as you have the idea.

- You’re in control: Sole proprietors work alone, so you’ll be fully in charge of making your business vision come to life.

- You can grow at your own pace: Sole proprietors can have employees on their roster and work to scale their businesses without the pressure of immediate business registration.

- Taxes are simple: Sole proprietors usually file their business taxes along with their personal tax return.

Cons of being a sole proprietor

Being in the driver’s seat can sometimes lead to accidents. A few cons of pursuing sole proprietorship are the following:

- You’re liable for your company: Any debts or losses incurred, payments to be made, or employee liabilities encountered will fall solely on you to handle.

- Raising funds can be difficult: Because sole proprietorship can be risky, banks might hesitate to dole out a loan. Many sole proprietors have to bootstrap or secure third-party funding to start working.

- It’s easy to overwork: When you’re running the business on your own, you might find yourself working way beyond typical business hours, which can lead to burnout.

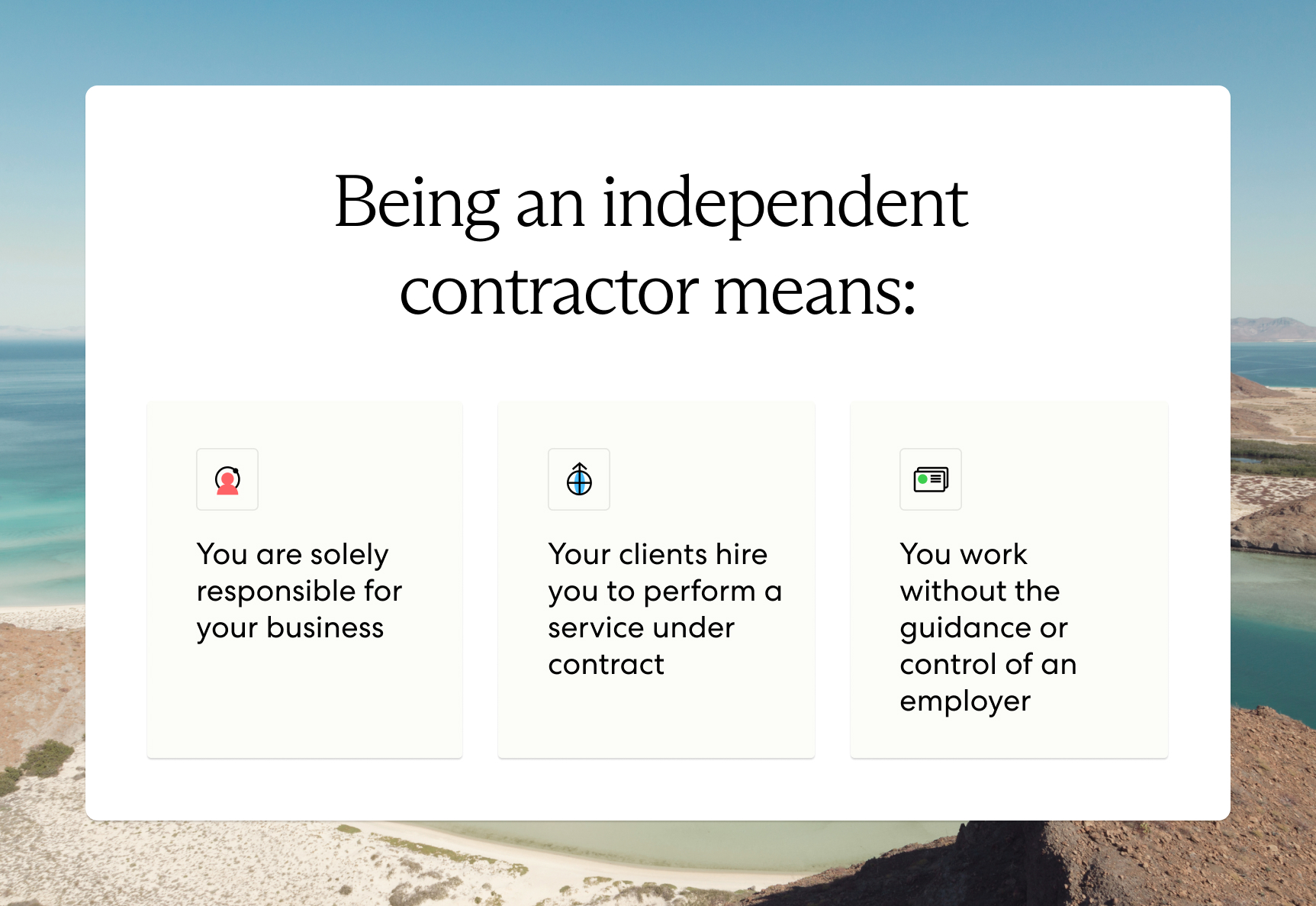

What is an independent contractor?

Independent contractors, also often called contract employees, are people who offer services to the general public and administer those services based on a written contract. To be considered an independent contractor, these services cannot be provided under the supervision or control of an employer.

Examples of independent contractors include:

- Doctors or surgeons

- Veterinarians

- Lawyers

- House painters or renovators

- Mechanics

Is an independent contractor self-employed?

Independent contractors are self-employed. This means that they perform their specified trade without supervision or guidance from an employer. This also means that independent contractors set their own working hours and provide their own tools to do the job. The contract between the contractor and the person receiving the services is decided only between those two parties without any sort of agency or third-party.

There are some risks to independent contracting, especially globally. In some countries, legislation like the IR35 is in place to distinguish between contractors and employees.

Pros of being an independent contractor

Being an independent contractor allows you to decide the specifics of how you perform your trade. A few pros of this type of work include:

- You may earn more than rostered employees: When working for a firm or agency, your hourly wage may be less than you could be charging as an independent contractor. Think of it this way: If you work for a firm that bills clients $100 per hour for your work, you’ll probably only earn about $25 of that total. If you bill the client directly without a firm involved, you’ll receive the entire amount.

- Your taxes might be lower: You won’t be paying income taxes, so you have the potential to earn more throughout the year.

- More flexibility with scheduling: As you make your own schedule as an independent contractor, there’s more wiggle room for you to push appointments if you have errands to run or are going on vacation.

Cons of being an independent contractor

Leaving the security of a firm or agency to work solo can also come with a few downsides. A few cons of independent contracting include:

- No guaranteed clientele: When you’re providing services to the general public, you’ll be responsible for drumming up your business. If you have a slow month, your profits could suffer as a result.

- No federal or state benefits: When you work for an employer, you may have access to federal benefits like health care insurance. When you begin independent contracting, you’ll be responsible for securing these for yourself.

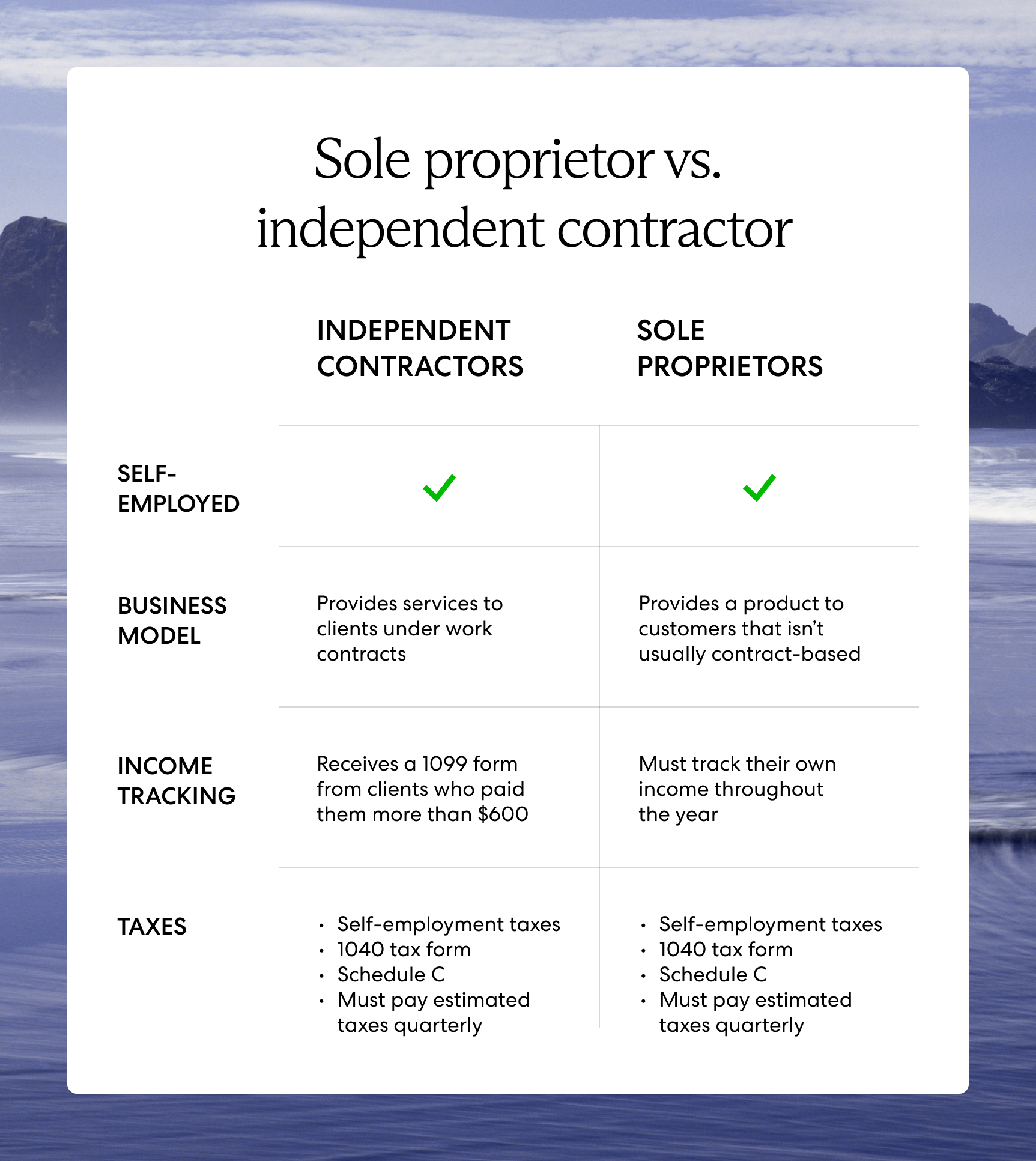

Sole proprietor vs. independent contractor

What’s the difference between sole proprietors and independent contractors? Check out this chart for quick differences.

The most notable difference between sole proprietors and independent contractors is the way they document their profits and pay their taxes.

Independent contractors who earned more than $600 from a client will receive a 1099-NEC form detailing their earnings. Sole proprietors are fully responsible for tracking their own income. Independent contractors file their 1099 form with the IRS and also submit a self-employed tax form. Sole proprietors, on the other hand, usually file their business taxes along with their personal taxes.

These business models also differ in the way they provide their services or products. Independent contractors provide a service under a specified employment agreement, while sole proprietors provide a product to a customer.

An independent contractor could be a self-employed construction worker who a customer hires to build a new shed in the backyard. A sole proprietor may run a copywriting business where they produce blog content for several different clients.

FAQs: Sole proprietorship and independent contracting

Let’s answer some frequently asked questions about sole proprietorship and independent contracting.

Do you have to register a sole proprietorship?

Sole proprietors are not required to register their businesses with the state. As soon as you begin conducting business, you are considered a sole proprietor.

However, you’ll usually need to register with your local government to legitimize your business. In many states, you need to file your business name with the county clerk. Depending on your business activities, you may also need to obtain a business license or zoning permit, and if you want to hire employees, you need an Employer Identification Number (EIN).

Do all small business owners get a 1099?

You’ll only receive a 1099 form if you worked for someone as an independent contractor.

Note: People selling products to customers don’t receive a 1099 form. Only those who perform services or work for a customer or client report their earnings on the form.

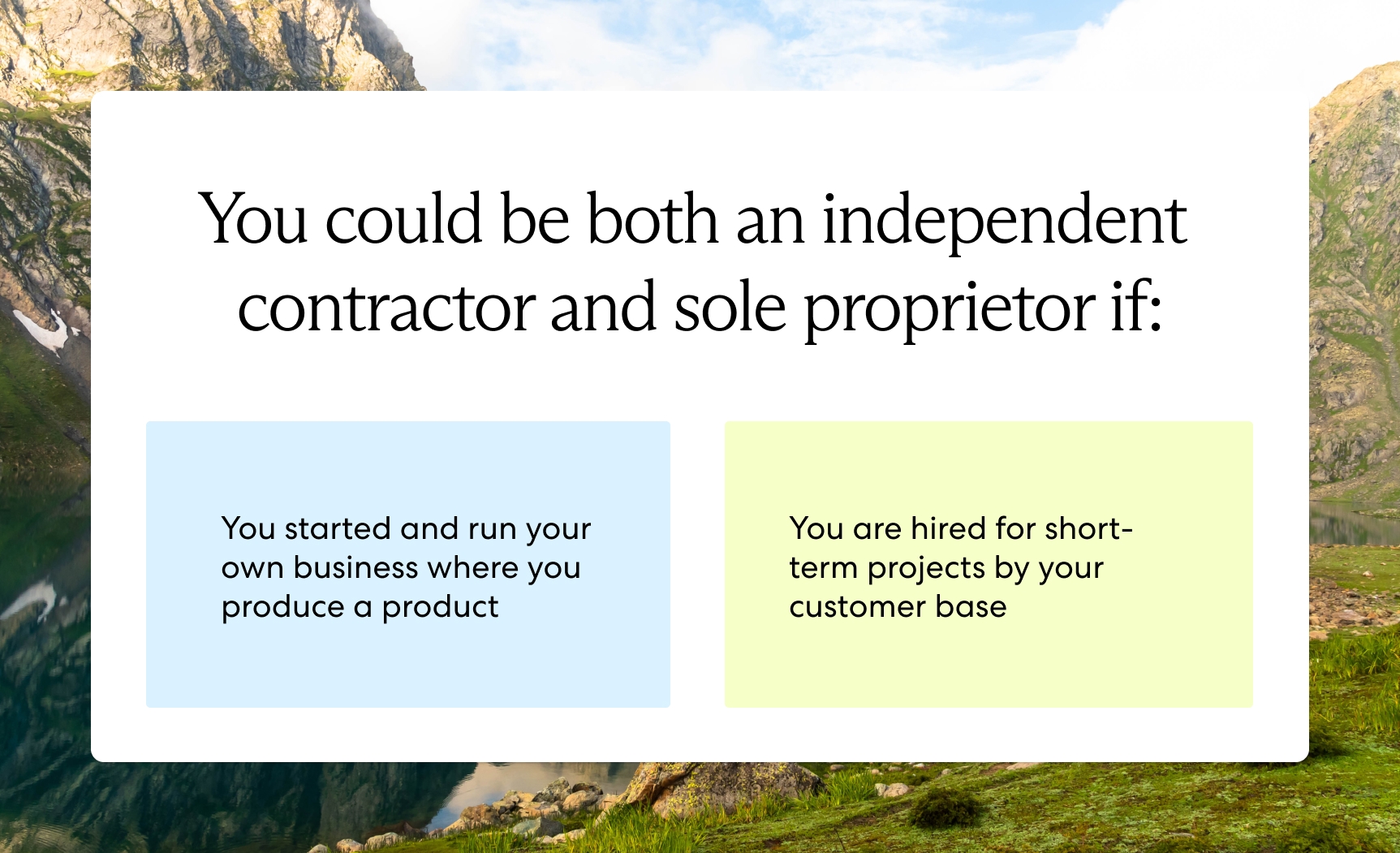

Is an independent contractor considered a sole proprietor?

Independent contractors aren’t usually sole proprietors, but they can be under specific circumstances. If you own your own business where you provide services under employment contracts, you would be an independent contractor who is also a sole proprietor. In most cases, however, independent contractors are not sole proprietors.

Is it possible to be both a sole proprietor and an independent contractor?

It is possible to be both a sole proprietor and an independent contractor. People who own their own businesses and provide services to clients will be both a sole proprietor (by running their own business) and an independent contractor (by providing a service under an employment agreement with a client).

An example of this could be a freelance copy editor who runs their own copy-editing business. Because they run a copy-editing business, they are a sole proprietor. And because they negotiate a contract with each specific person who hires them to do edits, they are an independent contractor.

How do sole proprietors and independent contractors differ from LLCs?

The most prominent difference between self-employed people like sole proprietors and independent contractors and a Limited Liability Company (LLC) is that an LLC is required to register their business. In turn, an LLC will receive more liability protections than those who are self-employed, who will be solely responsible for those costs.

An LLC will also usually be run by multiple people, while sole proprietors and independent contractors often work alone. This means that LLCs are separate from the business owner, whereas sole proprietors and independent contractors are directly tied to their businesses.

Stay on top of your business

If you're a business owner seeking to engage independent contractors, make sure you're in compliance with worker classification laws to avoid unwanted financial and legal penalties. Check out our guide on how to avoid contractor misclassification to get started.

Or contact us today to learn how Velocity Global can help you level up your workforce while reducing your risk.