Inland Revenue 35 (IR35) legislation aims to reduce tax avoidance by independent contractors who perform the same work as employees in the United Kingdom. The liability for defining employment status currently rests with the employer rather than the employee.

Because of this liability, it’s crucial for employers who hire independent contractors or sole proprietors in the UK to understand the legislation and its organizational impacts. This guide will help you understand what IR35 legislation is, whether it applies to you, and how you can ensure global compliance with the newest regulations.

Overview: What is IR35 Legislation?

Inland Revenue 35 (IR35) legislation is a set of anti-avoidance tax laws introduced in the UK in 2000 that redefine employment statuses to eliminate the tax discrepancy between contractors and employees with the same roles and responsibilities.

IR35 legislation, also known as intermediaries’ legislation or “off-payroll working rules,” is designed to close the “deemed employment” tax loophole when firms hire contractors to fulfill the roles of employees. Preventing deemed employment also ensures that:

- Firms pay proper employment taxes for their workforce

- Firms provide employees with appropriate benefits

- Contractors pay income taxes and national insurance contributions (NICs)

It was originally the responsibility of the contractor to determine whether or not their contract fell inside IR35, but this proved difficult to enforce. The responsibility to correctly classify laborers now falls with public and private sector employers, which increases employers’ risks of hiring independent contractors in the UK.

How Does IR35 Work?

IR35 dictates that “deemed” or “disguised” employees—contractors who would be classified as employees if they provided services directly to the client without an intermediary—should pay the same amount of income tax and NICs as employees.

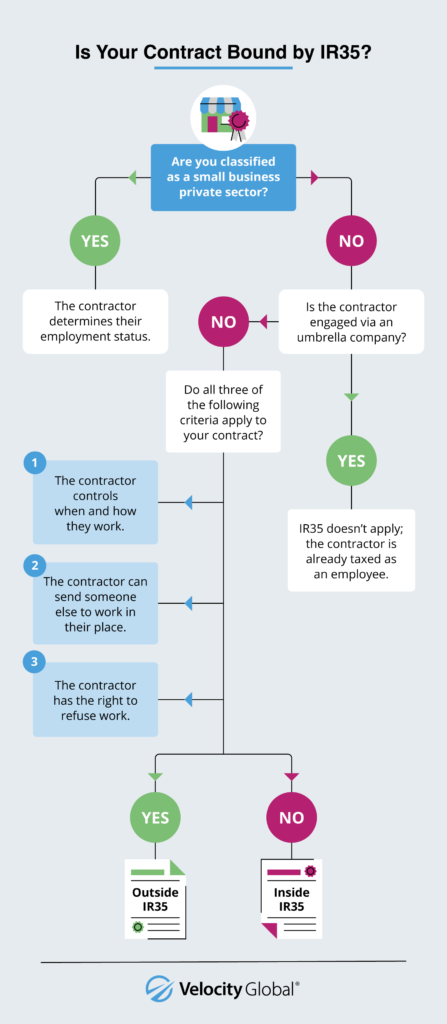

Clients (except small, private-sector businesses) who hire contracted workers are responsible for determining:

- The employment status of those workers

- Whether their work contract is bound by IR35

If HM Revenue and Customs (HMRC) investigates and judges that a deemed employee has been misclassified, it is the employer’s responsibility to pay the evaded taxes.

Inside vs. Outside IR35: Who Does IR35 Apply To?

IR35 legislation is applicable when a contractor provides their services to a client through an intermediary. The intermediary is typically the contractor’s own limited company (or “personal service company”), but it could also be a partnership or an individual.

“Inside” and “outside” IR35 are terms that convey whether the legislation applies to a contracted worker or not. IR35 applies to:

- Workers who provide services through an intermediary

- Clients who receive services from a worker through their intermediary

- Agencies that provide workers’ services through their intermediary

If a contract is inside IR35:

- The off-payroll working rules apply and the contractor is considered an employee of the client for tax purposes

- The fee-payer will deduct income tax and NICs from the payment the contractor receives, and will also pay NICs for the employer (which are not deducted from the worker’s wages)

- The fee-payer is the party that pays the contractor’s personal service company (PSC), whether it’s the client, agency, or another third party

If a contract is outside IR35:

- The contractor is considered self-employed and operates as their own business

- They can be paid by invoice with no taxes deducted and are responsible for managing their business’s taxes]

- The contractor does not use a PSC

Employee vs. Independent Contractor Classification: Seven Factors for Businesses To Consider

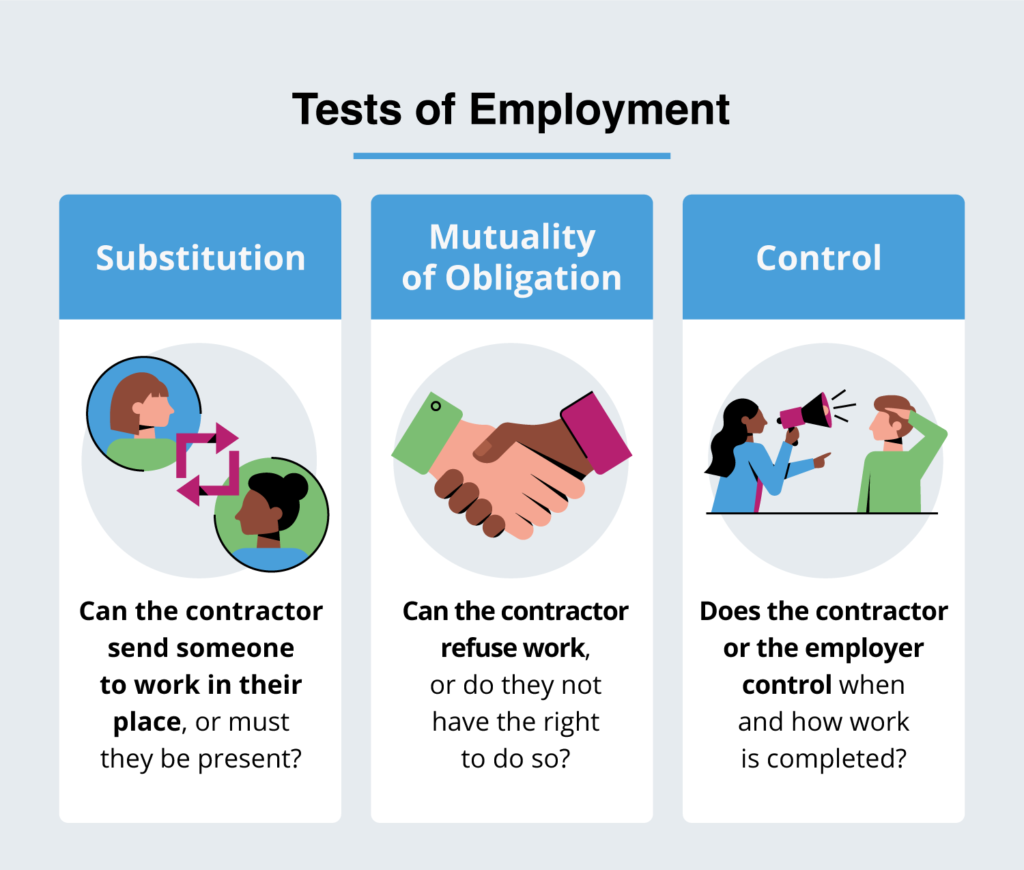

IR35 case law established a set of tests of employment that employers can use to classify all workers under their purview. The assessment criteria include:

- Control

- Substitution

- Mutuality of obligation

- Miscellaneous factors

These tests should be evaluated together to get the clearest picture of someone’s employment, so be wary of making a decision based on a single factor.

Employers should also keep in mind that HMRC assesses these factors not only based on the written contract but on actual working practices, so “implied” terms can supersede the written terms of a contract if the two are not consistent.

1. Control

- Inside IR35. An individual is an employee if the client controls how and when they execute their responsibilities, as well as which duties they perform.

- Potentially outside IR35. If the individual can control the constraints around their work, they might not be bound by IR35.

2. Substitution

- Inside IR35. An individual is an employee if the client does not allow them to pass off or substitute responsibilities to another individual.

- Potentially outside IR35. If the individual can send someone in their place to complete the work, then they might be a contractor outside IR35.

3. Mutuality of Obligation

- Inside IR35. An individual is an employee if they are obliged to offer their services, and the client is equally obliged to accept those services.

- Potentially outside IR35. If the individual has the right to refuse work, they might be outside IR35.

Four Other Factors

Control, substitution, and mutuality of obligation are the main considerations to determine employment classification, but they don’t always paint a complete picture of the situation.

Other factors to consider include:

- The type of contract

- How the individual is paid

- Their level of financial risk

- If they supply the equipment necessary to complete their responsibilities

Each of these factors is enough to distinguish an inside IR35 contract from an outside one.

Recent IR35 Updates + Compliance Checklist

In September 2022, a repeal of 2017 and 2021 IR35 updates was announced, potentially shifting the liability of employee classification onto contractors. There are currently no changes to the legislation and both updates remain in effect until at least April 2023.

2017 IR35 reporting reforms transferred the responsibility of determining employment status from workers to employers in the public sector, resulting in an additional £550 million in income tax and NICs.

UK regulators extended public sector employers’ classification responsibilities to private sector employers in April 2021, adding to their potential labor burden. The reform extends the 2017 provisions to the following private-sector employers in the UK:

- Independent contractors

- Recruitment agencies

- Medium- to large-sized companies

The 2021 IR35 updates exempt 1.5 million private small businesses that meet at least two of the following criteria:

- 50 or fewer employees

- Annual turnover not exceeding £10.2 million

- Balance sheet totaling £5.1 million or less

No exemptions exist for small businesses in the public sector.

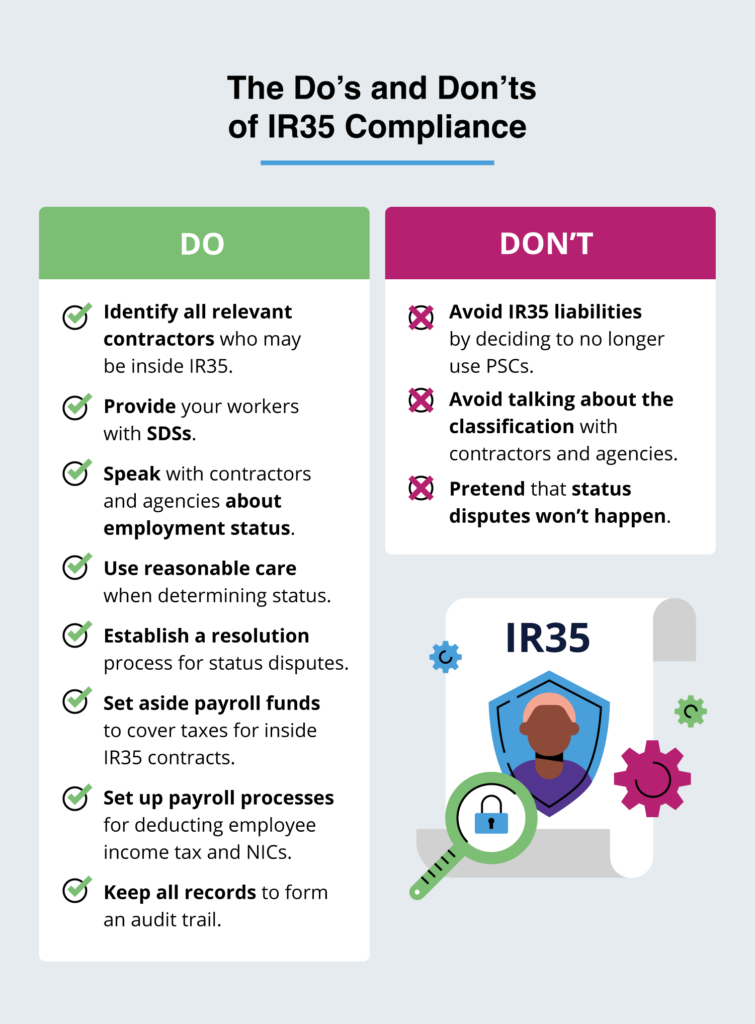

To make sure you’re IR35 compliant, there are several do's and don’ts that your company should follow:

- Do provide Status Determination Statements (SDSs) to your workforce.

- The SDS is an official form that establishes the status of the worker and provides the reasoning behind the determination.

- Do look out for status disputes from contractors or their PSC.

- If PSCs challenge the status, employers must revisit the status decision and reply within 45 days. Any tax liabilities exposed by the SDS are the employer’s responsibility to pay.

- Do take “reasonable care” when determining a worker’s employment status.

- HMRC’s definition of reasonable care is subjective. An employer should consider each situation specifically, with the amount of care appropriate for the client’s ability, experience, and resources.

- Do establish an audit trail for IR35 compliance.

- In the event of a compliance audit, it’s crucial to have evidence of care and due diligence in each classification decision under IR35. Omitting evidence may result in your business paying fines for noncompliance.

- Don’t choose to avoid IR35 liabilities by deciding to no longer use PSCs.

- It’s unwise to make a blanket assessment classifying all of your contractors as inside IR35 regardless of their individual situations; this is not considered reasonable care.

- Don’t avoid talking about the classification with contractors and agencies.

- Since contractors and PSCs have the ability to dispute employment classification if they believe it to be incorrect, speak with them to make sure you have all the information you need.

- Don’t pretend that status disputes won’t happen.

- You should put a process in place that instructs parties on what to do in the event of a dispute over status. Being prepared will ensure you meet the moment knowing what to do next and will help you avoid further confusion about the process.

Hire Global Talent + Maintain Compliance With an HR Partner

Independent contractors invite risks. With the IR35 legislation, businesses must expose any intentional or unintentional worker-employer relationships, and employers face penalties for misclassifying workers.

Navigating the hiring process in the UK is difficult, but businesses can save time and effort by partnering with Velocity Global’s Employer of Record (EoR). With the assistance of an EoR solution, employers can compliantly hire talented employees, ensure independent contractor compliance, and build a robust and scalable team.

Want to learn more about how Velocity Global’s team of employment law experts helps your firm understand the IR35 changes, complexities, and other UK employment law considerations? Reach out to us today.