Global hiring and expansion present exciting business opportunities. One of the most common strategies for entering a foreign market is establishing a foreign subsidiary.

A foreign subsidiary acts as a separate legal entity in the target country and offers the parent company benefits like local tax incentives and compliance risk mitigation.

However, entity establishment requires a hefty investment in time and money. It also exposes businesses to compliance risks that may result in fines, lawsuits, and reputational damage.

In this guide, we outline the pros and cons of establishing a foreign subsidiary as part of a global business strategy and suggest flexible alternatives for international hiring and expansion.

What Is a foreign subsidiary?

A foreign subsidiary is a company that operates in one country but is partially or wholly owned by a parent company based in another country. Also known as a daughter company, a foreign subsidiary is a separate legal entity that must comply with the local jurisdiction's tax and employment laws.

Read also: What Is a Wholly-Owned Subsidiary?

Foreign subsidiary examples

One of the most well-known examples of a parent company with multiple foreign subsidiaries is Google. Google is headquartered in Mountain View, California, but it operates over 40 foreign subsidiaries worldwide.

Many companies rely on thousands of subsidiaries to support their global operations. For example, American media giant WPP has established 2,000+ subsidiaries in strategic locations worldwide.

Foreign branch vs. subsidiary

The main difference between a foreign branch and a subsidiary is that a foreign branch is an extension of the parent company, whereas a subsidiary is a separate entity. Both entity types have different implications for the parent company regarding taxation, governance, and liability.

Foreign branch

A parent company owns 100% of a foreign branch and is liable for all branch operations. As an extension of the parent company, a foreign branch can only source talent by hiring contractors or relocating employees from its home country, which requires following complex immigration processes. A foreign branch also uses the same tax return as its parent company.

Foreign subsidiary

A foreign subsidiary is legally independent of its parent company and conducts its own business operations. It must comply with local taxation and employment laws, which often vary from the home country. If the subsidiary faces a lawsuit or fine from local authorities, the subsidiary is responsible, while the parent company retains immunity.

Permanent establishment vs. subsidiary

A permanent establishment is a business status that imposes various taxes on foreign businesses with an ongoing presence in a foreign jurisdiction. Permanent establishment applies to businesses with a fixed presence in the host country that acts as a dependent agent of the parent company.

The implications of permanent establishment vary across jurisdictions, but it typically triggers a local tax obligation for the impacted business, subjecting it to income tax, sales tax, value-added tax (VAT), and other local taxes required in the host country.

Advantages of establishing a foreign subsidiary

Establishing a foreign subsidiary as part of a global growth strategy comes with perks like access to local talent, local tax benefits, less financial risk, and workload diversification.

Access to new markets and talent

Establishing a foreign subsidiary creates opportunities for increased revenue that may not be possible in your home market. By setting up a foreign subsidiary, you can market solutions to the local population and directly source local talent.

Local tax benefits

As a separate entity, a foreign subsidiary only pays taxes to the local government in the host country, which may be lower than the tax rates in the home country. If the parent company opens a foreign branch instead, the holding company must pay taxes in both countries.

For example, a foreign subsidiary of a U.S. company does not have to pay taxes to the Internal Revenue Service (IRS) because the IRS considers it a foreign company. The parent company only pays taxes on the dividends it receives from the subsidiary as a shareholder. If the parent company reinvests that revenue into the subsidiary, it does not have to pay taxes.

International subsidiaries may also take advantage of local tax benefits in the host country, such as tax holidays, tax credits, and tax-exempt free economic zones.

Less risk for the parent company

Because a foreign subsidiary is its own entity, the parent company is free from the legal risks of doing business overseas. If a third party sues an international subsidiary, the parent company remains protected. If a subsidiary violates a local law, only the subsidiary pays the fine.

Additionally, local governments recognize foreign subsidiaries and can enforce local employment contracts or other legal matters under the relief of the local court system.

Workload diversification

Foreign subsidiaries help carry the growing number of responsibilities that come with global expansion. By splitting your workload between the parent company and foreign subsidiaries, your domestic and foreign teams can focus on smaller, more specialized tasks. This split creates a more manageable workload and allows you to achieve business goals more quickly.

Disadvantages of establishing a foreign subsidiary

Establishing a foreign subsidiary also entails several disadvantages, such as a time-consuming setup, complicated dissolution, cultural challenges, and compliance risks.

Costly and time-consuming

Establishing a foreign subsidiary is costly and time-consuming, which deters many companies from building global teams. Preparation alone involves several months of meticulous research and a sizable upfront investment.

Additionally, businesses must continue spending time and energy maintaining their international subsidiaries after initial setup, which may detract from other high-return activities.

The reality is that many businesses cannot afford the time and resources required for entity establishment—especially if they plan to enter multiple markets worldwide.

Read more: The Hidden Costs of Entity Establishment

Difficult to dissolve

If your investment does not deliver results, you may need to dissolve the subsidiary, which is a lengthy and costly process. In fact, it often takes three times longer to dissolve a foreign subsidiary than to establish one.

Even though the parent company is not responsible for compliance, it must provide foreign subsidiaries access to legal consultation that helps them navigate steps like paying government and employee debts, tax clearance, deregistration, and establishing formal dormancy.

When dissolving, foreign subsidiaries must also consider steps like closing bank accounts, ending lease agreements, liquidating investments, and giving employees prior notice.

Cultural differences

Cultural norms vary greatly between countries, which impacts daily operations. The parent company must adapt to the cultural norms of their foreign subsidiary’s host country and accommodate different workday schedules or approaches to completing tasks.

For example, a foreign subsidiary of a U.S. company in Spain likely works typical Spanish hours—9 a.m. to 1:30 p.m. and 4:30 to 8 p.m. CET. The parent company must adapt to timezone differences and the siesta their Spanish team takes during the day.

Additionally, factors like personality differences, gestures, manners, and body language can lead to miscommunication and conflict between team members from different cultures.

Compliance risks

Setting up a foreign subsidiary is complex and requires a thorough understanding of the foreign country's tax and legal systems. Navigating these processes alone is overwhelming and puts your business at risk of noncompliance.

Consider a foreign subsidiary in Mexico. The subsidiary must be ready to pay employees 200% of their wage for the first nine hours of overtime and 300% for any additional hours. Mexican employees are also entitled to an annual bonus (aguinaldo) worth 15 days of their salary.

The foreign subsidiary must have access to adequate legal consultation to ensure they comply with all local labor laws and avoid noncompliance penalties, like fines and damaged business reputation.

Learn more in our guide to global compliance.

When should you set up a foreign subsidiary?

Whether or not setting up a foreign subsidiary makes sense for your company depends on your long-term business goals. You may consider setting up a foreign subsidiary if you plan to:

- Establish a long-term presence in a specific market

- Hire several employees in a specific foreign location

- Reduce the taxes your company pays on global profits

- Hold physical assets in a specific market

Foreign subsidiaries make sense for your business if you have validated your target market and are ready to commit to long-term investments.

2 Alternatives to establishing a foreign subsidiary

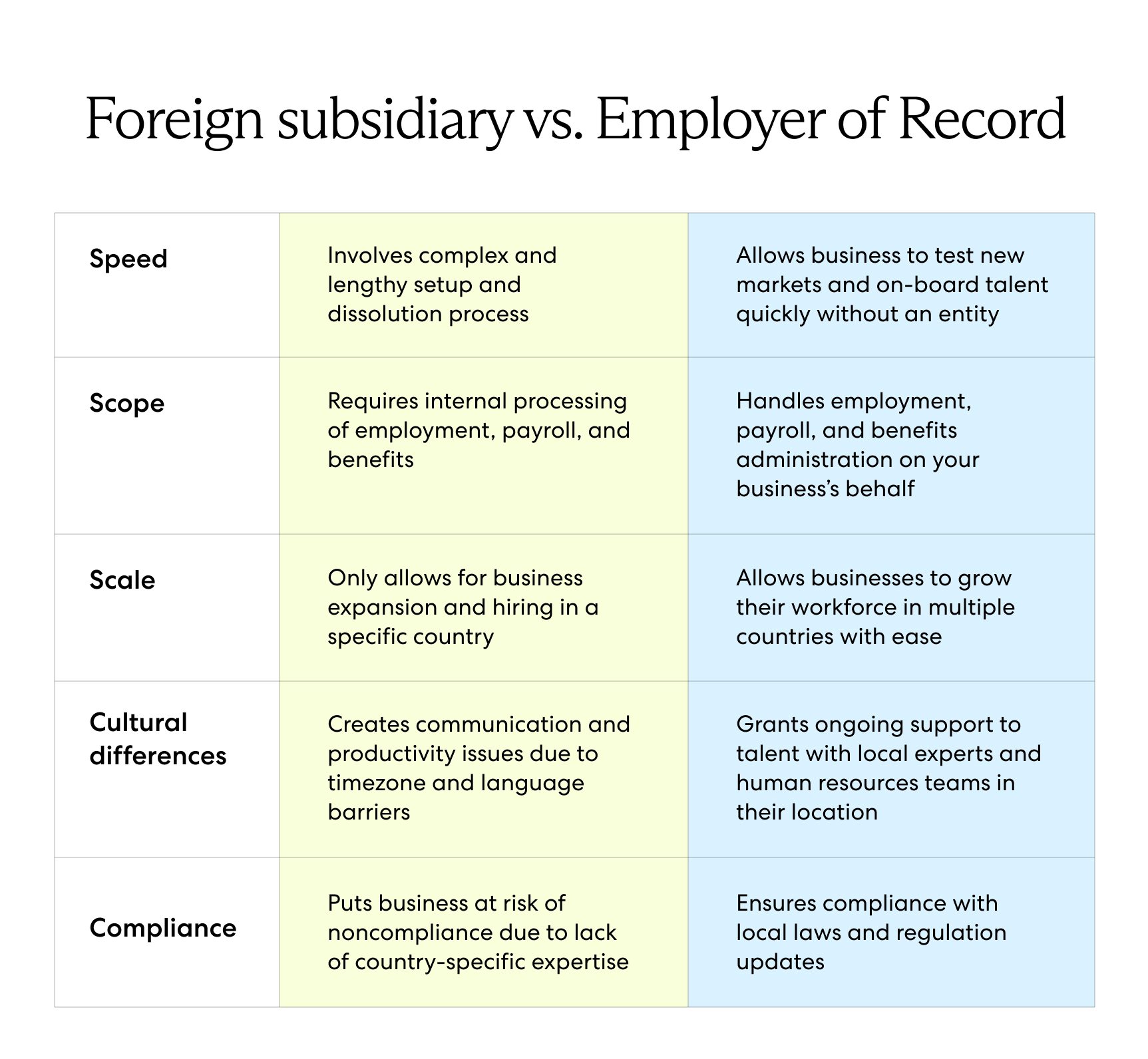

Businesses interested in global growth but not ready for the commitment of establishing a foreign subsidiary have other flexible options. Two popular alternatives are engaging contractors or partnering with an employer of record.

1. Engage contractors

Engaging international contractors is a simple alternative to entering a foreign market without taking on the burden of entity establishment. Engaging contractors comes with several benefits, like cost savings, staffing flexibility, and reduced exposure to lawsuits. These benefits are valuable to companies that are merely testing the waters of a foreign market.

However, engaging contractors exposes your company to serious misclassification risks. While you may view your workers as contractors, local authorities may classify them as employees according to local worker classification laws. Misclassification leads to fines, employee back pay, damaged business reputation, and fewer business opportunities.

2. Partner with an employer of record

Another option for expanding into a foreign market is to partner with an employer of record (EOR). By partnering with an EOR, you enjoy the benefits of entity establishment without the time-consuming registration process, enormous upfront investment, and compliance risks.

An EOR is a third-party partner that serves as the legal employer of your global talent. An EOR assumes employer duties related to onboarding, payroll, benefits administration, immigration services, and compliance with local labor laws while you handle daily tasks and responsibilities.

Partnering with an employer of record makes sense for your company if you want to:

- Increase speed to market without making long-term investments

- Quickly onboard and offboard international talent

- Choose a more cost-effective option for global hiring and expansion

- Avoid compliance risks

Learn more: What Is an Employer of Record (EOR)?

Jumpstart your global business goals with Velocity Global

The high costs, time investment, and legal risks of setting up a foreign subsidiary deter many businesses eyeing global growth. Fortunately, there is a more flexible alternative.

Velocity Global’s Employer of Record (EOR) solution allows companies to expand across borders quickly without setting up a subsidiary. With our EOR solution, you can jumpstart your global business initiatives rather than wait months.

Velocity Global handles onboarding, payroll, benefits administration, compliance, and ongoing HR support for your distributed workforce in 185+ countries.

Contact Velocity Global today to learn how to quickly and cost-effectively expand to foreign markets and grow a global workforce.

Foreign subsidiary FAQs

What are the characteristics of a foreign subsidiary?

Foreign subsidiary characteristics vary between jurisdictions, but they must all be at least 50% owned by their parent company. Foreign subsidiaries are entities governed independently from their parent company and are subject to their host country's local tax and labor laws.

What is a foreign subsidiary strategy?

A foreign subsidiary strategy is a global expansion strategy in which a company establishes a legal entity in a foreign market for doing business in that country. The subsidiary offers the parent company opportunities for growth while protecting it from litigation in the host country.

The foreign subsidiary can market the parent company’s solutions to the local population, import and export goods, and hire local employees.