The U.S. is an opportunistic location for foreign companies to explore new markets, target specialized talent, and expand their global presence. As one of the world’s largest economies, a top global trader, and home to a vast, well-educated workforce, the U.S. is a powerhouse for international companies looking to build their global presence.

Still, hiring employees in the U.S. from another country is no easy feat. Not only do U.S. employment laws differ from other countries, but each U.S. state also has its own employment laws and tax codes. Global companies must follow federal and state employment requirements, which vary significantly depending on where in the U.S. you plan to hire.

The following guide outlines how to hire employees in the U.S. and the key federal and state employment laws to consider.

Can a foreign company hire employees in the U.S.?

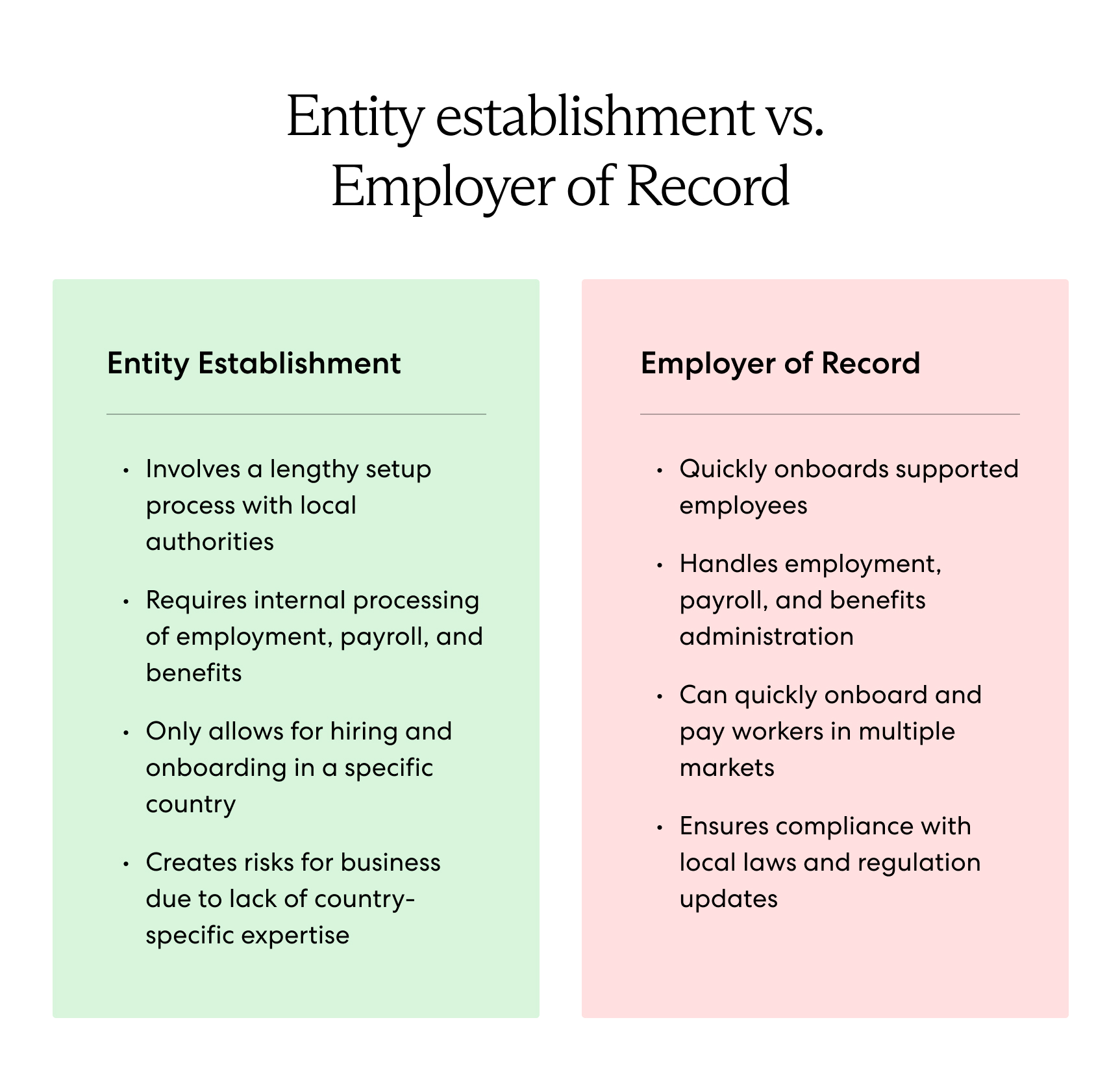

Yes, a foreign company can hire employees in the U.S. There are two main options for compliantly hiring U.S. employees: setting up a legal entity or partnering with an employer of record (EOR). The method you choose depends on several factors, such as the number of employees you plan to hire, time commitment, budget, and overall goals for U.S. expansion.

1. Set up a legal entity

Setting up an entity in the U.S. gives you a physical presence in the country and the autonomy to hire employees and run payroll in compliance with local labor laws. Entity establishment is a smart investment for companies planning to hire a sizable U.S. workforce and build a long-term presence in the country.

While entity establishment gives you full autonomy to hire and manage talent directly, it requires extensive in-country knowledge of the local employment and tax regulations. Entity establishment is also costly and time-consuming. You should only pursue this method if your team has the bandwidth, expertise, and capital investment.

2. Use an employer of record in the U.S.

Employers can skip the hassle of entity establishment by partnering with an employer of record (EOR) in the U.S. An EOR is a third-party organization that serves as the legal employer of your U.S. workforce and assumes all employer-related tasks while you manage day-to-day operations.

An EOR partner handles hiring, onboarding, payroll, benefits administration, and risk mitigation to ensure compliance with all federal and state employment regulations.

Partnering with an EOR allows you to hire talent in the U.S. quickly and cost-effectively without the investment and challenges that come with entity establishment.

Learn more: What Is an Employer of Record (EOR)?

Engaging independent contractors in the U.S.

Alternatively, you could engage U.S. contractors for short-term projects. A contractor is classified as a self-employed individual instead of an employee, which allows you more flexibility to work with talent in the U.S. without having to navigate complex and unfamiliar labor laws.

However, hiring contractors leads to misclassification risks. According to U.S. tax law, companies cannot attempt to control the work methods or schedules of their contractors. If they do, they may be at risk of worker misclassification, which leads to fines, employee entitlement back pay, and legal headaches.

We discuss misclassification and how to avoid the risks in more detail later on in this guide.

How much does it cost to hire an employee in the U.S.?

The cost of hiring an employee in the U.S. is, at a minimum, 7.65% of the employee’s base salary because the employer must contribute 6.2% of their employee’s base salary to Social Security and 1.45% to Medicare. Additionally, the employer must pay 6% on the first $7,000 of their employee’s annual salary for Federal Unemployment Tax (FUTA).

Still, employee cost varies since individual states may have additional mandatory payroll contributions as well as varying contribution rates for State Unemployment Tax (SUTA).

Interested in hiring employees in the U.S.? Use our employee cost calculator below to get reliable insights into employee costs and payroll contributions in the U.S.:

What to know before hiring employees in the U.S.

To compliantly hire talent, global employers must navigate U.S. employment laws relating to payroll taxes, statutory employee benefits, and worker classification.

Differences in federal and state employment laws

Unlike many countries, employment law in the U.S. is a combination of federal and state legislation. Employment laws also vary from state to state, further complicating the process of employing a distributed workforce in the U.S.

An international company hiring employees in the U.S. will not only need to understand federal regulations but state-specific legislation as well.

Employment law in the United States: Overview

International employers should familiarize themselves with the following aspects of U.S. employment law:

- At-will employment and termination. Employment in the U.S. is predominantly at-will, meaning employers can terminate their employees at any time without notice, and employees can leave their jobs at any time without notice. However, there may be exceptions in certain U.S. states.

- Minimum wage. The federal minimum wage is $7.25 per hour. However, some U.S. states have higher minimum wages. For example, New York’s statewide minimum wage is $15 per hour.

- Working hours. There is no mandatory limit for work hours under U.S. federal law, but the standard workweek in the U.S. is 40 hours. Employees typically work eight hours a day, five days a week.

- Overtime. Hourly employees must receive overtime pay at 150% of their regular rate if they work more than 40 hours in a week. Salaried employees may be considered exempt and do not receive overtime pay. Some states have different overtime laws, so qualified employees are subject to whichever state or federal law provides a higher overtime standard.

- Severance. There are no federal requirements for severance pay, but most employers choose to offer it to maintain a positive rapport with former employees. Some states require severance pay in situations related to facility closures or large layoffs.

Payroll tax in the U.S.

Once an employee is on payroll, the employer must withhold taxes and make contributions to government funds. These deductions go toward federal programs such as Social Security, Medicare, unemployment, and workers’ compensation.

- Social Security. Social Security provides retirement income for U.S. workers. Employers and employees must each contribute 6.2% of the employee’s wages toward social security. Some states also impose some form of income tax on social security benefits.

- Medicare. Medicare is federal health insurance for adults aged 65 or older and younger people who receive disability benefits. Employers and employees must each contribute 1.45% toward Medicare.

- Federal and state unemployment. The Federal Unemployment Tax Act (FUTA) and State Unemployment Tax Act (SUTA) provide compensation to workers who have lost their jobs. Most employers pay both federal and state unemployment taxes. The federal minimum taxable wage base is $7,000, and the federal tax rate is 6%. States may set their own minimum taxable wage bases and unemployment insurance tax rates, but employers usually pay between 1% and 8% on the taxable earnings of employees.

- Workers’ compensation. Workers’ compensation insurance covers medical care and payments to employees when they are injured or sick because of their job. Employers pay a percentage of the payroll to workers’ compensation insurance, but the requirements vary in each state.

- Income tax. Employees must pay state and federal taxes on their earned income. Federal income taxes are divided into seven tax brackets ranging from 10% to 37%, with higher earners paying a higher percentage. Tax rates also vary from state to state. Some states have a flat-rate income bracket, and others have more tax brackets than the federal level.

Learn more: Complete Guide to Payroll Tax + How to Calculate

Employee benefits in the U.S.

As with payroll taxes, statutory benefits requirements differ between U.S. states. Statutory benefits in the U.S. are typically low compared to statutory benefits in other countries, so employers should prioritize a comprehensive benefits package to attract and retain top talent.

Read more: Guide to Required Employee Benefits in the U.S.

Leave entitlements

The federal law does not require employers to offer paid leave to U.S. employees. However, under the federal Family and Medical Leave Act (FLMA), employers with 50 or more employees are required to provide eligible employees with up to 12 weeks of unpaid, job-protected leave per year.

Some states have leave entitlement laws that provide employees with paid, job-protected time off. For example, 16 states require paid sick leave. Additionally, many companies choose to provide various forms of paid leave, such as family leave and vacation, whether or not their state requires it.

Social Security

Social security is a federally mandated benefits program that ensures U.S. employees have income after they retire. Both the employee and employer make social security contributions through payroll taxes. While most states do not impose an additional tax on social security benefits, 11 states in the U.S. have some form of additional social security tax.

Healthcare

Under the federal Affordable Care Act (ACA), companies with more than 50 employees must provide their full-time workers with affordable minimum essential coverage. Smaller companies can purchase insurance through the Small Business Health Options Program.

Some states have additional laws in place to improve employee health insurance. For instance, Massachusetts mandates that employers provide minimum creditable coverage to ensure employees have fair and adequate health plans.

Providing health coverage to employees in multiple states is tricky because health insurance plans and providers vary across states.

Learn more: How to Provide Health Insurance for Employees in Different U.S. States

Misclassification: Employees vs. contractors in the U.S.

If an employer chooses to engage U.S. contractors rather than hire employees, they run the risk of worker misclassification. If an employee is misclassified as a contractor, employers may face back taxes, back benefits, and reputational damage.

To help employers determine whether a worker is an employer or contractor, the U.S. Internal Revenue Service (IRS) provides a checklist of common rules based on the extent of control, financial aspects, and the relationship between the employer and worker.

However, following this IRS checklist alone does not guarantee proper classification. To ensure compliance, employers should consult a legal expert, such as an employer of record.

Read our complete guide to employee and contractor misclassification.

Simplify hiring employees in the U.S. with Velocity Global

Entering the U.S. market and complying with federal and state labor laws may feel overwhelming and complicated, but it doesn’t have to be when you partner with an experienced and knowledgeable partner. Velocity Global streamlines the entire employment process so you can focus on building your global workforce in the U.S.

Our EOR solution navigates foreign employment regulations on your behalf, simplifies the hurdles of international employment, and ensures you stay compliant. Velocity Global makes it easy for you to quickly hire, pay, and manage your distributed workforce.

Ready to quickly and compliantly hire talent in the U.S.? Contact Velocity Global to get started.