Employees today demand more than a competitive salary. Fringe benefits are a significant consideration for employees who increasingly value flexibility, work-from-anywhere policies, and life-work balance.

According to Bankrate, 56% of U.S. employees say adjustable working hours and remote work are a priority, while 51% are willing to forgo higher salaries for greater flexibility. Companies must embrace the concept of fringe benefits to retain and attract high-quality talent. This guide explains how.

Fringe benefits definition

Fringe benefits are non-wage benefits that supplement an employee’s regular salary. From adoption assistance to gym memberships, fringe benefits provide a well-rounded approach to employee health and life-work balance. Employers offer fringe benefits in addition to statutory benefits to create a comprehensive and competitive benefits package.

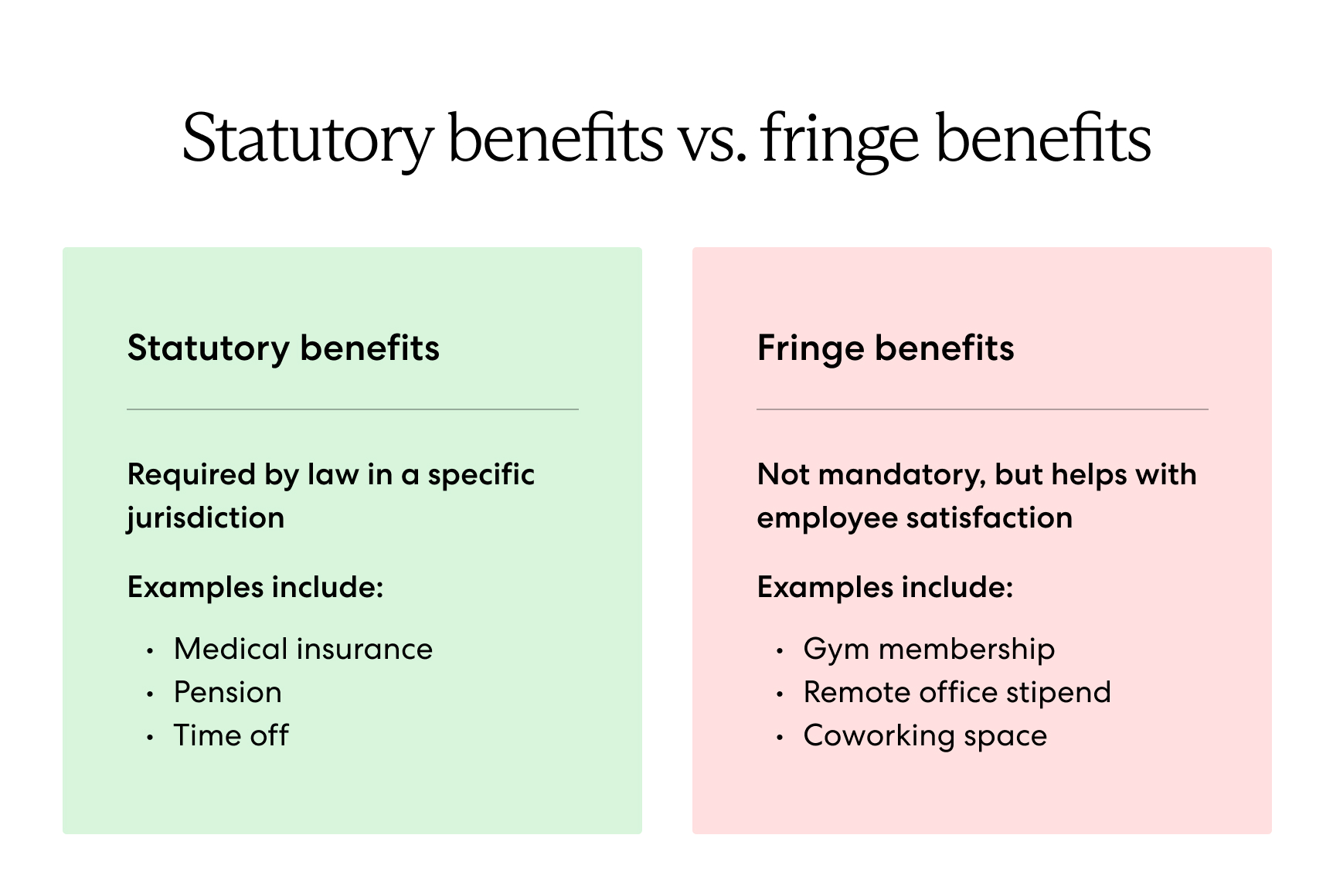

Statutory benefits vs. fringe benefits

Statutory benefits are required benefits an employer must provide to their employees. While they vary by country, statutory benefits typically include medical insurance, pension plans, and paid time off.

Fringe benefits are not required by the government, but they address employee needs and improve retention. Fringe benefits create an optimal working environment for employees by offering perks such as gym memberships, co-working space access, and housing allowances.

Read more on how a comprehensive benefits package gives you a hiring edge.

Example: statutory vs. fringe benefits in Canada

Let’s take a U.S.-based employer who manages three employees based in Canada.

Statutory benefits in Canada include provincial health insurance and pension plans. In addition, Canadian supplemental benefits typically include private medical insurance with access to maternity care, dental, and vision. The employer could add fringe benefits by providing child care reimbursements, stock options, or co-working spaces to further elevate their employees’ benefits packages.

Learn more about employee benefits in Canada in this guide.

11 fringe benefit examples to offer your global team

There’s a wide range of fringe benefit options to offer your team—let’s look at several common fringe benefits that companies offer to attract and retain employees.

Bonuses

Bonuses are a type of supplemental pay and common fringe benefit that many companies offer. Oftentimes bonuses are structured according to employee performance and are distributed on an annual basis. However, offering rolling bonuses throughout the year is an impactful way to show your employees you value their work.

Health and wellness funds

Employers sometimes offer gym memberships or additional compensation for health and wellness expenses. Offering gym memberships encourages employees to prioritize their well-being, which benefits their productivity at work.

Perks that support mental health, such as meditation apps or mental health services, improve your team's ability to actively engage and perform. Studies show that the treatment of depression has been shown to reduce absenteeism and presenteeism by about 40-60%.

Co-working space

Due to the strong shift to remote work policies, offices aren’t as common as they used to be. Still, working from home doesn’t suit everyone, so offering flexible workspaces for employees can be an excellent fringe benefit. Your employees will have the option to collaborate as a team or escape the house when they need a change of pace.

Housing allowance

Some companies may choose to offer a housing stipend or free housing for employees. This fringe benefit is useful for employees who have to relocate for work—especially if the job location has a high cost of living. A housing allowance takes the financial burden off an employee when they move cities or countries to join your company.

Educational reimbursement

Educational reimbursement is reserved for employees pursuing further education while on the job. For example, if a content marketer enrolls in a UX design course, their employer may reimburse their tuition. The employee gains valuable skills they can use on the job, and the employer benefits from an invested and qualified employee.

Company car

Some companies allocate a company car to employees who travel frequently on the job. Company cars allow employees to avoid wear and tear on their personal vehicles, making this a valuable fringe benefit to offer.

Event tickets

Employers who offer free event tickets as a fringe benefit show their employees that they value life-work balance. Encourage your employers to make more time for what they love by providing complimentary passes to concerts, sports games, or the theater.

Adoption assistance

Adoption aid helps employees pay costs associated with adopting a child, such as medical coverage and fees related to completing the adoption process. Employees typically appreciate efforts to provide a more inclusive and equitable workplace by offering family-forming benefits like adoption assistance.

Childcare reimbursement

Some businesses offer childcare reimbursement for working parents. Rising childcare costs often push parents to leave their jobs—especially women. Providing additional compensation for childcare relieves this stress and creates more equity in the workplace between men and women.

Stock options

While retirement plans are common for many companies, stock options take investment opportunities a step further by allowing employees to buy shares of their company. Granting stock options to your remote workforce gives them the opportunity to benefit from your company’s growth, making them more likely to feel passionate about business success.

Health savings accounts

In the U.S., companies can offer health savings accounts (HSAs) or flexible spending accounts (FSAs) for employees. HSAs allow employees to set aside money on a pre-tax basis to pay for qualified healthcare costs.

FSAs are similar in that they help employees pay for healthcare, but they are limited to yearly medical costs. HSAs and FSAs are valuable fringe benefits because they help employees manage health costs not covered by medical insurance.

Read more: How to Provide Health Insurance for Employees in Different States

Are fringe benefits taxable?

Not all fringe benefits are taxable, but it ultimately depends on where the employee is located.

In the U.S., fringe benefits are taxable and must be included in the employee’s pay unless the law specifically excludes it. For example, gym memberships and HSAs are exempt from federal taxes, but bonuses are always taxable.

Australia, on the other hand, has a fringe benefit tax (FBT) that employers pay for such benefits. FBT is separate from income tax and required even when the benefit is provided by a third party. It’s calculated based on the taxable value of the fringe benefit. Australian employers can often claim an income tax deduction for the cost of providing fringe benefits and FBT they pay.

Fringe benefit taxation varies from country to country. Ultimately, it’s the employer’s responsibility to adhere to the laws of local taxation agencies and ensure payroll compliance. Maintaining compliance requires in-country expertise or working with a knowledgeable partner like Velocity Global.

Retain your global team with competitive fringe benefits

Today’s top talent demands high-quality benefits that empower them to thrive on and off the clock. Show your employees you care by offering fringe benefits that meet their unique needs.

Our Global Benefits solution allows international companies to offer market-specific benefits packages worldwide. We help companies in over 185 countries develop benefits offerings that adhere to local requirements and make you stand out as a global employer.

Attract and retain top talent from around the world by contacting Velocity Global today.

Topic:

Employee Benefits