India is a leading country for hiring English-speaking remote workers. However, due to India’s complex employment laws, companies must understand statutory and supplemental employee benefits in India to remain compliant and competitive.

This guide outlines Indian employee benefits to help growing companies do business in India.

What are the types of employee benefits in India?

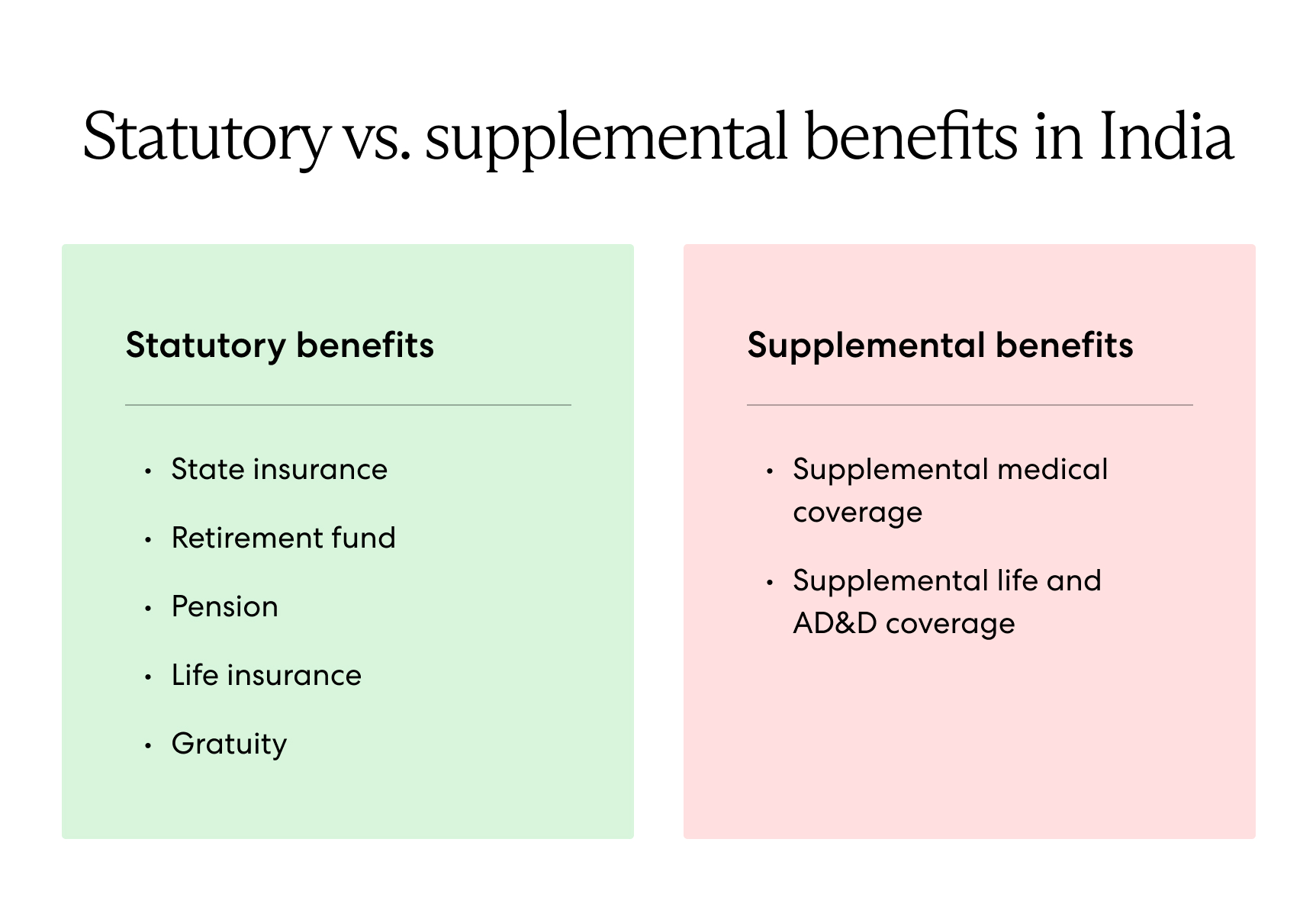

India has two types of employee benefits: statutory and supplemental. Statutory benefits are mandatory, while supplemental benefits are additional benefits to attract and retain talent.

Under the employee benefits policy in India, the Indian government implements and requires statutory benefits, including state insurance, gratuity payments, and provident funds, among others. Supplemental benefits are not required by the government and include additional health insurance and disability coverage.

Statutory vs. supplemental benefits in India

Statutory benefits in India

Statutory, or mandatory, benefits are required by law and include social security benefits. Below is a closer look at mandatory employee benefits in India.

Learn more about what statutory benefits are here.

Social security benefits in India

Indian employment law breaks down social security into two main categories: the Employees’ State Insurance and the Employees’ Provident Fund. The latter encompasses three objectives: retirement fund, pension, and life insurance.

Medical insurance: Employees’ State Insurance (ESI)

The Employees’ State Insurance (ESI) Act, passed in 1948, applies to businesses that employ at least 10 people and to all employees earning less than INR 21,000 (roughly 286 USD) per month. The ESI Act in India requires businesses to contribute 4.75% of employees’ wages monthly to their ESI fund. Employees also contribute 1.75% of their wages, which entitles them to medical benefits.

Retirement fund: Employees’ Provident Fund (EPF)

The Employees’ Provident Fund and Miscellaneous Provisions Act, passed in 1952, established

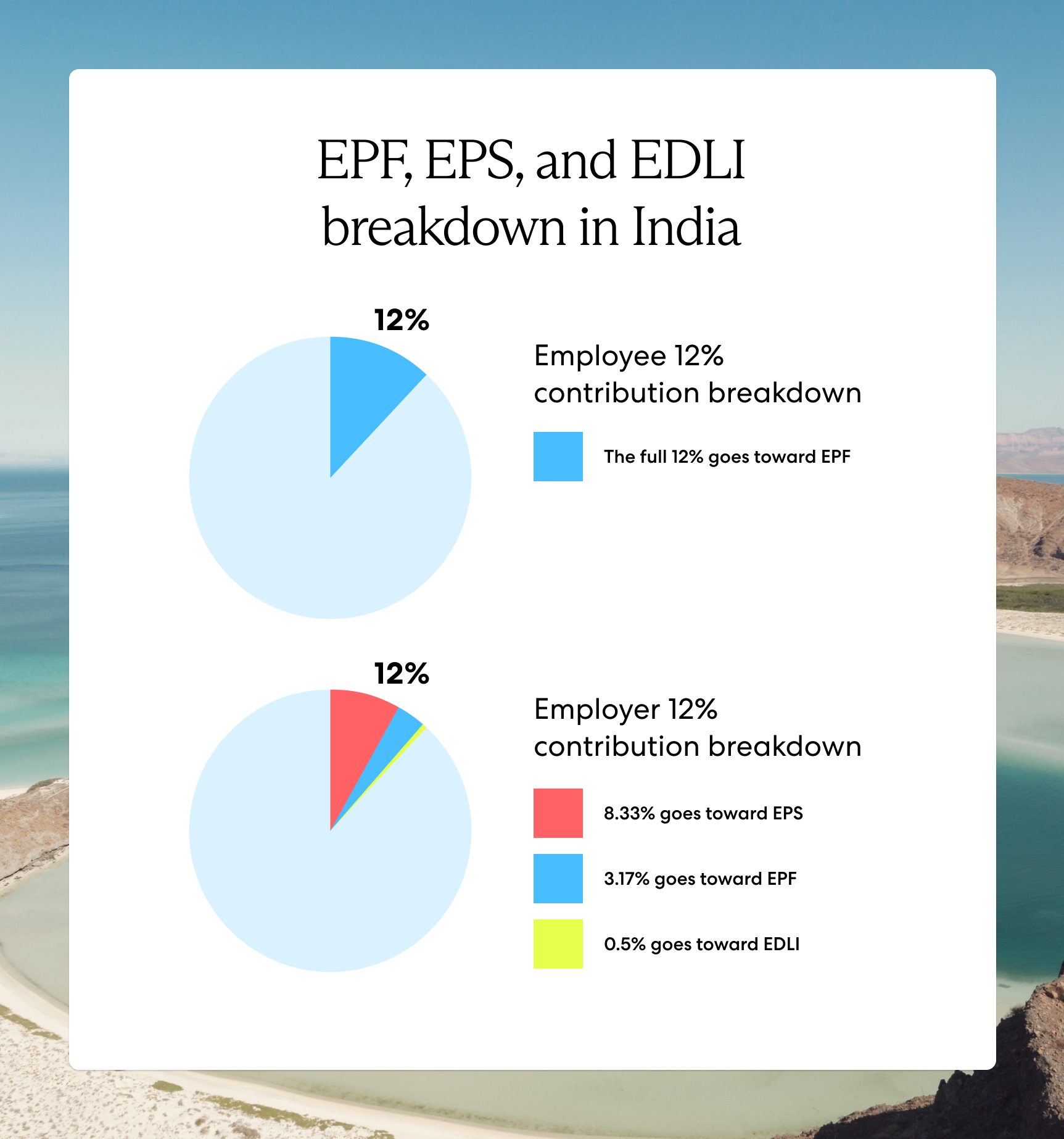

the Employees’ Provident Fund (EPF) Act. Under this act, employees who work for companies with 20 or more employees and who earn less than INR 15,000 (roughly 204 USD) per month must contribute 12% of their wages monthly. Employers contribute an equal amount to the EPF.

Upon retirement, employees receive payment, including interest, from the EPF.

Pension: Employees’ Pension Scheme (EPS)

The Employees’ Pension Scheme (EPS) collects a percentage of income to provide a pension for employees after age 58. When employers contribute 12% of the employee’s salary to the EPF, 8.33% goes to the EPS.

The EPS provides pension payments for life; if the member dies, his or her nominee will receive the pension. There aren’t investment risks for employees as the Indian government sponsors the EPS and guarantees returns.

Life insurance: Employees’ Deposit Linked Insurance Scheme (EDLI)

The Employees’ Deposit Linked Insurance Scheme (EDLI) is life insurance provided by the EPF. Under the EDLI, the registered nominee receives a lump-sum payment upon the insured person’s death. The EDLI is an automatic life insurance policy made available by the EPF scheme.

Under the EDLI, 0.5% of the employer’s 12% salary contribution goes toward this scheme.

EPF, EPS, and EDLI breakdown in India

Gratuity benefits in India

Employees who have worked for their employer for over five years and who retire, resign, or become disabled are eligible for gratuity benefits. Gratuity payments are equivalent to 15 days of wages for every year of employment.

The gratuity scheme applies to employees working in factories, mines, ports, or other establishments with 10 or more employees.

Learn more about payroll taxes and contributions in India.

Supplemental benefits in India

Supplemental benefits are add-ons to statutory benefits that Indian employers commonly provide to professionals, such as managers and supervisors. These include benefits such as additional medical insurance, accident insurance, and additional retirement funds.

Read more: What Are Supplemental Benefits?

Local and multinational employers provide supplementary medical benefits, including wellness benefits and routine annual health checks. Along with the benefits listed above, some employers offer transportation allowance, meal vouchers, and even mobile or internet reimbursements.

Competitive global employee benefits packages are vital for talent attraction and retention—not only do they ease the financial burden of healthcare, but they also provide a well-rounded approach to employee wellness.

Supplemental medical coverage

Additional medical coverage is the most common supplemental benefit employers provide to management-level employees. Many employer-sponsored medical insurance plans offer coverage for maternity care, cancer treatments, and fertility treatment. Supplemental medical plans often extend to include dependents and partners.

Supplemental life and AD&D coverage

Employers also commonly offer life and AD&D (accidental death and dismemberment) coverage as a supplemental benefit.

Supplemental life and AD&D coverage provide employees peace of mind by covering their families in uncertain situations. Companies that offer this type of coverage will stand out among local and international employers.

Find more information about India’s employment benefits and labor laws here.

Offer compliant and competitive employee benefits in India

Global companies that want to hire employees in India attract and retain top talent by offering comprehensive and compliant benefits that exceed the market standard.

Still, ensuring your benefits packages are competitive and legally sound is complicated. Instead, work with an experienced global partner like Velocity Global to create market-specific rewards packages on your behalf.

Our Global Benefits solution helps employers gain a competitive edge in the hiring process by offering locally competitive benefits packages that go beyond statutory requirements and ensure your talent feels valued. Plus, you gain peace of mind knowing that your benefits offerings always comply with local labor laws.

Attract the best talent in India today with Velocity Global.