Expand your orbit, with ease

Our Employer of Record (EOR) solution gives you legal peace of mind, an expert services team, and a single platform to simplify global workforce management and navigating local employment laws. So while you support an expanding business, we’ll support the talent making it happen with global employment solutions.

Regional compliance

Local experts in HR, payroll, and employment ready to help mitigate any risks that may arise globally.

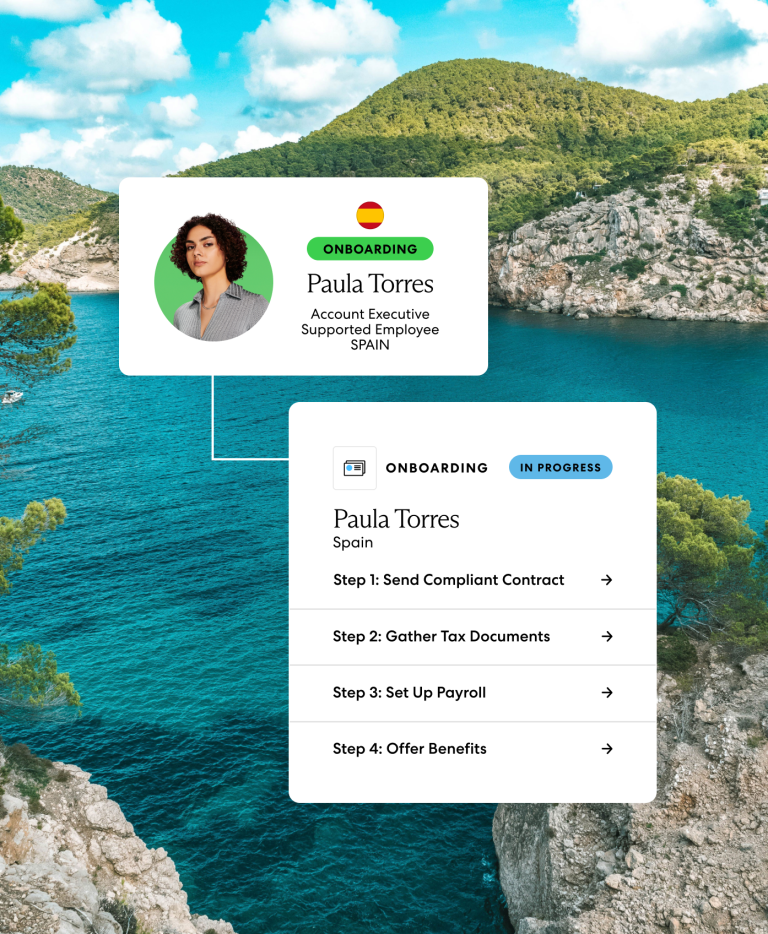

Streamlined hiring

HR experts ready to get your talent set up and keep your team moving.

Accurate and compliant payroll

Our global payroll capabilities get your people paid right and on time while complying with local regulations.

Effortless workforce management

Employee data tools to keep you on top of every team and department.

Mobility services

Immigration support for relocating talent across the globe.

Reporting + analytics

Make informed decisions to give talent the best overall experience.

Always-on assistance

Around-the-clock human support for businesses and talent, no matter the time zone.

Integrations + automation

Our Global Work Platform™ integrates with ATS and HRIS systems to minimize hiring and employment management errors.

Watch the Global Work Platform demo

See how you can employ talent compliantly and enter new markets quickly with our Global Work Platform™.

Wherever your business is headed, let EOR clear the way

Growing across the globe is complex—Velocity Global’s Employer of Record solution and expert services team help keep it simple no matter what’s on the horizon for your business.

Accurately budget payroll costs for your global team

Get reliable insights into employee costs and country-specific contributions so you can expand your global workforce compliantly and with confidence.

Please fill out your contact information and hiring details, and an expert from our team will be in touch with you shortly.

We help you go above and beyond for your talent

The market for talent is competitive. With our Employer of Record solution, you'll also be able to offer the comprehensive perks and rewards that both attract top talent and keep them happy. Effortlessly navigate local labor laws, manage employment contracts, and facilitate employee onboarding for a seamless hiring process.

Global Benefits

Support every member of your team with comprehensive, flexible medical and life coverage.

Global Equity Program

Easily reward talent with a transparent equity program that eliminates compliance risks.

Global Immigration

Make talent relocation, employee visa approvals, and the general working visas process, simpler for an easy transition of employment.

International Pensions

Empower your talent to invest in their future with flexible retirement savings plans.

Flexible Office Space

Give your global team a home base with Upflex workspaces available in 120+ countries.

Get a global perspective with our resources

FAQ

-

Is EOR the same as PEO?

EOR is not the same as a PEO (professional employer organization) or co-employment solution.

-

Will an employer of record recruit candidates for me?

No, we don’t recruit, but we do partner with recruiting firms that can help with any sourcing needs.

-

Will an employer of record hire candidates for me?

Yes, we use locally compliant employment contracts to hire new employees for your global team and become their legal employer of record.

-

Do you broker a deal with local partners, or are you involved through the entire employer of record process?

Velocity Global manages established entities in multiple countries. Within our entities, we make it a priority to have local labor law experts, as well as trusted and vetted partners. From the beginning of our partnership, we provide our customers and their supported employees with a dedicated services team to help answer any employment questions and navigate any regional intricacies.

-

Do you assist with paying the necessary in-country benefit contributions?

Yes, our team of HR experts will help you understand contribution options and additional programs you can offer your talent.